Day Trading Forex With Ichimoku Kinko Hyo

By Galen Woods ‐ 4 min read

The Ichimoku Kinko Hyo is a powerful trend following tool from Japan. Learn how to use it in forex market to capture solid intraday trends.

Ichimoku Kinko Hyo (Ichimoku) by Goichi Hosoda is a unique trading method that combines several trend-following indicators.

In this review, we apply the Ichimoku trading strategy on the forex markets for day trading.

To trade with Ichimoku, we need learn some Japanese.

- Tenkan Sen (Turning Line) - Average of the highest high and the lowest low of the last 9 periods

- Kijun Sen (Standard Line) - Average of the highest high and the lowest low of the last 26 periods

- Chikou Span (Lagging Line) - Closing price shifted to the left (back in time) for 26 periods.

- Senkou Span A (First Leading Line) - Average of Tenkan Sen and Kijun Sen shifted 26 periods into the future

- Senkou Span B (2nd Leading Line) - Average of the highest high and the lowest low of the last 52 periods, displaced 26 periods into the future

- Kumo (Cloud) - Area between Senkou Span A and B

Trading Rules - Day Trading With Ichimoku

These trading rules define the Ideal Ichimoku Strategy from Trading with Ichimoku Clouds: The Essential Guide to Ichimoku Kinko Hyo Technical Analysis.

Long Trading Setup

- Price above the Kumo

- Tenkan Sen is above Kijun Sen

- Chikou Span is above price from 26 periods ago

- Senkou A is above Senkou B

- Price is not far from Kijun Sen and Tenkan Sen

- Tenkan Sen, Kijun Sen, and Chikou Span are not in Kumo

Short Trading Setup

- Price below the Kumo

- Tenkan Sen is below Kijun Sen

- Chikou Span is below price from 26 periods ago

- Senkou A is below Senkou B

- Price is not far from Kijun Sen and Tenkan Sen

- Tenkan Sen, Kijun Sen, and Chikou Span are not in Kumo

Ichimoku Day Trading Examples

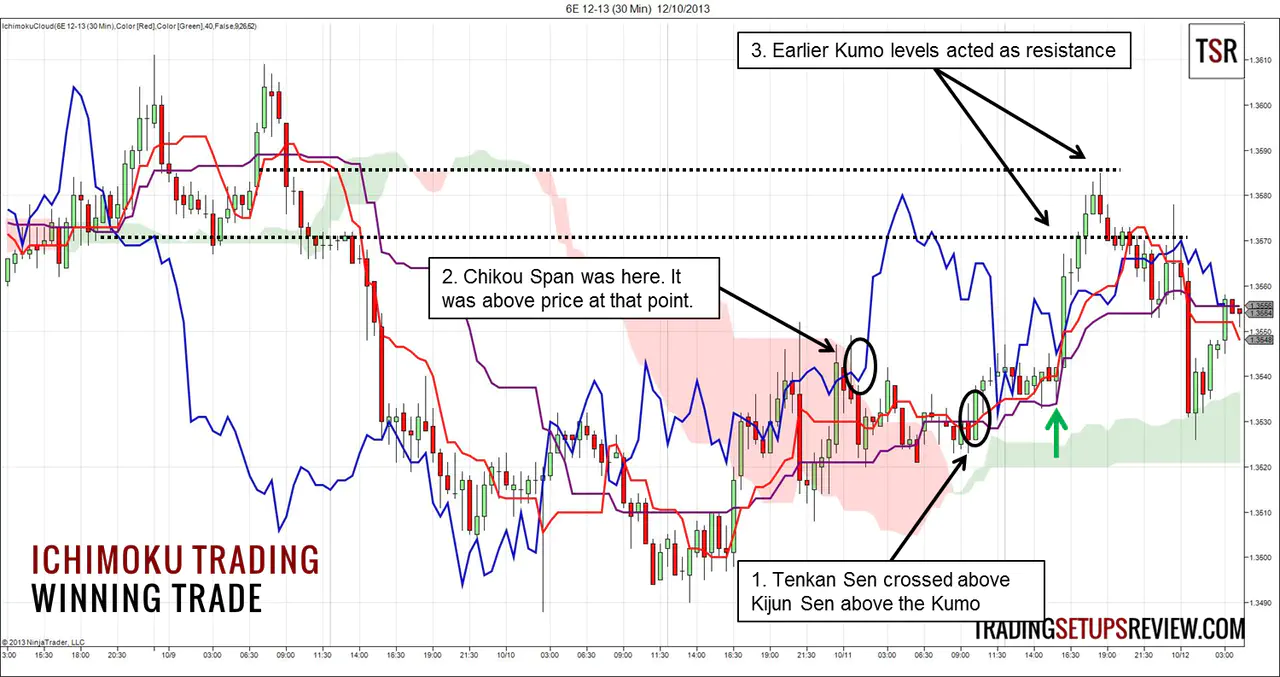

Winning Trade - Long Ichimoku Setup

This is a 30-minute chart of 6E, the EUR/USD futures on CME. It looks cluttered with many lines and colors. However, Ichimoku Kinko Hyo’s distinctive Kumo cloud helps to clarify price action.

- Tenkan Sen (red) moved above Kijun Sen (purple). This is akin to a bullish moving average crossover. Furthermore, price and both lines were above the Kumo which is an area of support and resistance.

- Before looking for a trading setup, we must look left at the Chikou Span (blue) and make sure that it is above price. It overlapped with price for a few bars before moving above the price bars. Together with a bullish reversal bar, we entered a long trade at the green arrow.

- For this trade, previous thin Kumo levels provided good price targets.

Although this trade was profitable, it was not a textbook example of an Ichimoku trade. The ideal Ichimoku trade aims to capture a substantial chunk of a trend. In this case, the reward was more limited.

Losing Trade

This is a 20-minute chart of JPY/USD futures on CME. It shows a Ichimoku long trade that failed in the ranging market.

- Focus on the Kumo and you can spot trades easily. Tenkan Sen crossed above Kijun Sen above the green Kumo.

- We checked Chikou Span, which assured us that the current price is higher than the price 26 bars ago.

- We took a bullish inside bar as our signal to go long. However, prices collapsed after forming a small double top with the previous swing high.

Review - Day Trading with Ichimoku

At a glance, the Ichimoku Kinko Hyo looks complex and clutters the chart. However, I found this package of trend indicators effective in finding clear trends. (I still find that it clutters the chart. Consider removing it after your Ichimoku analysis so that you have a clean chart to assess price action.)

There are three trend measures in Ichimoku Kinko Hyo.

- Tenkan Sen and Kijun Sen (dual moving average)

- Chikou Span (comparison of current price with past price)

- Kumo (projection of support and resistance areas)

In particular, the Chikou Span shows us a simple yet effective way to assess trends. Just compare prices now, to prices then.

If you follow the trading rules above, you will find infrequent trading setups. But when trading opportunities present themselves, we are ready to capture long-lasting trends.

Look out for candlestick patterns as for trade entries to avoid whipsaws.

Pay attention to rule no. 5 and filter away trades when price is far away from Tenkan Sen and Kijun Sen. This ensures that we do not enter when the trend is exhausted.

To learn more about this trend following strategy from Japan, refer to:

- Cloud Charts: Trading Success with the Ichimoku Technique

- Trading with Ichimoku Clouds: The Essential Guide to Ichimoku Kinko Hyo Technical Analysis (Wiley Trading)

If you are a trend follower, you should also check out the Donchian Channel, a popular trend-following tool. The Ichimoku construction is strikingly similar to that of the mid-line of Donchian Channel.