Three-Bar Reversal Pattern For Day Trading

By Galen Woods ‐ 3 min read

The Three-Bar Reversal Pattern can be adapted easily for day trading. When combined with other analysis, it gives an excellent entry point for day traders.

Alton Hill from TradingSim, a day trading simulator, wrote about an enhanced three bar reversal pattern for day trading.

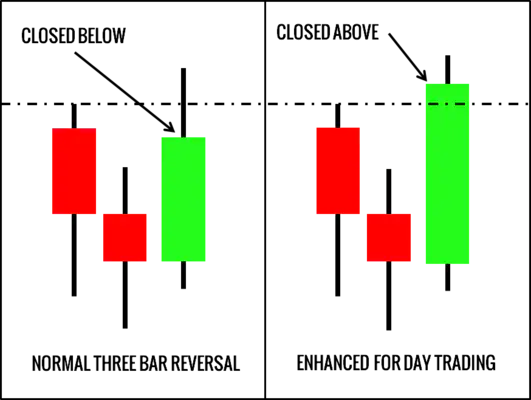

According to Alton Hill, three-bar reversals are too common in intraday time-frames. To select the best three-bar reversal patterns for day trading, he wants the third bar in the pattern to close above the highs of the first two bars.

The diagram below demonstrates the difference between the usual three-bar reversal pattern and Alton Hill’s day trading version.

Trading Rules

Long Setup

- Bar 1 closes down

- Low of Bar 2 is below the low of Bar 1 (and Bar 3)

- Bar 3 closes above the high of both Bar 1 and Bar 2

- Buy at the close of Bar 3

Short Setup

- Bar 1 closes up

- High of Bar 2 is above the high of Bar 1 (and Bar 3)

- Bar 3 closes below the low of both Bar 1 and Bar 2

- Sell at the close of Bar 3

Trading Examples

Winning Trade

This a 5-minute chart of ES futures. It shows the regular session.

I included part of the previous section to show the uptrend that ended yesterday. After our entry, the prices drifted up for the rest of the session.

- The previous session ended with a strong bull trend.

- The three-bar reversal pattern was also the right shoulder of a bullish head and shoulders formation. (You might have noticed that its head was a regular three-bar reversal pattern. In this case, it gave a better entry than our enhanced pattern.)

- The last bar of the pattern closed above the highs of the two previous bars. That was our signal to buy.

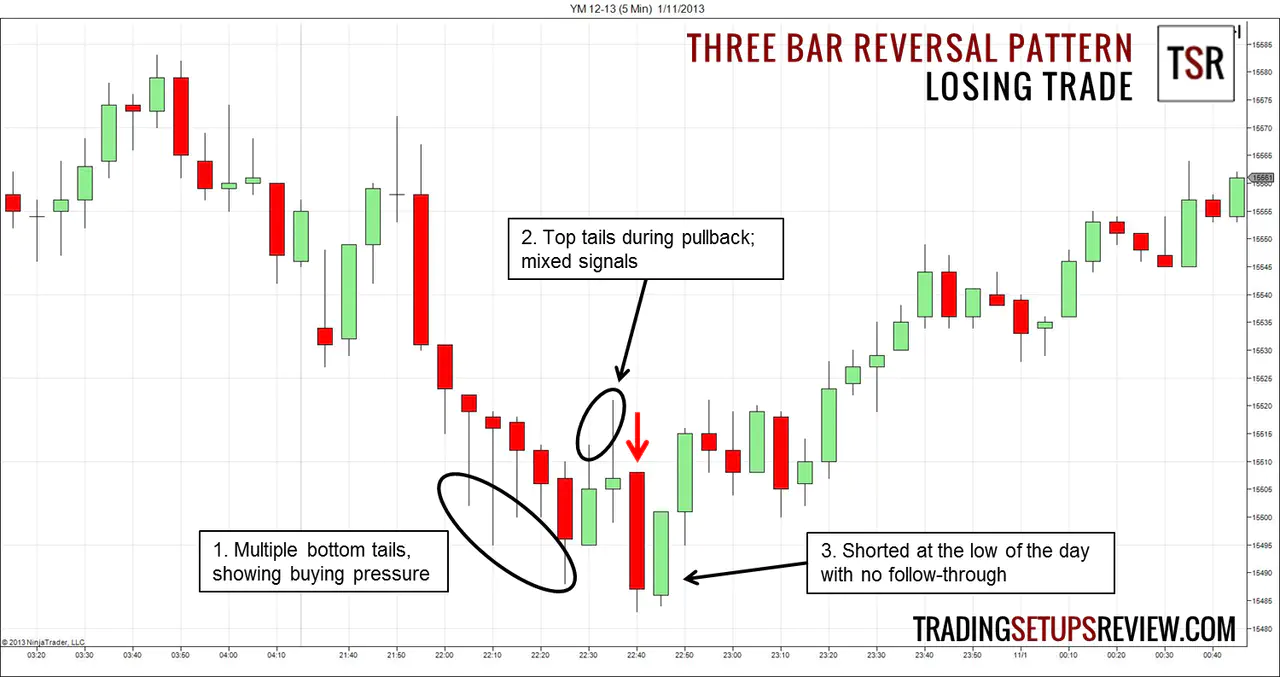

Losing Trade

This is a 5-minute chart of E-mini Dow contract. Despite a solid signal bar, the pattern failed immediately after entry.

- Although prices fell for seven consecutive bars, the increasing buying pressure is evident as the bars show long bottom tails (shadows).

- Tails developed at the top of the bars during the pullback upwards. Tails on both top and bottom of the bars are giving us mixed signals, implying that prices might be congesting soon.

- If we ignored the above warning signs and shorted the three-bar reversal pattern, we would have entered a losing trade.

Review - Three-Bar Reversal Pattern For Day Trading

This modified three-bar reversal pattern is impressive. A simple rule has turned this typical pattern into a great setup.

Recognize that this added rule is asking for confirmation of the pattern in advance.

Applying the technique of candle blending, if Bar 3 in a standard three-bar reversal pattern has excellent follow-through in Bar 4, blending Bar 3 and Bar 4 would have resulted in this enhanced three-bar reversal pattern.

You can easily combine this pattern with other indicators or price patterns to find high probability trade setups. The winning example is an excellent combination of a head and shoulders formation and a three bar reversal pattern.

However, due to this additional criterion, the signal bar (Bar 3) tends to have a wide range. As our stop-losses are usually placed on the opposite end of the signal bar, the trade risk might be higher. We should either cut down our trade size or tighten the stop if possible. If you are unable to manage the risk, then skip the trade setup.

One last point to note is that if the middle bar of the pattern is an outside bar, be very careful. Outside bars often precede wild and unpredictable price action.

Need an indicator to help you find the Three-Bar Reversal? Click here.

If you want to read more about three-bar patterns, check these out: