Yum-Yum Continuation Pattern Trading Setup

By Galen Woods ‐ 7 min read

The Yum-Yum Continuation Pattern from the Ultimate Trading Guide is a great way to find valid break-outs in the trend. Master this pattern and minimize the pain of false break-outs.

The Yum-Yum continuation pattern is a unique price action setup from the Ultimate Trading Guide by John R. Hill, George Pruitt, and Lundy Hill. This book is an excellent source of price action trading ideas. If you’re looking for inspiration beyond trading indicators, definitely check out this book for its huge variety of price-based trading concepts.

This price pattern is interesting because it integrates several market aspects:

- Trend

- Swing pivots

- Intraday bar trend

- Bar range

- Momentum

Trading Rules - Yum-Yum Continuation Pattern

This setup focuses on the point where the market pushes to a new extreme. Then, based on how the market reacts to this action, it evaluates if there’s an opportunity for a trend continuation trade.

The rules below define the setup completely, except for what constitutes an upwards/downwards trend.

You can experiment with any trend-tracking method here, but it works best with tools that track the medium-term trend, like the 20-period EMA.

Long Trading Setup

- Existing upwards trend.

- The market pushed above the highest swing high with a wide-range bar*.

- The bar closes near its high, and above its open.

- Buy on the breakout of the wide-range bar (within 1 to 3 bars).

Short Trading Setup

- Existing downwards trend.

- The market pushed below the lowest swing low with a wide-range bar*.

- The bar closes near its low and below its open.

- Sell on the breakout of the wide-range bar (within 1 to 3 bars).

*A wide-range bar here is defined as one with a bar range that exceeds the 10-period average bar range.

The default stop-loss level is at the opposite end of the setup bar (i.e., the wide-range bar).

Yum-Yum Continuation Trade Examples

In the three examples below, you’ll see this setup in action.

Particularly, the final example shows how to repurpose this pattern as a general price action tactic for market analysis.

