5 Skills All Price Action Traders Must Have In Their Trading Toolbox

By Galen Woods ‐ 7 min read

Want to improve your price action trading skills? Make sure you focus on honing these five essential price action skills and add them to your arsenal.

There’s no professional qualification or academic courses for price action trading. Yet, you’re expected to know what’s going on in a market with just one input: price. Not only that, you must have a plan to trade your interpretation of price action.

Price action is simple, but being a price action trader is tough.

Memorizing candlesticks and bar patterns is not enough to be an adequate price action trader. You must have a set of price action skills to apply to any market to make sense of it.

Here, I’ve identified five skills all price action traders should have. To be an effective price action trader, you need to first hone and eventually excel in these skills:

- Find swing pivots

- Draw trend lines

- Determine if a support or resistance would hold or fail

- Recognize buying and selling pressure

- Use realistic targets

Trading Skill #1: Find Swing Pivots

The market prices move in swings. These swings:

- Define the market structure

- Form the basis of market support and resistance

The market structure is like your battlefield. It is the terrain in which you will fight. Therefore, the more you understand it, the greater your advantage.

If you want to flow with price, follow price swings. They will show you:

- The current direction of the market; and

- Potential support and resistance.

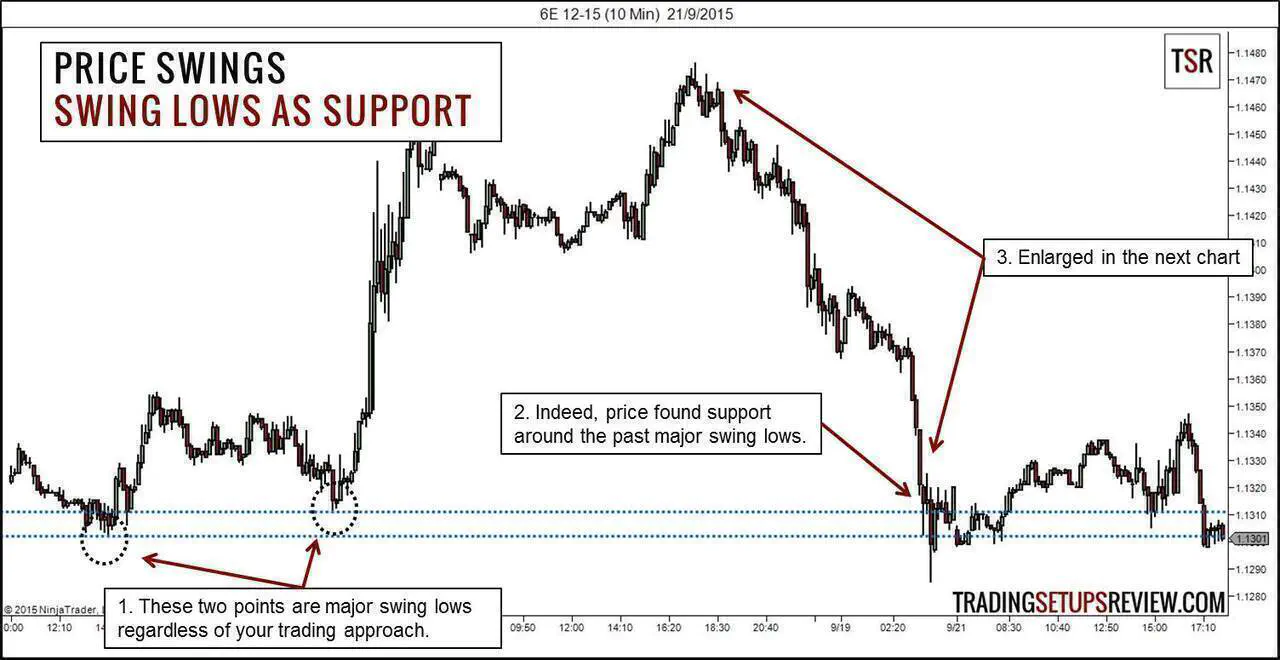

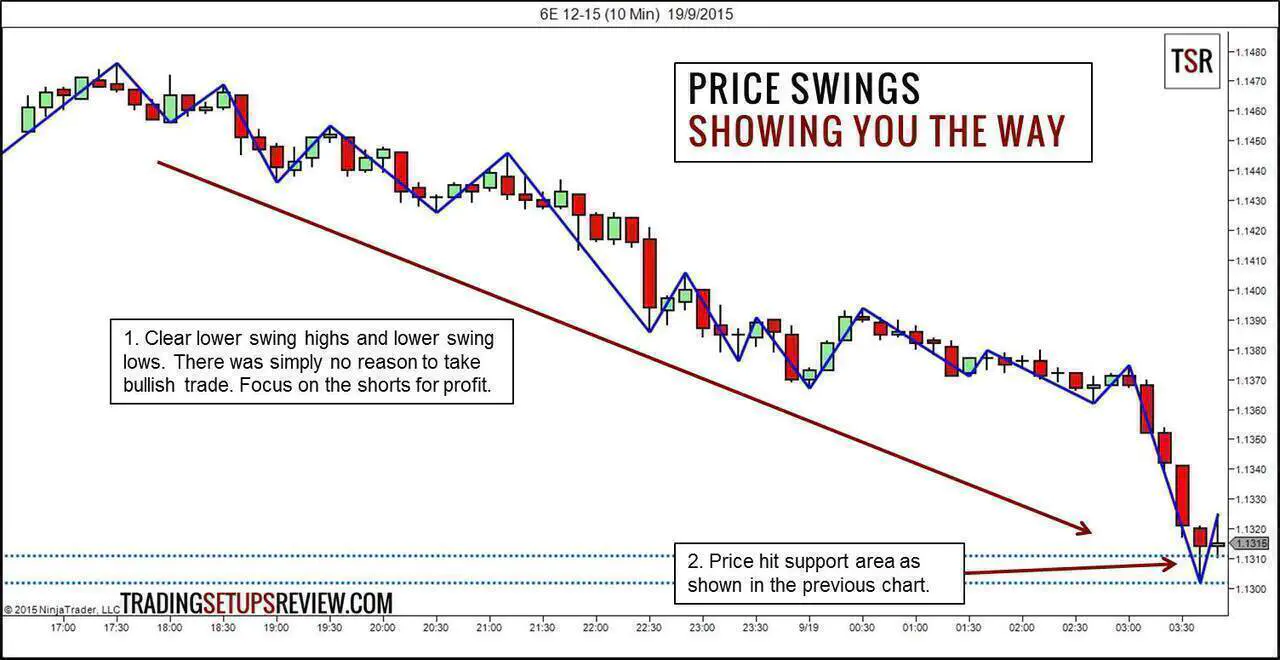

The two examples below come from the 6E (Euro FX) futures 10-minute price action.

- Regardless of how you define swing pivots, these two points were significant swing lows. From these swing lows, we could project a support zone.

- Despite the rapid selloff, the market was halted around the support area.

- Let’s zoom into the price action of this downwards trend (between these two points) in the chart below.

- Observe the swing highs and swing lows. They went lower and lower. Attempts to rise above the previous swing high were rejected—a clear downwards trend.

- Support area projected from the major swing lows shown in the first chart.

Here are some methods of marking swing pivots:

Like everything in trading, no method is perfect. Just pick one way to define market swings and stick to it.

See how the market structure of price swings works with a popular candlestick pattern.

Trading Skill #2: Draw Trend Lines

Drawing trend lines is the natural progression from price swings.

To get a trend line, just connect your swing pivots and extend the resulting line to the right of your chart.

Trend lines are incredibly versatile as a trading tool.

- Trend lines tell you which direction to trade with.

- Trend lines act as support and resistance.

- Trend lines give you a sense of trend momentum.

So don’t leave your trend lines behind.

