Modified Hikkake Price Pattern For Trading Reversals

By Galen Woods ‐ 4 min read

The Modified Hikkake price pattern is an effective twist on the Hikkake for reversal traders. Learn how to find this rare variant of the Hikkake pattern.

The Hikkake pattern is one of my favorite price patterns. Although it is a simple pattern, it demonstrates powerful price action concepts. In this tutorial, you’ll learn about a lesser-known variation of the Hikkake:

Modified Hikkake Pattern

According to Dan Chesler, the Basic Hikkake works for both continuations and reversals. On the other hand, the Modified Hikkake Pattern is for trading reversals.

Before proceeding, make sure that you’re familiar with the basic Hikkake pattern. (If you’re not, please go through our article on the Basic Hikkake pattern here.)

How To Identify The Modified Hikkake Pattern

Apply these guidelines on top of the rules for the Basic Hikkake.

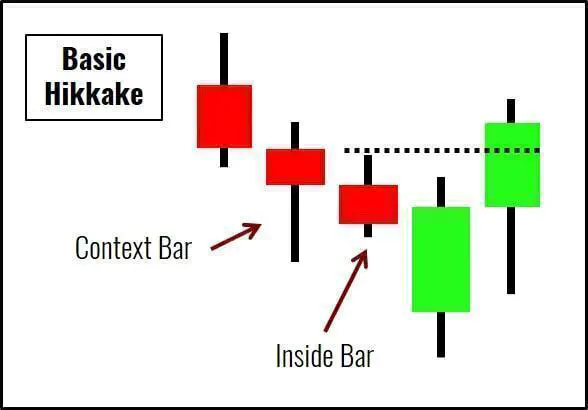

First, recall that the Basic Hikkake pattern has an inside bar.

Now, look at the bar preceding the inside bar. For ease of reference, let’s call it the Context Bar.

For a bearish Modified Hikkake, the Context Bar must:

- Close near the top of its range; and

- Have a smaller range compared to the bar preceding it.

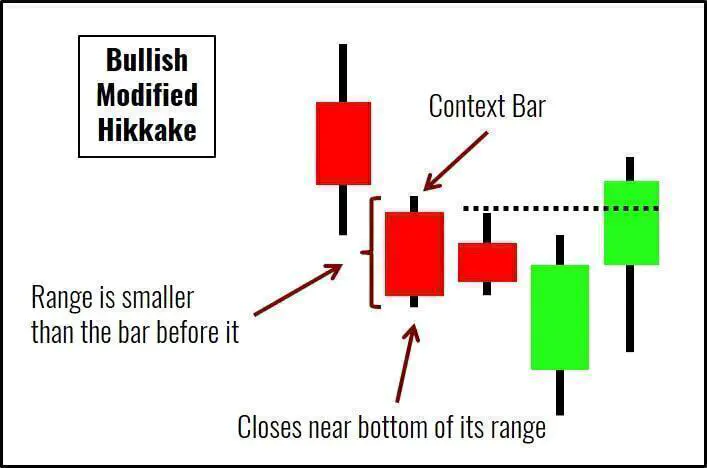

For a bullish Modified Hikkake, the Context Bar must:

- Close near the bottom of its range; and

- Have a smaller range compared to the bar preceding it.

The diagram below shows a bullish Modified Hikkake price pattern.

The Price Action Dynamics of a Modified Hikkake

For the following discussion, let’s focus on the bearish Modified Hikkake.

It’s important to recall that it works as a reversal pattern here.

A bearish reversal pattern makes sense only if there is a bullish context. If not, there is nothing to reverse. This is why you want the Context Bar to close near the top of its range. You want it to be bullish.

However, a solid reversal setup should show a weakening trend. This is why you want the bullish Context Bar to have a smaller range than the bar before it. Hence, despite its bullish close, the reduced range implies weakening bulls.

With this modifying context, a bearish Hikkake is primed to reverse a bullish trend.

The above explanation comes from my understanding of this modified price pattern. You’ll not find them in the Dan Chesler’s article I used as source material.

Trading Examples - Modified Hikkake Pattern

In the examples below, the green and red arrows mark out basic Hikkake patterns. (This price action pattern indicator was used.)