Example #1: A Successful Yum-Yum Continuation Trade

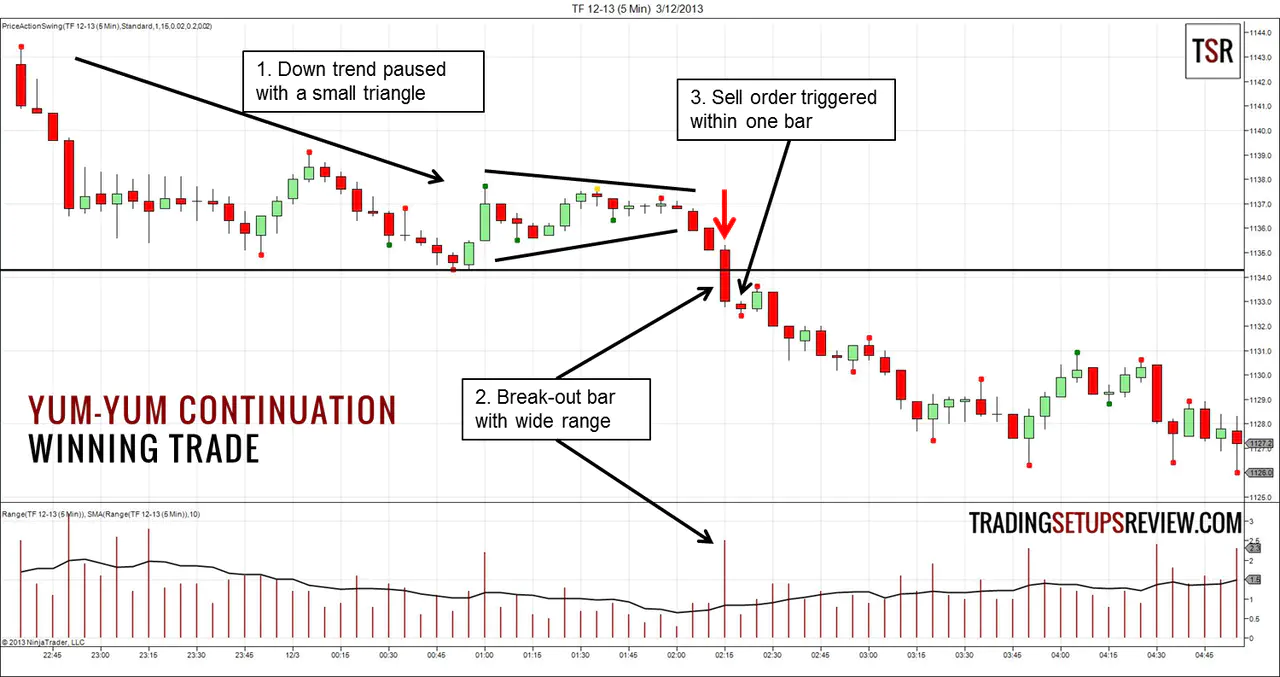

This is a 5-minute chart of the Russell 2000 E-mini futures.

The lower panel shows the range of each candlestick with a 10-period simple moving average. If the bar range exceeds the average, it is a wide-range bar that fulfills our trading rules.

- This session started with a bear trend before stopping to rest in a triangle formation.

- A wide-range bar broke the low of the day after breaking out of the triangle. The lower panel highlighted that this bar had a range that was more than two times that of the 10-bar average. This wide-range bar served as our setup bar, and we could place a sell-stop order below its low.

- The next bar pushed below it and triggered our sell order. This immediate breakout showed urgency in the selling and confirmed the legitimacy of the bearish break-out.

This session had a strong bear trend, and the Yum-Yum continuation pattern got us in midway. It performed solidly as a continuation setup here.

Example #2: Yum-Yum Continuation Pattern and Whipsaws

Now, let’s turn our attention to the daily timeframe.

This is a daily chart of Wal-Mart, which shows a failed Yum-Yum continuation pattern.

- There was an existing up trend, which was essential for a continuation trading setup.

- The range of the break-out bar exceeded the 10-bar average range. However, compared with the dozens of bars before it, its range was not especially high. Contrast this with Example #1, where the expansion in bar range was much more remarkable.

- The next day triggered our buy order, but there was not much follow-through. Prices moved sideways for two days before stopping us out with a rapid bear swing.

As our setup bar is a wide-range bar, placing the stop-loss at the opposite end of the setup bar entails higher trade risk. One way to lower the risk is by trailing our stops behind bars that closed in our trade direction.

In this example, an option for managing the position was to trail the stop to just below each bullish candlestick (close > open). Here, active trade management might help us improve our reward-to-risk ratio.

