Two-legged Pullback to Moving Average (M2B, M2S)

By Galen Woods ‐ 3 min read

Two-legged pullback is one of the most reliable price action trading setups. Learn how to combine it with a moving average for a high probability trade setup.

Many price action traders claim that two-legged pullbacks are the most reliable trade setups. The variant we are reviewing today is from Al Brooks, who wrote three tomes on price action trading. These three books are not an easy read, but are extremely informative for price action traders.

In his books, he identified a two-legged pullback to the moving average as one of the best trade setups when there is a strong trend.

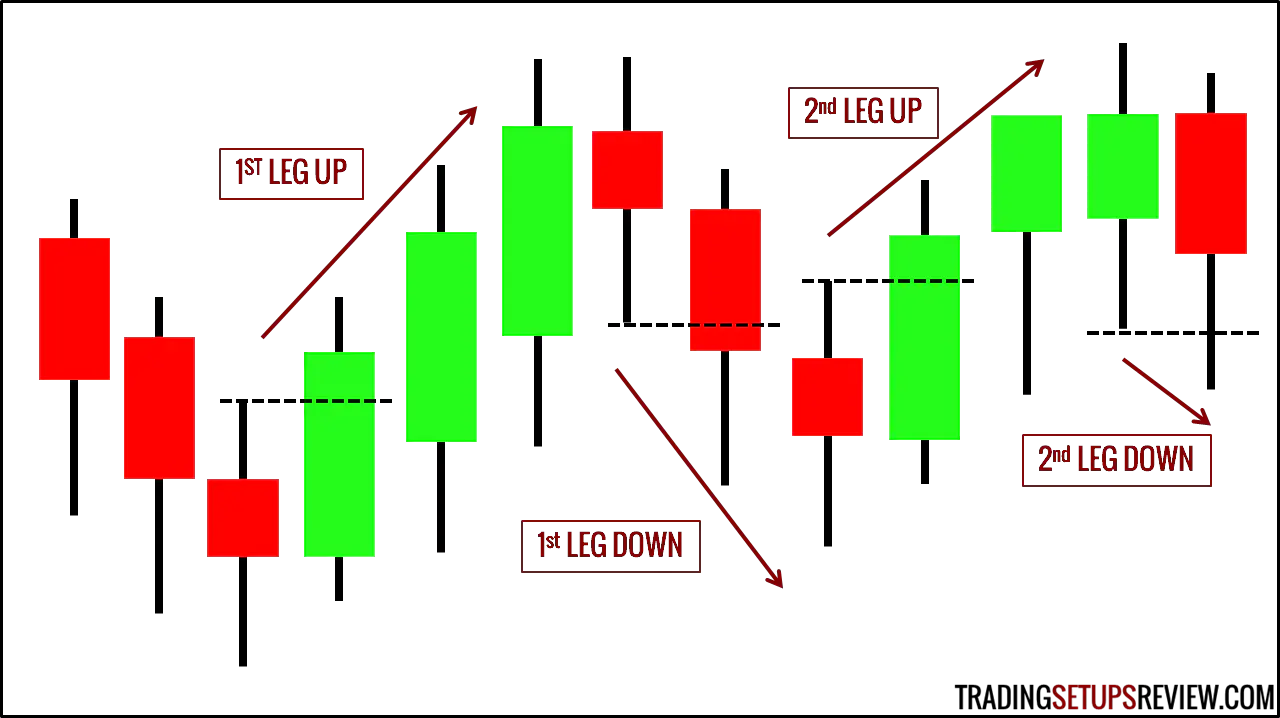

Before we start, let’s have a basic explanation of counting legs. Any bar that goes higher than the previous bar starts a new leg up. Any bar that goes lower than the previous bar starts a new leg down.

