How To Trade Cryptocurrencies With Price Action

By Galen Woods ‐ 5 min read

Do cryptocurrencies and price action trading go well together? Learn how you can apply simple price action trading tools through three in-depth examples.

Cryptocurrencies are hot now. They have created a new wave of active traders specializing in them. Unsurprisingly, some of these traders are turning to traditional financial markets for ideas. And a common question is this: does price action work for cryptocurrencies?

There’s no better way than seeing it for yourself. Let’s look at how price action tools perform in blockchain-powered markets.

Learn how to apply price action tactics through three price action trading examples. The charts below showcases Bitcoin, Ethereum, and Litecoin price action.

Cryptocurrencies - Price Action Trading Considerations

Cryptocurrencies are volatile. One defining feature of cryptos is their tendency to make sudden strong moves.

Hence, in the examples below, we will apply price action tools that are suitable for such markets.

- Price channel - a potent tool for taking profits and spotting potential reversals.

- Anti-climax pattern - ideal for identifying climactic and potentially exhaustive moves.

If you’re not familiar with these trading tools, click the links above to check them out. This will ensure that you gain the most out of the examples below.

Cryptocurrencies - Price Action Trading Examples

The following examples are not a prescription on how to trade. They aim to highlight the possibilities for a price action cryptocurrency trader.

Chart Legend

- Green arrow - Bullish Anti-climax Pattern

- Red arrow - Bearish Anti-climax Pattern

- Blue Zones - Congestion

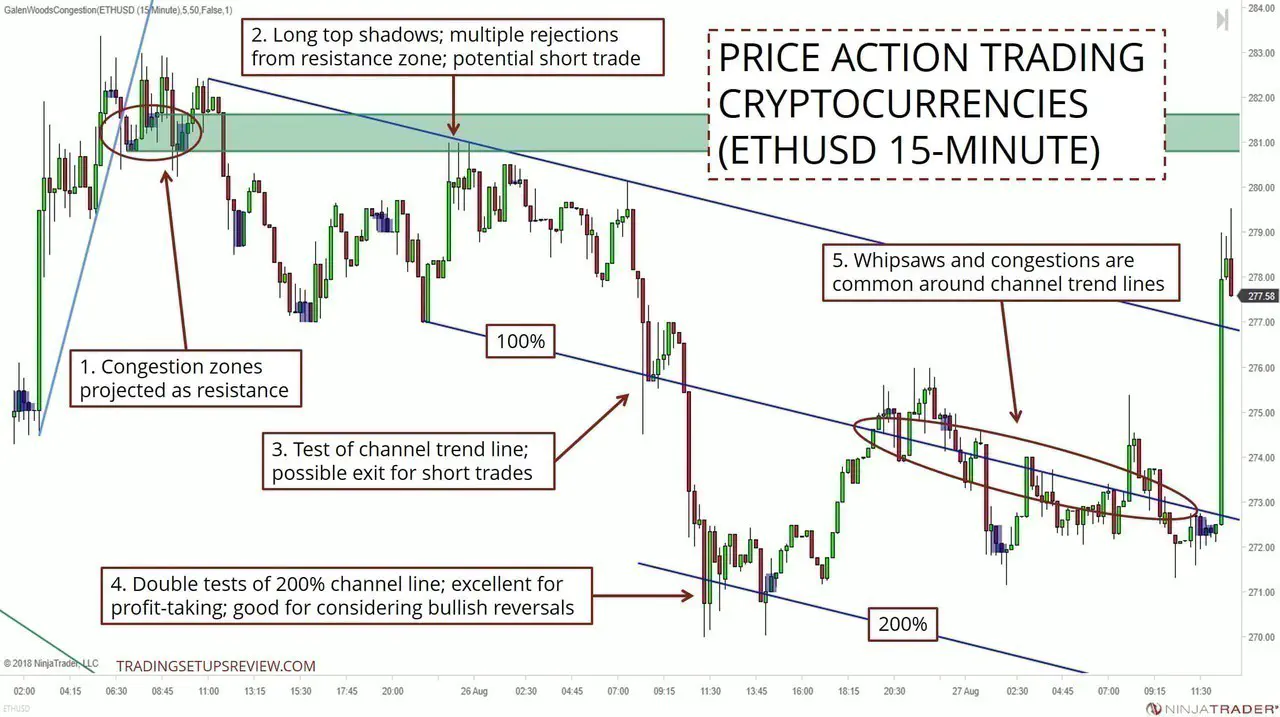

Example #1: ETHUSD

Let’s start with a simple example.