These basic patterns serve as a starting point for finding the Modified Hikkakes.

The charts use the 20-period SMA as a basic method to determine the market trend.

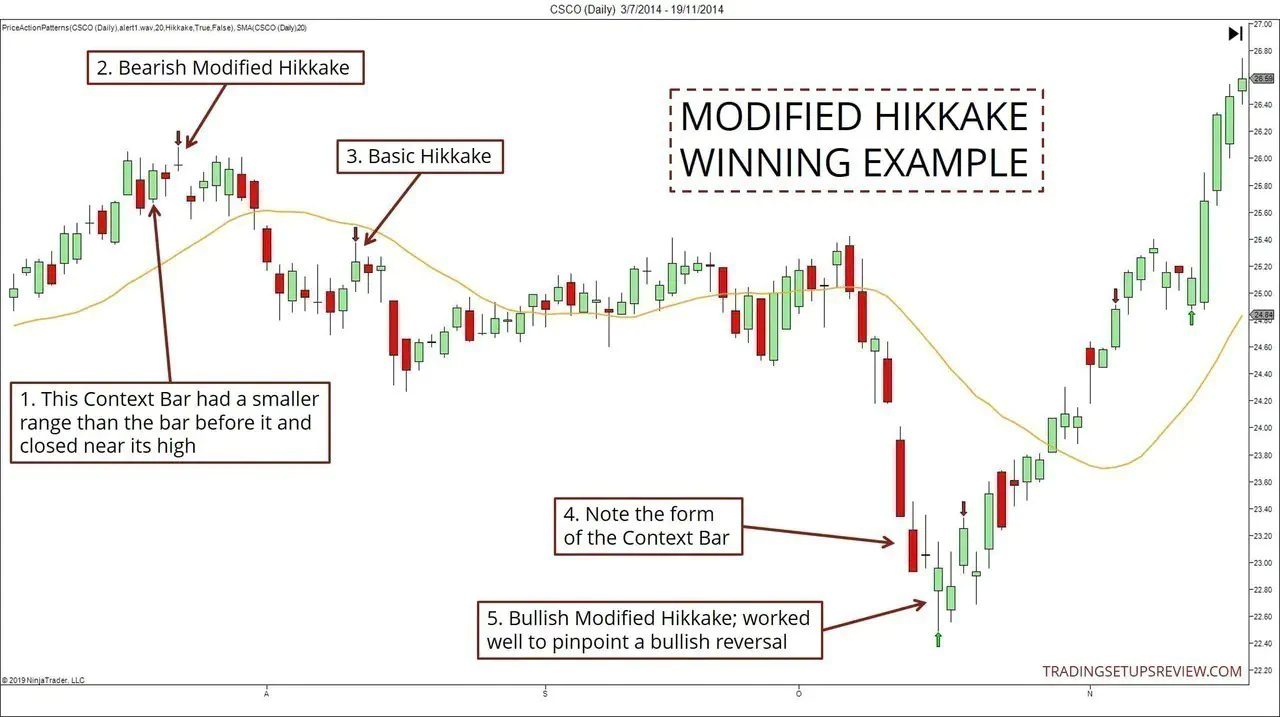

Winning Example

This example highlights the prowess of the Modified Hikkake as reversal price patterns.

It shows two Modified Hikkake patterns that managed to pinpoint trend reversals.

- This Context Bar had a smaller range than the previous bar. Also, it closed near its high. Hence, it satisfied the conditions for a bearish Modified Hikkake.

- This red arrow marked out the corresponding bearish Modified Hikkake. From here, the market took a turn down. (As the Context Bar was an inside bar too, this pattern was also a Double Inside Bar Breakout Failure.)

- For comparison, look at this Basic Hikkake. It can serve a trigger for both reversal and retracement setups. (A Modified Hikkake targets only reversals, and is presumably better at it.)

- Take note of the Context Bar of the bullish Modified Hikkake. It closed near its low and had a smaller range compared to the bar before it.

- This bullish Modified Hikkake worked perfectly here as a bullish reversal entry trigger.

