Camelback Trading Technique

By Galen Woods ‐ 3 min read

The Camelback Trading Technique finds shallow pullbacks in strong trends for quick profit. Learn how to improve this simple trading strategy.

The Camelback trading technique comes from Joe Ross’ trading manual. Its uses a moving average channel and an exponential moving average to keep traders on the right side of the market.

Trading Rules - Camelback Trading Technique

Long Trading Strategy

- Price is above the 40-period moving average of bar highs

- Slope of 15-period exponential moving average is not flat or negative

- Wait for a bar with a lower low (signal bar)

- Buy one tick above signal bar

Short Trading Strategy

- Price is below the 40-period moving average of bar lows

- Slope of 15-period exponential moving average is not flat or positive

- Wait for a bar with a higher high (signal bar)

- Sell one tick below signal bar

Camelback Trading Examples

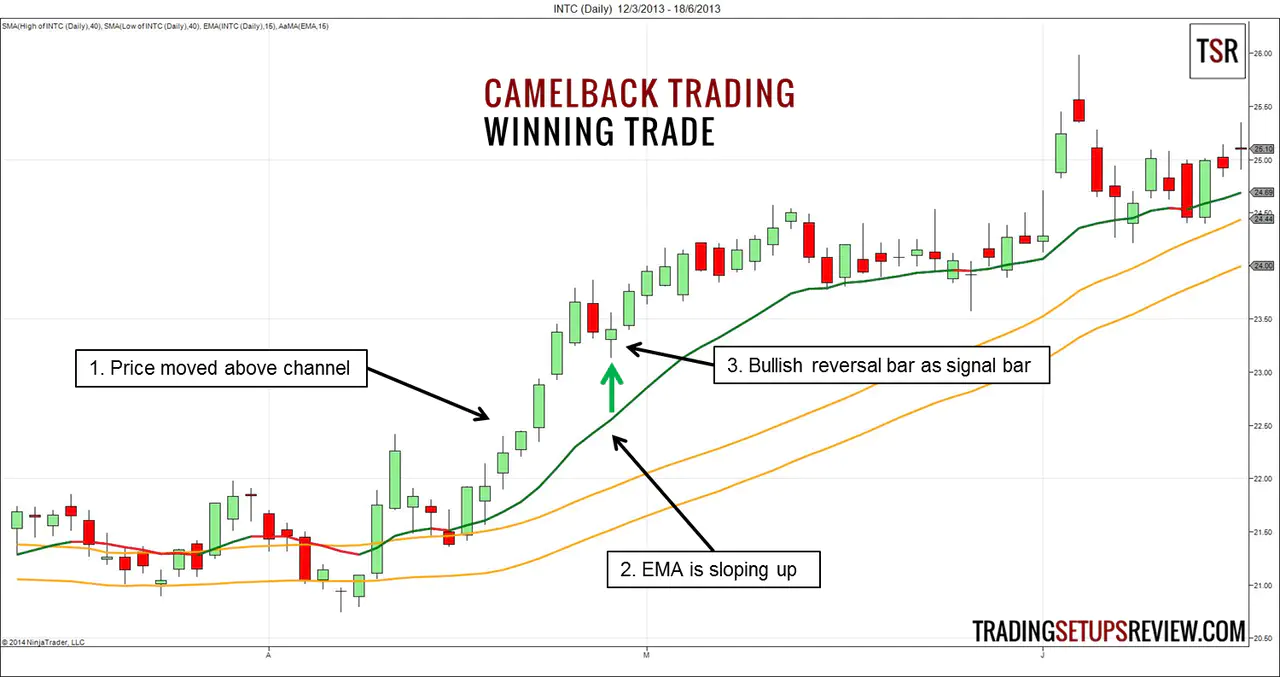

Winning Trade - Bullish Setup

This daily chart of Intel Corp shows a long Camelback trading setup after a strong up thrust.

- Price rose above the 40-period moving average channel and moved far beyond it. The seven consecutive bullish bars point out the obvious upwards momentum.

- The exponential moving average should keep us out of sideways market. It is sloping up nicely as expected.

- The signal bar was also a bullish reversal bar and gave us a great entry into a long trade.

This was the first trade after price moved above the channel. For continuation trading strategies, the first trade has higher odds of success.

