4 Types Of Basic Trade Setups

By Galen Woods ‐ 3 min read

Basic trade setups can be classified into 4 types: continuation, reversal, range-bound, and breakout. Each trade setup is used in different market contexts.

Understanding the different types of trade setups is immensely useful. It is an easy way to improve your trading performance regardless of your strategy. There are four types of basic trade setups:

- Continuation

- Reversal

- Range-bound

- Break-out

Trade Setups for Trending Markets

#1: Continuation Trade Setup

A continuation trade setup finds a chance to join an existing trend. It profits as the trend continues. This basic trade setup has at least two parts to it:

- Identify a trend

- Identify a pause in trend for trade entry

The 9/30 trading setup is a classic example of a continuation trade setup. It uses two moving averages to find the market direction and pinpoint the entry.

#2: Reversal Trade Setup

A trend either continues or reverses.

Similar to a continuation trade, we must have an existing trend before looking for a reversal trade setup. However, instead of entering with the trend, we are looking for a reversal.

Reversal trades have low hit rate but very high potential rewards. Hence, for reversal trades, let your profits run.

The popular trend following systems are examples of reversal trading. As they try to follow trends, they reverse their position with each reversal signal their system gives.

More: Trend Trading Strategies

Trade Setups for Ranging Market

#3: Range-bound Trade Setup

What if the market is not trending? What if the market is stuck in a range?

In that case, a range-bound strategy is ideal. In short, we buy low and sell high within the range.

As long as the trading range does not break out into a trend, such trading setups have a high win rate. However, as our profit target is most within the trading range, each trade gives a small profit.

Oscillators like stochastics and CCI are very useful for range-bound trading setups.

Learn: Use Gimmee Bars to Trade Range-Bound Markets

#4: Breakout Trade Setup

Eventually, all range-bound markets resolve into new trends. A breakout trade setup tries to capture the break-out of a range to profit from the birth of a new trend.

As most breakout attempts fail, a breakout trade is a low probability trade. However, it remains popular as the chance to catch a new trend is too enticing for most traders.

The squeeze setup using Bollinger Bands is a great example of a breakout trade setup. It uses Bollinger Bands to find low volatility periods to avoid false breakouts.

Basic Trade Setups Tips

Types Of Trade Setups Are Not Mutually Exclusive

These four types of basic trade setups are not mutually exclusive.

For example, an upwards trend might pause and form a small range before continuing up. In that case, the breaking out of that range is both a breakout trade of the lower range and a continuation trade of the larger trend.

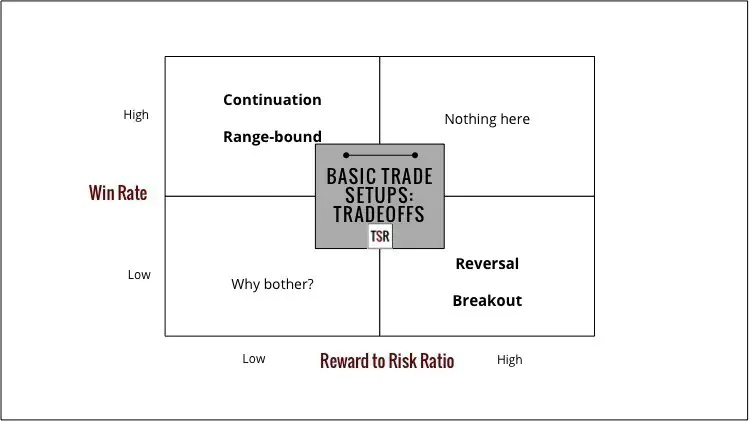

Basic Trade Setups - Trade-off Diagram

As you can see, you cannot have your cake and eat it too.

Stop looking for the perfect trading setup with high win rate and high reward to risk ratio.

Start learning about the right market context to use your favorite trading setups.