Trading Rules - Two-legged Pullback to MA

Long Trading Setup - M2B

- Strong up trend

- Two-legged pullback down to 20-period EMA

- Enter a tick above the bar that tested the 20-period EMA

Short Trading Setup - M2S

- Strong down trend

- Two-legged pullback up to 20-period EMA

- Enter a tick below the bar that tested the 20-period EMA

Two-legged Pullback to MA Trade Examples

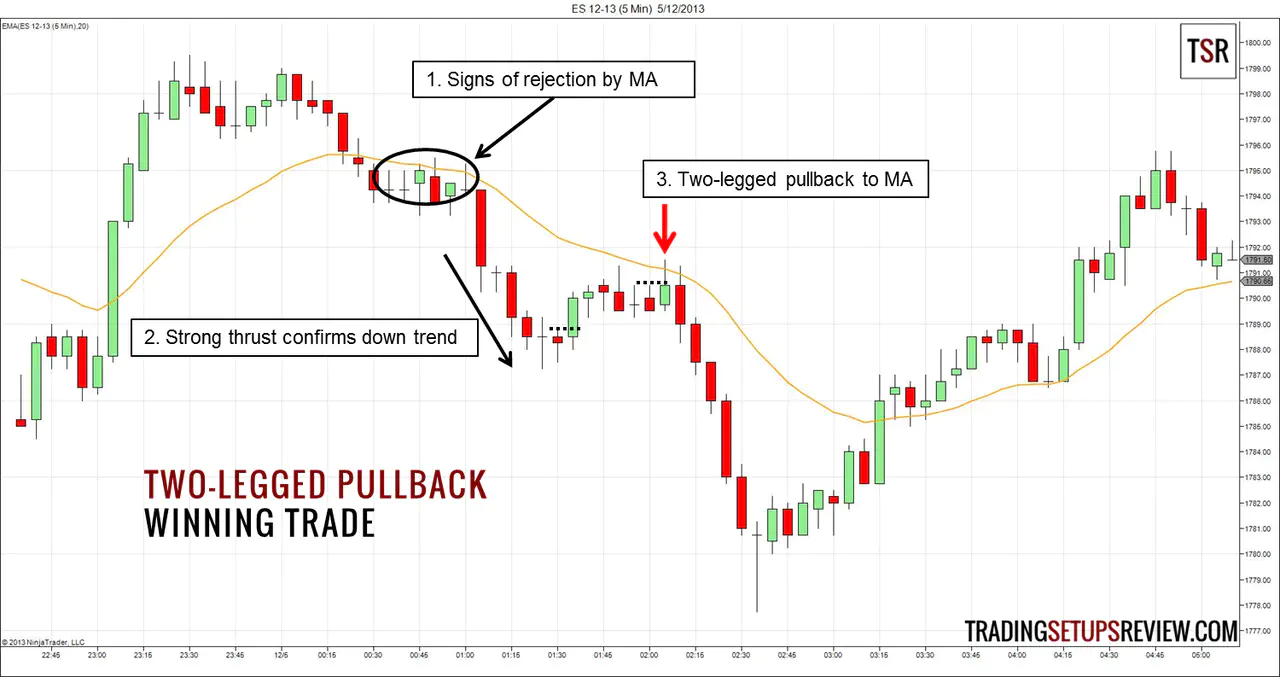

Winning Trade - M2S

This is 5-minute chart of ES futures contract, which is the main instrument Al Brooks trades. This trade is a beautiful example of a two-legged pullback trade.

- After prices crossed below the EMA, it tried to crossed back but was clearly rejected.

- The strong downwards thrust confirmed the down trend, which was what we needed before looking for continuation trades.

- The two short, dotted lines highlight the beginning of each leg up. This two-legged pullback looked good with the long top tails that showed as prices approached the EMA. The long top tails implied selling pressure.

Losing Trade - M2B

Another session of S&P E-mini futures showing 5-minute bars, which is Al Brook’s recommendation as the sweet spot for day traders.

- The day started with swings up and down without a clear direction. However, as prices made new lows, bottom tails emerged, showing buying pressure.

- The up swing above the EMA seemed strong as there were eight consecutive bars with higher lows. However, there were three bear trend bars within the swing, which hinted at persistent bears.

- Following a two-legged pullback to the EMA, we had a bullish reversal bar as our signal bar. We entered a tick above it but got stopped out after some sideways movement.

A key difference between the losing trade and the winning trade is how certain we were that the market was trending. In the winning trade example, we saw clear rejection from the EMA, which we did not see in the losing example.

Review - Two-legged Pullback to MA

Continuation trades work because the trend traps counter-trend traders. Two-legged pullbacks are more enticing to counter-trend traders and works better as a mousetrap for them.

Hence, in a trending market, the two-legged pullback to the moving average is a simple and high probability trading setup.

The key lies in finding trending markets. Pay attention to signs of a trending market and trade opportunities will present themselves. Very often, you can pay attention to the space between prices and the moving average for a sense of momentum. Two-legged pullbacks that follow strong momentum are better quality setups.

However, very strong trends tend to have single leg pullbacks. If you insist on waiting for two-legged pullbacks, then you must be ready to miss some trades in strong trends.