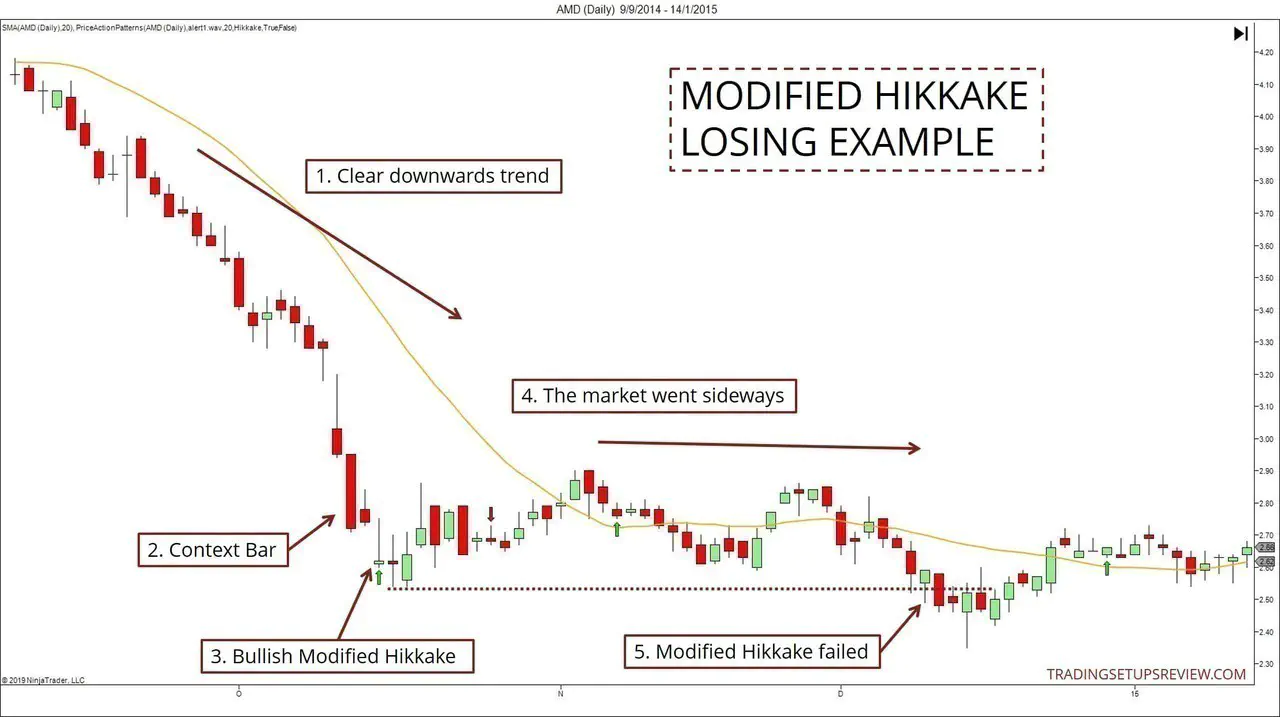

Losing Example

- The market was in a strong bearish trend.

- This Context Bar met the conditions for setting up a bullish Modified Hikkake.

- This was the bullish Modified Hikkake.

- The market stopped falling, but it did not succeed in creating a new bull trend. Instead, it drifted sideways.

- The market punched below the Modified Hikkake. It would have triggered reasonable stop-loss orders for this price pattern.

In this example, the Modified Hikkake might not be ideal for a reversal setup.

Nonetheless, the market did go sideways after the Modified Hikkake formed. Hence, it was useful as a signal for taking profits if you were already in a short position.

Another interesting point here was the range of the Context Bar. Although it had a smaller range than the bar before it, it was not smaller by a significant margin. You can interpret it as a warning against the Modified Hikkake pattern.

Strategy Review - Modified Hikkake For Reversals

If you like to trade reversals, you should check out the Modified Hikkake pattern on your charts. While it does not occur as often as the Basic Hikkake, it is a useful trigger for a reversal setup.

Remember that you should never trade a reversal just because you spot a Modified Hikkake.

The best reversal trades have support and resistance and volume analysis on their side. Use these frameworks to augment your analysis before getting into a reversal trade.

The Modified Hikkake found value in analyzing the range of a price bar. Other price patterns that made use of such information include the Yum-Yum pattern and the NR7 pattern.