5 Exit Strategies To Secure Your Profits and Limit Your Risk

By Galen Woods ‐ 8 min read

Exit strategies are important in a trading plan but are often neglected by new traders. Learn how 5 ways to secure your profits and limit your trading risk.

In our trade setups review, we always state the rules for entering the trade. Each trading rule is stated with the room for discretion highlighted. However, in many reviews, we left out explicit exit strategies.

It is not because exit strategies are not essential.

On the contrary, they are so crucial that they require a separate discussion. And trade exits deserve so much attention that it’s not practical to include them in a concise strategy review.

I know where I’m getting out before I get in. - Bruce Kovner

An exit strategy is integral to any trading plan. You cannot enter the market without an exit plan. In this sense, your exit is as important as your entry.

We might be tempted to equate an exit plan to a simple stop-loss placement. While placing a stop-loss is a crucial component, a holistic trade exit strategy goes substantially beyond that.

In particular, consider the following questions:

- What’s your exit plan when the market goes against you?

- What’s your exit plan when the market goes in your favor?

- At what price do you exit?

- When do you exit?

- How do you exit? (Consider the type of trading order)

- Is your exit strategy cast in stone once you are in the market?

- Why is your exit plan the way it is? (Is it consistent with other parts of your trading plan?)

If you can answer all these questions confidently, you probably already have a solid exit plan in place.

If not, you might find the methods below helpful for developing your exit strategy.

In this article, we’ll discuss five ways to exit your trades.

From a practical viewpoint, there is a significant decision you need to make for your exit strategy.

Do you want to stick to a set and forget method? Or do you want to manage your position towards a complete exit actively?

Depending on your trading time frame, time available for analysis, trading strategy, and experience, you will gravitate towards either passive or active trade management.

Passive Exit Approaches

1. Exit when your initial stop-loss is hit

2. Exit when your target price is hit

3. Exit once a certain period has passed since you entered the market

Active Exit Approaches

4. Exit when your trailing stop is hit

5. Exit when the reasons for taking the setup are no longer valid

As you explore the approaches below, bear in mind that they are not mutually exclusive. Exit strategies are just as varied as entry strategies. Hence, you can mix and match them for your purpose.

Passive Exit Strategies

If you prefer to set and forget, these strategies will appeal to you.

Approach #1: Initial stop-loss hit and exit

An initial stop-loss is an order you place to limit your risk the moment you enter the market.

I’m assuming that you have an initial stop-loss order. If you don’t, then do.

In this approach, the market hits your initial stop-loss, and you suffer a loss.

Although this is the worst outcome for your trade, be glad, as you have followed your trading rules to limit your loss. At least, you’ve proven yourself to have the discipline required for long-term trading success.

The chart below shows a common way to place an initial stop-loss: pattern stops. This method uses your entry price pattern as the basis for your initial stop-loss order. It is the natural choice for traders using price patterns.

Another basis for setting initial stop-loss considers the volatility of the market. Learn more in this guide to volatility stops.

Approach #2: Target price hit and exit

Have a target price in mind? Use a limit order to bank your profits.

If you want to let your profits run, it’s okay not to place a working target limit order. But you should not do away with an exit plan for taking profits.

Don’t just think of letting your profits run. Have a specific plan to let it run. A trailing stop-loss might help. More on that later.

This chart shows the targeting options using the market structure: support and resistance.

- There are three support levels shown in this example. You could use any of the levels as a target order for a short trade. However, there is an inevitable trade-off between potential profit and the probability of achieving it.

- In the example above, the market did not reach the most ambitious marked target.

While having the market hit your target might sound great, some traders are not exhilarated when their goals are hit.

Why?

The fact that their targets were hit meant that they could have set it more ambitiously. (Except in situations when the price hits your target to the exact tick. Not likely.)

This outcome is ex-post regret. You need to learn to accept it as a trader.

Approach #3: Time stop hit and exit

Time is money. Thus, some traders adhere to a time stop. This refers to the practice of exiting once a period has passed, regardless of its profitability at that point.

Having your capital tied up in a sluggish position while missing many other great opportunities is not ideal.

If your trade is not going anywhere within a period, you should exit and look for other opportunities.

Time stops are especially relevant to certain classes of traders.