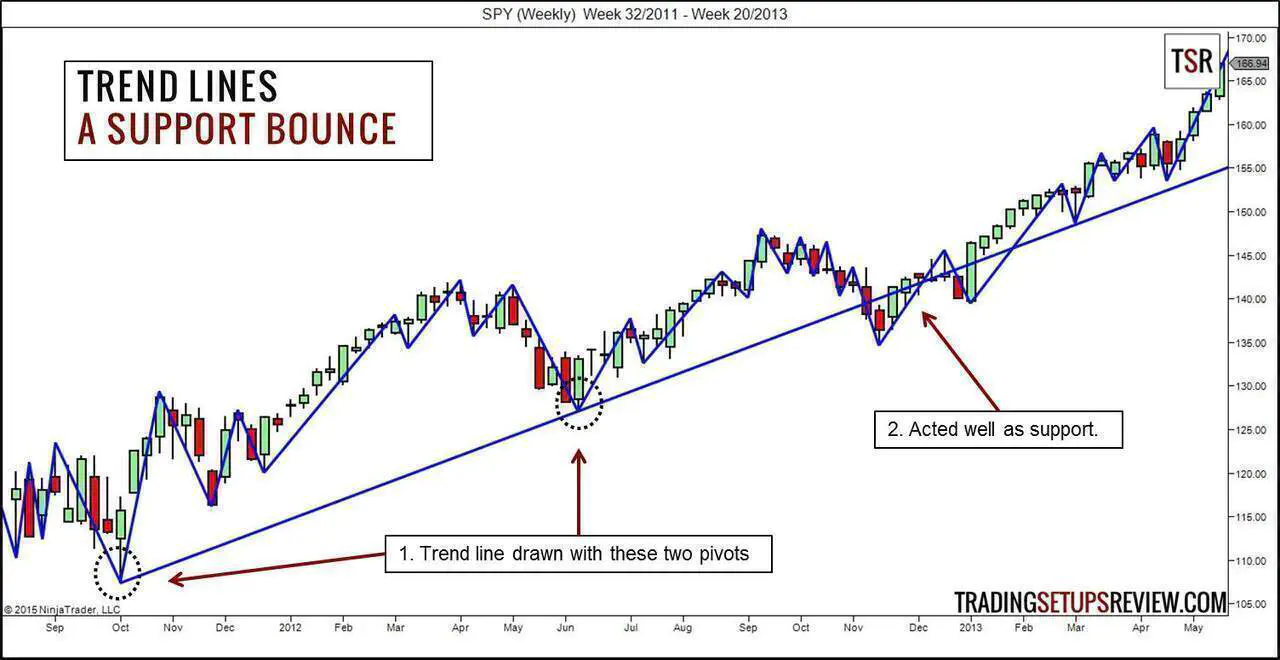

Price action methods work on most time-frames. Below is a weekly SPY (SPDR S&P 500 ETF Trust) chart.

(The trend line is drawn according to a valid pivot as taught in my course.)

Learning to draw trend lines is a crucial skill for any price action trader.

Here are some resources for you to dive deeper into:

- A Simple Trend Line Channel Strategy

- A Complete Trend Line Strategy

- Trading Pullbacks With Trend Lines and Trend Channels

Finally, If you want to learn about a unique trend lines technique, take a look at Andrew’s Pitchfork. It combines swing pivots and trend lines into an elegant trading tool.