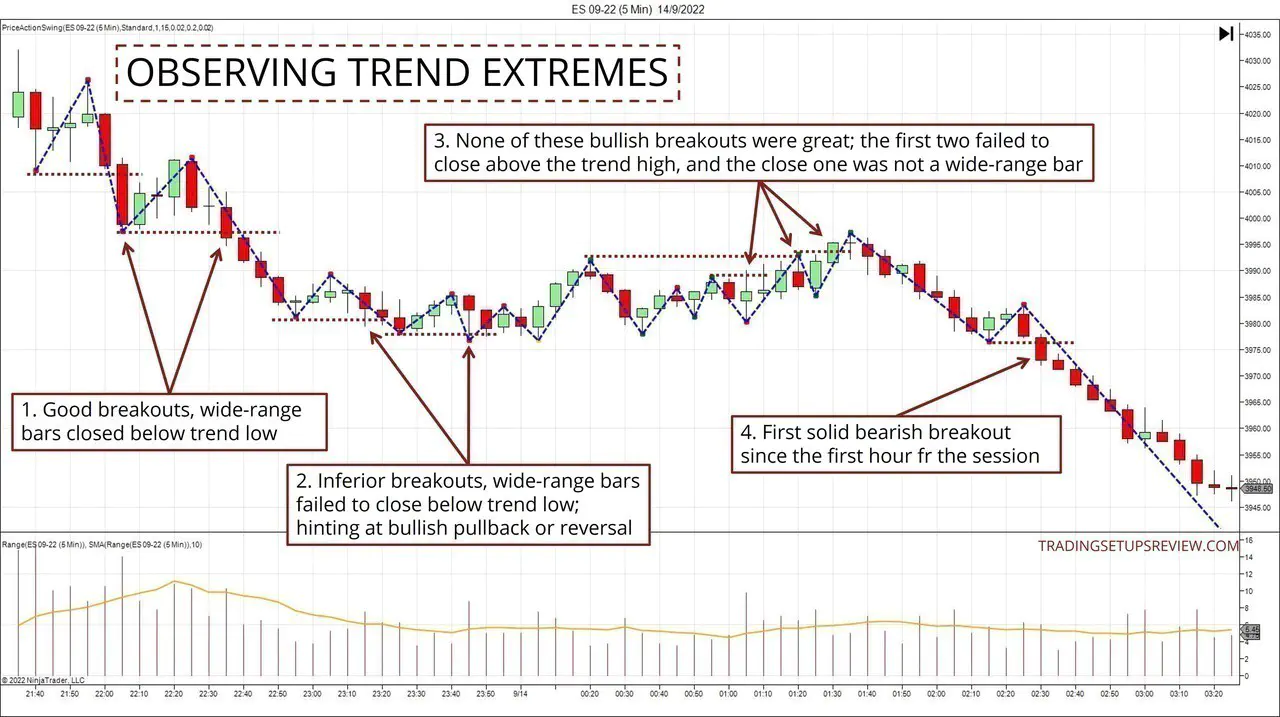

Example #3: Using the pattern as a tool, not a setup

The core idea of this pattern is that we should observe how the market reacts to a push to extend the trend.

Hence, you can put this pattern to use even when you are not actively considering a continuation trade. This is a price action analysis method for tracking the market bias.

In this example, we examine each push beyond the trend extreme. Specifically we look at the first bar to push past the trend extreme.

Ideally, this bar should:

- Close beyond the trend extremes; and

- Be a wide-range bar.

Chart notes:

- The swing pivots are drawn according to the method taught in my course.

- The horizontal lines were the trend extremes at some point.

The chart below is from a 5-minute chart of the ES futures market.

- These two breakout bars were solid. Both were wide-range bars that closed below the trend low, confirming a bearish market bias. (The arrows point exactly at the breakout bars. You might want to click on the chart to expand it.)

- These breakout bears were not ideal as they failed to close below the trend low. Hence, they hinted at a possible slowing down or reversal of the bearish trend.

- These were three bullish breakout bars. However, none of them fulfilled our ideal criteria. The first two failed to close above the trend high level; the last one was not a wide-range bar. The bulls did make their presence felt.

- This breakout bar was the first solid bearish breakout bar since the first hour of the session. Look at how the market resumed its bearish trend from this point.

Like most price patterns, this one might not be profitable when traded mechanically. However, as we discussed in this example, it introduces concepts that are helpful for analyzing market biases.

Review - Yum-Yum Continuation Pattern Trading Setup

The Yum-Yum pattern is a trend continuation trading setup. Please do not overlook this.

Always make sure that the market has a clear trend before considering this setup.

To understand this setup, it’s useful to talk about the two styles of continuation setups.

Two Methods For Trading Trend Continuation

There are two approaches for trading a trend continuation.

The first is to pinpoint an entry during the pullback/throwback. (An example is the 9/30 setup.)

- Typically, this approach gives us an entry with a better reward-to-risk ratio.

- However, it has lower odds of success because we are trying to pick the top/bottom of a smaller trend (think of the pullback as a mini-trend).

The second method is to wait for a break-out of the last extreme of the trend.

- As this approach waits for confirmation from the break-out, trend continuation is more likely. Essentially, we enter only when the trend has resumed.

- However, the cost of this confirmation is a lower reward-to-risk ratio. This is an example of the inevitable trade-off between trading methods.

How does Yum-Yum work?

The Yum-Yum continuation pattern uses the second method.

It attempts to improve a basic break-out trade in two ways:

#1: It uses bar range expansion to confirm the break-out.

Bar range tends to expand when moving along the path of least resistance and contracts when moving against it. So this behavior is an effective filter for false break-outs.

Another common filter for break-outs is volume analysis. which John Bollinger recommended for the Bollinger Squeeze trading setup.

#2: It implements a time limit for follow-through of the break-out bar.

Recall that the entry stop order must be triggered within 1 to 3 bars. Valid break-outs should present a sense of market urgency, and follow-through should come quickly.

This rule ensures that if there’s no swift confirmation, we should abandon the trading setup.

Finally, this setup requires you to buy high and sell low at the entry stage. And some traders are uncomfortable with this style of trading. Although this is necessary for trend followers, you should only use trading strategies that make sense for you. So check out other retracement strategies if you want to experiment with more approaches.