Gimmee Bar Trading Strategy

By Galen Woods ‐ 3 min read

Gimmee bar is a reliable trading setup for sideways markets. Employ this trading strategy to earn consistent small gains when market volatility is low.

The Gimmee bar is a classic entry pattern for a sideways market shared by Joe Ross - an experienced trader and educator. He is the author of several well-known trading books including Trading by the Book and Trading by the Minute.

This trading strategy looks for a reversal down from the top of a trading range, or a reversal up from the bottom of the trading range.

Trading Rules - Gimmee Bar

Long Trading Strategy

- Prices falling within a trading range

- Price must tag the lower Bollinger Band

- Wait for a bar that closes higher than open (This is the Gimmee bar.)

- Buy one tick above Gimmee Bar

Short Trading Strategy

- Prices rising within a trading range

- Price must tag the upper Bollinger Band

- Wait for a bar that closes lower than open (This is the Gimmee bar.)

- Sell one tick below Gimmee Bar

Important Trading Exceptions

Joe Ross warned against trading Gimmee bars with any of the following traits:

- The Gimmee bar overlaps or is close to the moving average.

- The Gimmee bar has a wide range compared to the previous bar.

- The bar after the Gimmee bar gaps and opens beyond the range of the Gimmee bar.

Gimmee Bar Trade Examples

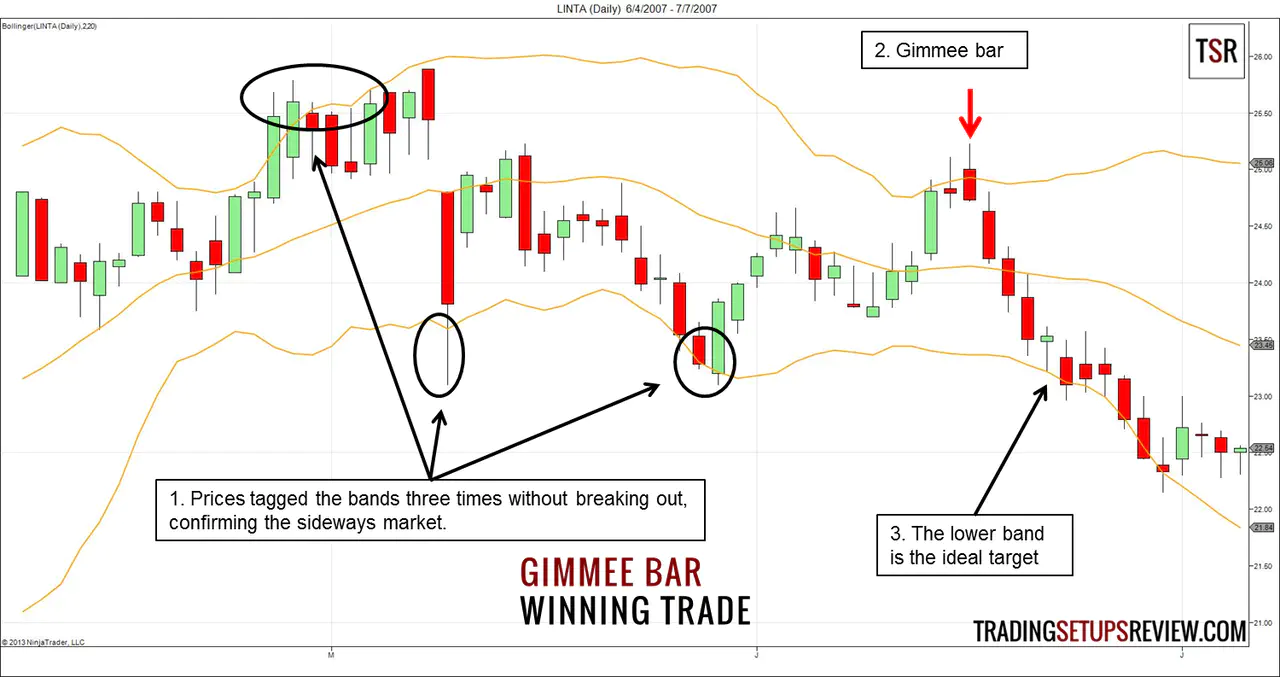

Winning Trade - Gimmee Bar

This chart shows the daily price bars of Liberty Interactive. This Gimmee bar achieved more than what we expected and started a whole new downtrend.

- Prices tagged the Bollinger Bands three times without breaking out, confirming a sideways market.

- Prices touched the upper Bollinger Band. Two bearish reversal bars emerged. Both were Gimmee Bars, but the market only triggered the second one.

- Prices moved quickly down to the lower Bollinger Band, which was the ideal target for bearish Gimmee bars.

Losing Trade - Gimmee Bar

This is a 20-minute chart of 6J, the JPY/USD futures contract.

There are many profitable Gimmee bars here, but we are focusing on the failed instance.

- This sideways market had many Gimmee bars as marked out by the gold arrows.

- This Gimmee bar touched the moving average. According to the exceptions mentioned, we should not take this trade.

- The last Gimmee bar before the upside break-out failed after tangling with the moving average for a while. For Gimmee Bars that are also reversal bars, consider placing your stop-loss just above the high of the previous bar (dotted line). Doing so can improve your reward-to-risk ratio.

This failed trade reminds us that the longer a sideways market lasts, the more likely a break-out will succeed.

Moreover, it occurred shortly after the Tokyo opening when we expect greater volatility.

Review - Gimmee Bar Trading Strategy

This trading strategy combines Bollinger Bands with price action to take range-bound trades.

The trickiest part of this trading setup is to confirm a sideways market.

If the market is in a trading range, you can use a reversal bar pattern to aim for consistent small profits. Candlestick reversal patterns should work well too.

Range-bound trading aims for smaller but more consistent profits. However, you should still pay attention to your reward-to-risk ratio.

If prices are tightly congested (narrow Bollinger Bands), you have limited profit potential.

Nonetheless, in a sideways market, prices should bounce off the Bollinger Bands without pushing much beyond them. Hence, tighter stops are often possible and can improve the reward-to-risk ratio.

The three critical exceptions Joe Ross highlighted extends beyond this trading strategy. They describe price action that does not bode for trade entries. You will find those exceptions helpful for other trading strategies as well.

A last note for day traders. The time of the day is important. Avoid high-volatility periods during which range breakouts are more likely.