Here in this Ethereum chart, the focus is on support and resistance, and price channels.

- Overlapping congestion zones form good support and resistance. Here, the congestion projected a resistance level.

- After an initial breakdown of prices, the market rose to test the resistance zone. Look at the three long top candlestick shadows. They signify repeated rejections from the resistance. A good entry spot for bearish traders.

- As the market pushed to a new low, a price channel formed. The channel trend line (100%) offered a potential exit for traders in short positions. (Note the small bounce up as the market tested the channel trend line.)

- Tests of the 200% channel line offer a sound basis for reversal trading.

More examples of the 200% line in action here.

Example #2: LTCUSD

This Litecoin example reinforces the effectiveness of price channels, in particular, the 200% line.

We’ll also look for the Anti-climax pattern to find potential setups.

- After a stark price fall, the market tangled with the 200% line. As mentioned, support from the 200% line offers a basis for reversal trading.

- This bullish Anti-climax pattern found solid support from the new bull trend line. An excellent long setup for a price action trader.

- This bearish Anti-climax pattern had the potential to reverse or stall the market. Hence, it was a reasonable point to exit from long positions.

Example #3: BTCUSD

This Bitcoin example has more instances of the Anti-climax pattern.

Pay close attention to them for greater price action insights.

- These three bullish Anti-climax patterns hinted that the bear trend had been exhausted.

- Indeed, the market proceeded to rise and break the bear trend line. There was some congestion around the break, implying resistance from the trend line. But the market broke the resistance and moved on quickly.

- This Trend Bar Failure was a potential long setup. Or, you might also see the sideways action as a triangle or flag formation and go on to trade its bullish breakout.

- For any trader who went long, these two bearish Anti-climax patterns were reasonable points for exiting with profits. The second pattern formed as the market tested the channel trend line. It opens the possibility of a bearish reversal. (Also note the long top shadows of the candlesticks overlapping with the channel trend line - signs of resistance.)

- Bearish Anti-climax patterns tend to form at new trend highs. Not this one. Its failure to push the bullish trend higher hinted again at a bearish reversal.

- A series of three Anti-climax patterns shows a drastic price move and is highly uncommon. Its occurrence here highlights the explosive behavior of cryptocurrencies.

- The broken bear trend line has flipped into a support zone. If you managed to short the market plunge, this was a possible target.

Conclusion - Trading Cryptocurrencies With Price Action

The point here is to show you how price action can be helpful in analyzing cryptocurrencies. These examples offer useful ideas on where you can enter and exit the market from a technical viewpoint.

This is NOT a comprehensive guide to trading cryptocurrencies.

Moreover, I must warn you against trading cryptocurrencies without understanding its fundamentals. You should understand how the blockchain technology works and its various aspects. Bitcoinist discusses the pros and cons of relying solely on technical analysis for cryptocurrencies.

Have fun with your crypto price charts, but be careful. It’s still the wild west out there.

Cryptocurrency Charting Platforms

To trade with price action, you need a charting platform with crypto data feeds. Here are two recommendations for you.

TradingView

TradingView is a free and popular charting option among cryptocurrency traders. It is one of the best online charting platforms, and you can run it from most major browsers.

It offers a vast selection of cryptos from exchanges including Bitfinex, Coinbase, and Kraken. Click here for a full list of available cryptocurrencies.

Click here to sign up for a TradingView account. [affiliate disclosure]

NinjaTrader 8

NinjaTrader is a full-featured charting platform that is free for simulation trading.

It has recently released an update with free cryptocurrency data feeds from Coinbase. This means that you can harness NinjaTrader’s full charting capabilities in your crypto-analysis.

You need NinjaTrader 8 to enjoy this free data feed. Follow this connection guide to set up the feed.