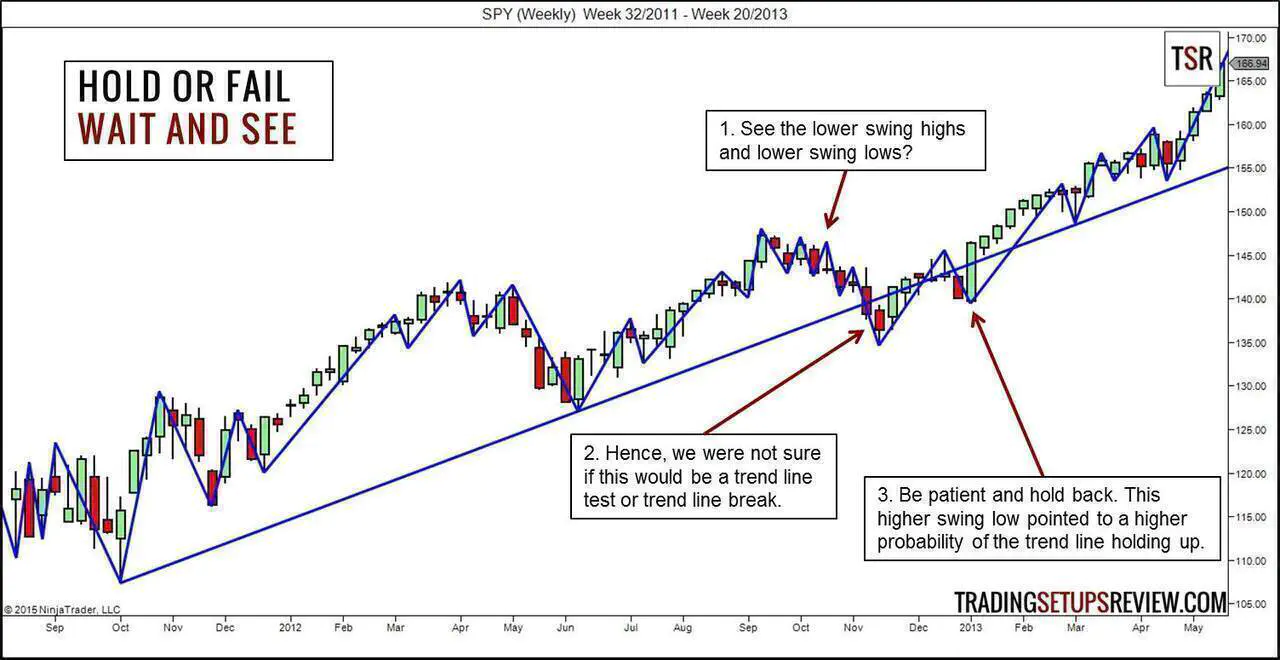

Trading Skill #3: Determine if a Support/Resistance Would Hold or Fail

What are support and resistance?

Do they always fulfill their role as support and resistance? Are these supposed support and resistance levels 100% reliable?

Nope.

However:

- If you expect a support level to hold, you will buy as the market tests the support area.

- If you expect a support area to fail, you will sell as the market breaks out below the support zone.

Hold or fail. It affects your trading strategy.

Hence, judging the likelihood of a support or resistance area holding up is an essential trading skill.

The key to a correct judgment is patience. Waiting for more price action clues is the best course of action when in doubt.

- The lower swing highs and lower swing lows seem to imply a bearish turn. However, the initial downswings were weak. Observe that the first three downswings barely retraced the last swing to the trend high.

- With this solid downthrust breaking the trend line, the trend line support might have been broken.

- However, as the market was in an established bull trend, a patient trader would have held back instead of concluding a trend reversal prematurely. As the market unfolded, this higher swing low formed and confirmed that the bulls were still hanging around.

Fundamentally, all price action concepts can be broken down into comparisons of support and resistance, across time and prices. Hence, evaluating support and resistance is a vital trading skill.

Learn more with these trading guides:

- A Complete Price Action Guide to Support and Resistance

- Flipping Support and Resistance

- Support and Resistance Based on High Volume Signals

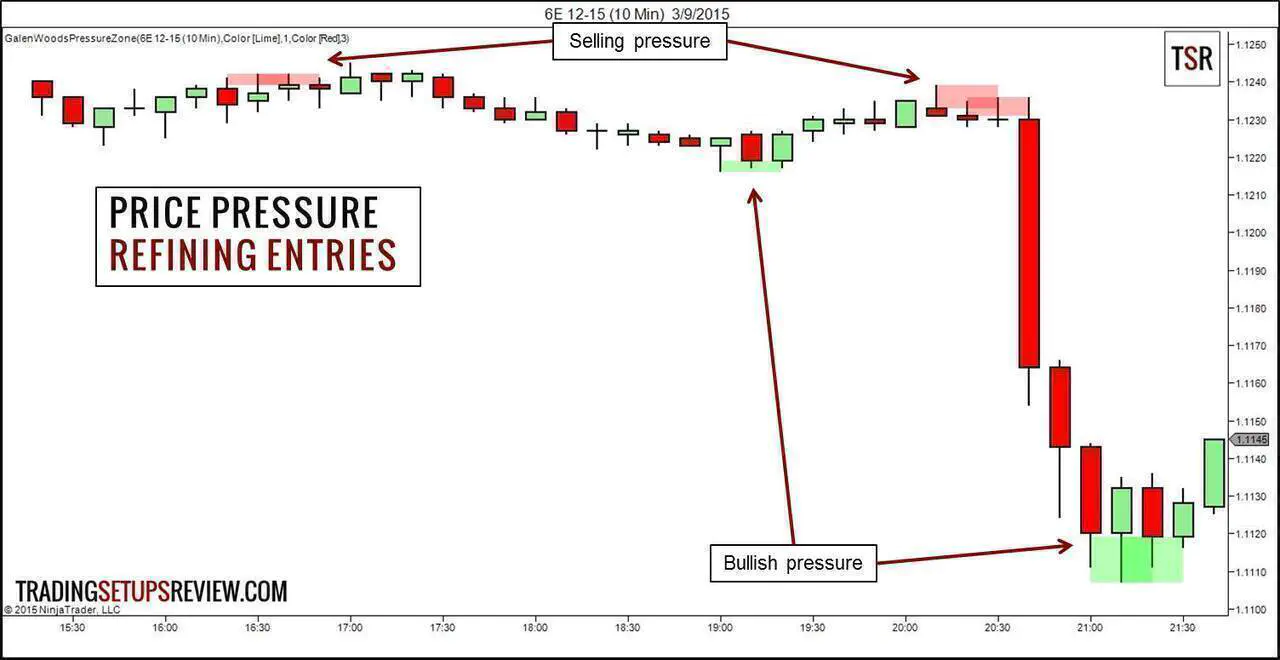

Trading Skill #4: Recognize Buying and Selling Pressure

There are micro price action flows you need to detect. Knowing how to identify buying and selling pressure at critical price points helps refine your trade entries.

A refined entry means taking on less risk and whipsaws for each trade.

Do you see the bullish and bearish pressure in the chart below?

How do you recognize buying and selling pressure?

Most price action traders use rigid price patterns to find buying and selling pressure.

But memorizing price patterns is not enough. You need to understand the psychology and rationale behind each price pattern.

- Break down each price bar: high, low, open, close, upper shadow, lower shadow, range, and the relative position of the candle body.

- Study each price bar with respect to the preceding bar.

- Understand what makes them work.

- Know when they work.

Only then, you can recognize buying and selling pressure in real-time trading.

Start with these guides:

Trading Skill #5: Use Realistic Price Targets

Taking profits is a skill that is often neglected. Most trades can be profitable, given the right price target.

Finding a realistic target based on price action is critical. This is especially so for short-term technical trading.

There are three broad categories of targeting techniques.

- Support/resistance. (Exit a long trade at a resistance level. Cover a short trade at a support level.)

- Target projection based on a price formation. (Like projecting a target from a firm price thrust as shown in the chart below.)

- Placing targets with some measure of volatility like ATR or standard deviation.

Profits do not take care of themselves. You have to grab them off the table.

- This bullish thrust was a significant formation useful for projecting targets. Accordingly, we cast a target equal to the height of the thrust.

- The target proved effective in this case.

There is no prescribed correct way to take profits. The key is to adopt methods to suit your trading plan. Here are ten ways for a trader to take profits that you can consider.

Conclusion - Price Action Trading Skills

Being a price action trader doesn’t just mean knowing what’s a Harami candlestick pattern, or a Head & Shoulders chart formation.

As you can see, a good price trader needs to perform different types of analysis.

- Market bias (Swing pivots and trend lines)

- Trade entry and risk control (Support and resistance holding versus failing, buying/selling pressure)

- Trade exit and profit-taking (Price target)

If you want to be a great price action trader, who produces consistent profits, you need to be more skillful than most other traders. At least better than the 80% to 95% that lost the trading game.

It’s not easy, but it’s possible if you’re gritty enough.

The skills we discussed are not independent of each other. There’s a lot of conceptual overlap here. So, don’t try to learn everything at the same time.

Start with understanding the bigger picture of market bias. Know what price is doing now. Then, naturally, you will find yourself moving on to finding trade entries and exits.

Most traders start from finding trades entries and ignoring the market context. Most traders fail.

There are many free resources you can use to learn these five skills. But if you want an organized way to master them, check out my price action trading course.

The article was first published on 25 September 2015 and updated on 18 February 2022.