3 Price Action Examples Of Trapped Traders

By Galen Woods ‐ 5 min read

Forget about rigid trading rules, and learn how to profit from trapped traders with three detailed trading examples with clear step-by-step explanations.

The idea of trapped traders is a useful concept for price action traders. It is not a trading strategy per se. But it is of great value as it helps you to focus on finding the right context for entering the market.

This approach is encompassing so it’s hard to reduce it to rigid trading rules. Hence, the best way to gain more insights is by studying trading examples of trapped traders.

In this article, we will cover three setups based on locating trapped traders on price charts.

The following chart examples come from a variety of markets and time frames:

- Futures: NQ 3-minute

- Forex: USDJPY 4-hour

- Stock: MMM Daily

This set of examples is an extension of what we covered in this previous article. It introduced the guidelines for finding and profiting from trapped traders. You should take a look at it before reviewing the examples below.

Example #1 - Intraday Outside Bar Trap

The first bar of the chart below is the first 3-minute bar of the session.

- The market rejected a test of the high of the day (HOD). It drew bearish interest as some sellers saw it as a chance to short at the high of the session; a tempting setup.

- The congestion that followed added anxiety for buyers, and confidence for sellers.

- Trend bars are useful for gauging sentiments. These two bearish trend bars were signs of bearish traders moving into the market.

- The bulls tried to push back, but the attempts were weak; small bullish bars.

- This bullish pin bar / outside bar sealed the deal and trapped the bears. It was a clear failed bearish attempt. As the bearish traders recognized that the market was not on their side, we get a nice bullish entry.

Example #2 - Trapped Out of The Market

There are two trading traps you can look out for.

Traders can get trapped in an awkward trading position. Or they can get trapped out of a desirable trading position.

This example sees the market through the lenses of the latter group.

- After extended congestion, the market slugged upwards.

- Then, a single bearish outside bar erased the gains of more than ten preceding bars. It also punched below the supporting trend line. Alarmed by the sudden reversal, myopic bulls ran out of the market. They did not wait to see if the congestion zone would hold up as a support level.

- Generally, outside bars should see follow-through pretty quickly. If not, there’s probably no interest in following through. In this case, it was clear that the bearish outside bar failed to overcome the supply at the congestion zone. At this point, the bulls that exited realized that they had been trapped out of the market.

- As the bulls try to re-enter, follow them in for a nice bullish push.

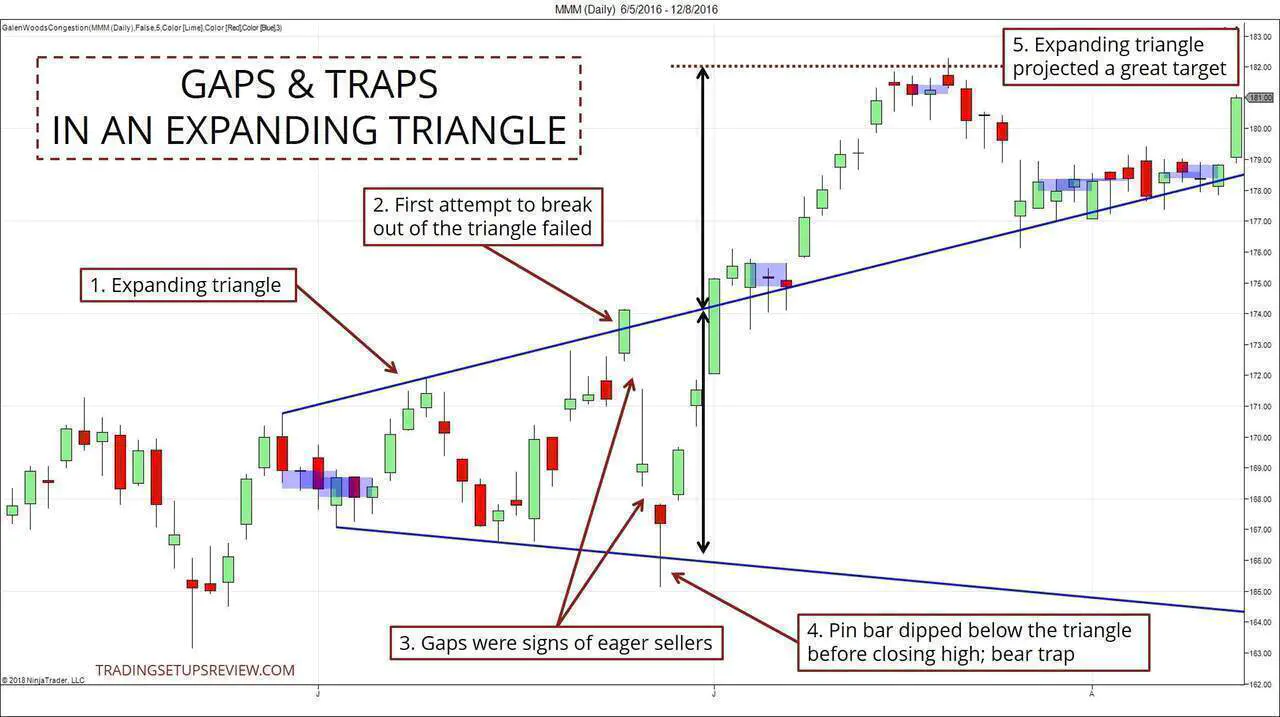

Example #3 - Gaps & Expanding Triangle

Expanding triangles are like outside bars. Both involve an expanding range and increasing volatility. An expanding triangle may well turn up as an outside bar on a higher time frame.

As these patterns introduce volatility and uncertainty, they prompt strong responses from market players.

Let’s take a look at an example of an expanding triangle on the daily chart.

- The two blue lines highlight the expanding triangle formation.

- The first attempt to break away from the expanding triangle enjoyed an optimistic close. However, the breakout was short-lived.

- For daily charts, gaps offer great windows of opportunity. These gaps were among the widest in the past few weeks. Moreover, down gaps are reliable signs of eager sellers.

- This pin bar was the telltale sign. It represented the failed breakout of bearish traders who were trapped. It was the ideal long entry in this example.

- The expanding triangle offered a projected target which worked exceptionally well.

As an aside, note the effectiveness of the top channel line. It flipped to become a support zone; look at the end of the chart where the market congested around it.

Price Action Principles - Trapped Traders

There’s a lot to take in from these examples.

Let’s focus and distill a few helpful principles from them to apply for practical trading.

Context matters

First, the most important takeaway here is that the context matters.

You don’t enter the market because of an outside bar failure.

You enter the market because you saw the preceding sluggishness (context). Hence, you know that the failure creates a knee-jerk response that you can take advantage of.

A market analysis of trapped traders forces you to focus on the context.

Contrast matters

Look for contrasting short-term momentum and longer-term support/resistance.

Emotional traders are easily swayed by short-term momentum. You can find them trapped if you give more weight to significant market levels instead of short-term fluctuations.

Go back to Example #2 - the bearish outside bar was in contrast with the support zone and the bull trend line. Such disparities offer a sound premise for trading setups.

Control matters

The general idea is simple. Look for bored and impatient traders. Identify anxious and scared traders. Think about what they are doing and take advantage of them.

But to do that, you must not be impatient or scared yourself. You must be calm and controlled, not anxious and jittery.

In a nutshell, to trade effectively, you need to stay in control.