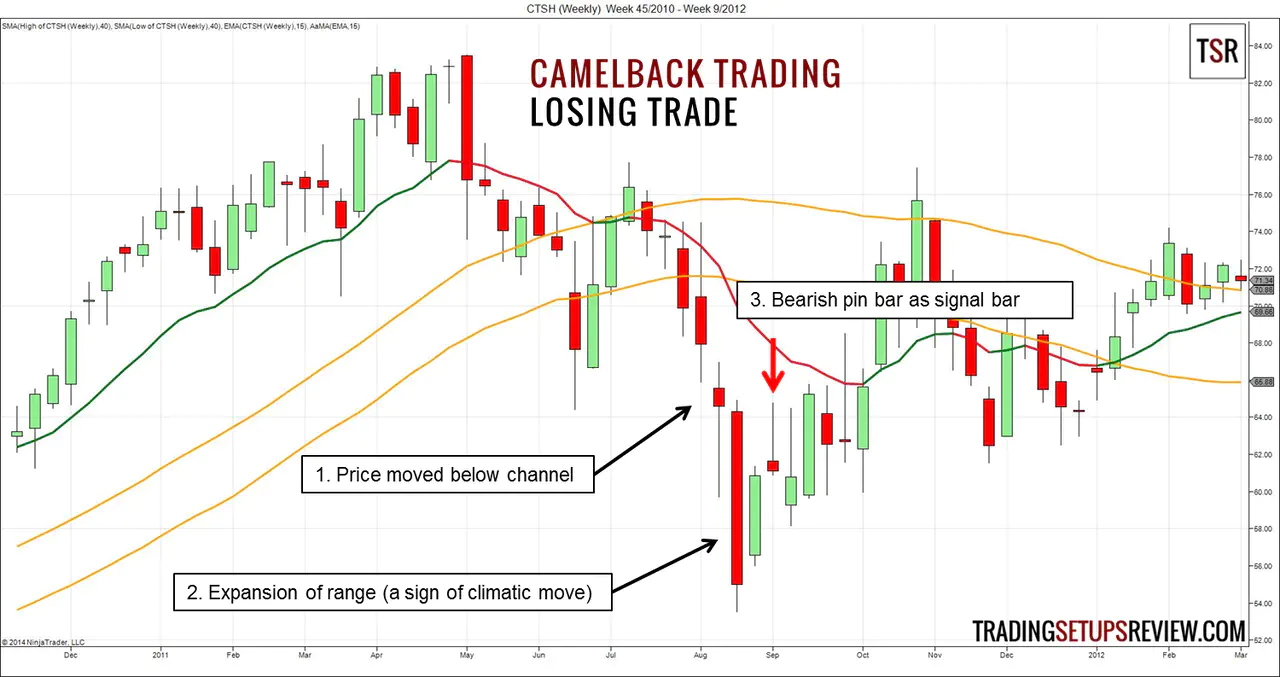

Losing Trade - Bearish Setup

This is a weekly chart of Cognizant Technology Solutions Corp. It shows a Camelback trading setup that failed within two weeks.

- Price moved below the channel with strong momentum.

- However, there was an obvious wide-range bar, which was a sign of climatic and exhaustive moves.

- Following a bullish inside bar, a bearish pin bar set up the short trade. While the bearish pin bar looked good, we lost on this trade.

Review - Camelback Trading Technique

The Camelback trading technique tries to find trending markets using two tools: the 40-period moving average channel and the 15-period exponential moving average.

Moving average channels are useful for staying out of sideways market. They turn a simple moving average into a zone of support and resistance.

(Read: Jake Bernstein’s Moving Average Channel Day Trade & DMA Channel Trading)

The 15-period exponential moving average will prevent trades when there is a slightly deeper pullback. Hence, this trading strategy is looking for shallow pullbacks in strong trends.

The tricky part of trading shallow pullbacks in strong trends is to tell strong trends apart from climatic moves. Climatic moves are signs of exhaustion and price will find it difficult to continue trending without a significant pullback.

Buying a shallow pullback after a climatic bullish move is a low probability trade. The same goes for selling a shallow pullback after a bearish climax.

How do we avoid climatic moves?

Avoid high volume bars. While impulsive moves should have increasing volume, extremely high volume is a sign of climatic moves. Also, watch out for bar range expansion. In climaxes, bar range tend to expand.

Joe Ross has a trade management strategy that involves splitting your position into three parts. You need to trade at least three contracts to put this in practice. If you want to learn more about it, you can refer to the trading manual.