A Simple and Effective Price Action Trading Setup

By Galen Woods ‐ 6 min read

This simple and versatile price action trading setup takes advantage of trapped traders. This price action strategy works great for any time-frame.

Observing price action is the simplest way to trade.

Yet, many price action trading setups are not simple at all, requiring interpretation of complex and subjective chart formations.

The worst part is that traders often memorize price action trading setups without understanding the concept behind them.

In this article, we will introduce a simple and effective price action trading setup - Trend Bar Failure.

Basic Definitions For Price Action Trading

Trend

In price action trading, higher highs and high lows show an upward trend. Lower highs and lower lows show a downward trend.

In our examples, for simplicity, we will be using the slope of the 20-period EMA as our trend filter.

You are free to use your own methods and discretion to find the trend. Some of the more popular trend tools are moving averages and the ADX indicator.

One tip for identifying trends: trends are evident. When it is doubtful whether the market is trending, it is not trending.

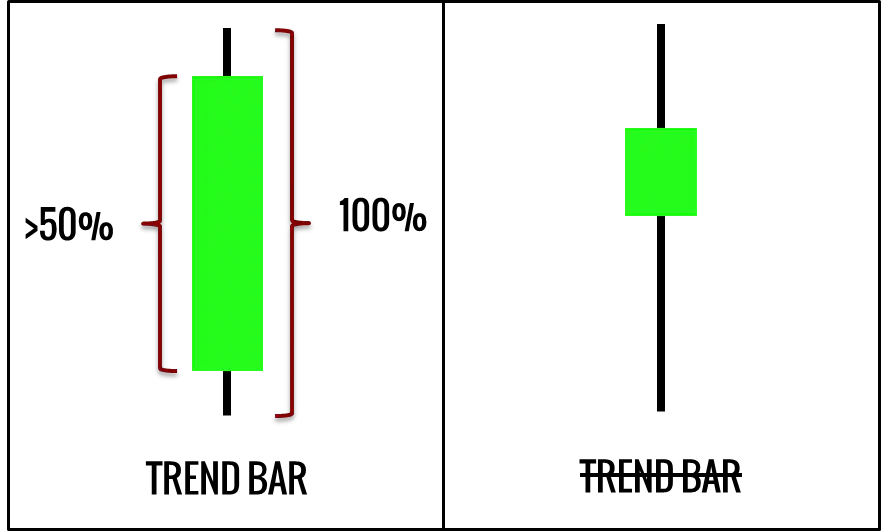

Trend Bar

A trend bar is one that represents a trend within a smaller time-frame. It opens and closes on opposite ends of the bar.

A bull trend bar opens near its low and closes near its high. A bear trend bar opens near its high and closes near its low.

What does a trend bar mean?

It means that traders have committed to one direction. Remember that in every bar, the same number of contracts are sold and bought.

The only reason for a bar to end up with a higher price is that the buyers were more aggressive than the sellers. The reverse is true for a bear trend bar.

How does a trend bar look like?

While we can identify trend bars subjectively depending on the market context, I prefer a more objective measure.

A trend bar has a body that is greater than 50% of the entire bar range.

Trading Premise

These premises set the stage for this price action trading setup and explain its concept.

The explanation below is for a bull trend. The reverse is true for a bear trend.

1. Trends tend to continue.

Our first premise is one of the principles of technical analysis.

As trends tend to continue, our edge lies in following the trend.

2. Trend bars against trend hint at the entry of counter-trend traders.

In a bull trend, bear trend bars represent counter-trend traders trying to reverse the trend. The committed bearish traders are counter-trend traders.

3. The trend continues as counter-trend traders fail in their attempt to reverse the trend.

According to our first premise, the trend is more likely to continue than to reverse. Hence, it is likely that the counter-trend traders are wrong. The bearish trend bar is expected to fail without significant follow-through.

As the counter-trend traders realize that the bull trend is not reversing as they anticipated, they will cover their short positions and might even reverse to buy.

The Trend Bar Failure Trading Setup

Following the premises above, the entry for a trend continuation trade takes place when a trend bar against the trend fails.

If a trend bar is not followed by another trend bar, we should prepare ourselves for a Trend Bar Failure.

Rules for Long

- 20-period EMA is sloping up (or if your trend assessment is bullish)

- Bear trend bar

- Low of bear trend bar broken (without forming a second bear trend bar)

- Place a buy stop order above the high of the bar

- Cancel order if not triggered within one bar

Rules for Short

- 20-period EMA is sloping down (or if your trend assessment is bearish)

- Bull trend bar

- High of bull trend bar broken (without forming a second bull trend bar)

- Place a sell stop order below the low of the bar

- Cancel order if not triggered within one bar

Trade Examples - ES Futures (5-Minute)

We have marked the trend bars in the charts. Bull trend bars with green arrows and bear trend bars with red arrows.

- A powerful bearish bar followed by a bullish reversal bar. It had good potential, but the buy order placed at the high of the bullish reversal bar was not triggered.

- A bearish trend bar tested the EMA without much follow-through. The bull trend bar triggered the buy stop order and led to a profitable trade.

- This bear trend bar was also an inside bar. The two failure trades (failure of inside bar and trend bar) led to the six consecutive bull bars.

- Although the bar after the marubozu was not a bear trend bar, its high was not broken, and our buy order was not triggered.

We cancel the orders if they are not triggered within one bar.

This is because the best trades happen quickly like a knee-jerk reaction. By canceling orders that are not triggered swiftly, we are avoiding inferior trades and taking only the very best trades.

Trade Examples - Ameren Corp (Daily)

You can use this price action trading setup for swing trading as well.

- A doji broke the low of the bear trend bar. However, the buy order was not triggered.

- An irresistible trade, with an outside bar hitting our buy stop order after testing the EMA.

- The firm bear trend bar had little follow-through, but the buy order was not triggered.

Trade Example - EUR/USD (Weekly)

Price action trading setups work well in the forex market.

- The bear trend bar failed with a bull trend bar. This pattern is also known as the pipe pattern.

- This trend bar failure was also an inside bar failure. However, the signal bar was a doji and not ideal.

- The bear trend bar had limited follow-through. Although this trade was profitable, prices went sideways before resuming the trend. A more conservative trader would have exited during the sideways congestion.

Trade Example - SPDR S&P 500 ETF (Monthly)

This simple price action trading setup is robust enough for long-term analysis as well.

- The bear trend was also an outside bar. This meant that the bears overwhelmed the bulls in that bar. However, the next bar was a bullish reversal bar. It was a good trade with excellent follow-through. However, it might end up as a loss if our targets were further.

- Another solid pipe pattern that tested the EMA.

Conclusion

The Trend Bar Failure trading setup is straightforward and versatile. It is the ideal starting point for price action trading.

The basic premise is the trapping of counter-trend traders. However, it manifests in different forms like inside bar failure and the pipe pattern.

As shown in the many examples above, you can use this price action trading setup in time-frames ranging from intraday trading to longer-term monthly analysis.

Want to learn more price patterns like the Trend Bar Failure? Check out my price action trading course and start learning right away.