- Day traders have a natural time stop at the end of each session.

- Options traders pay more attention to time stops due to the time decay of options.

How long should you wait before exiting?

Observe and record your trades to find out. Keep reliable trading records and examine them. From my experience, most of the best trades move quickly towards your favor.

Here are two trading strategies that employ time stops:

Active Exit Strategies

In theory, managing your positions (exits) actively as you receive new information is the right thing to do.

In practice, it is not easy to do it right.

Committing your capital to the market has the effect of magnifying your trading emotions and cognitive biases. This leads to all kinds of complications in your decision-making.

But if you can keep your cool while committed to a trading position, you might be able to reap the benefits of active trade management.

Approach #4: Trailing stop hit and exit

If you prefer to lock in profits when possible, trailing stops are your best tool.

Trailing stops are stop orders moved in your favor to secure profits. The first rule of a trailing stop is that you always move it towards the market price, and never away from it.

There are many methods to trail your stops, but the principle is the same. You need to balance between two aspects:

- Locking in profits

- Suffocating the trade to premature death

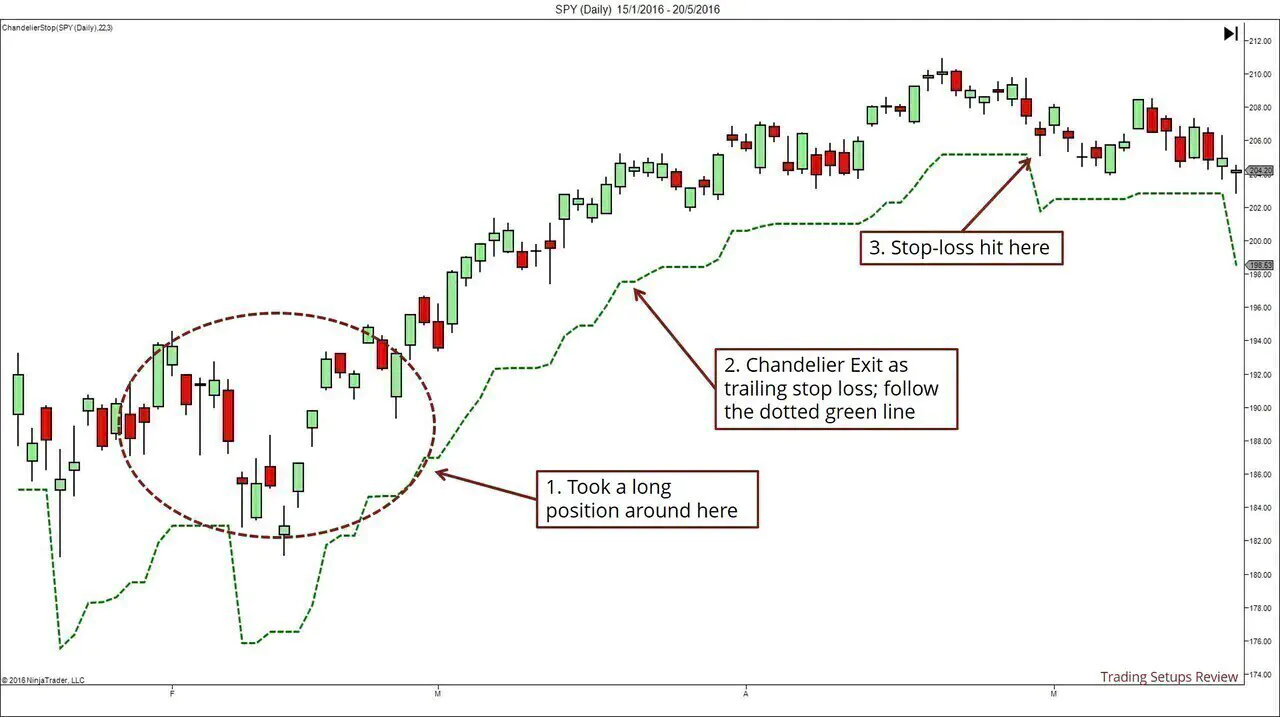

You can trail stop-losses with volatility stops (like the Chandelier Stop) or by adjusting according to price action (swing pivots).

The chart below shows Chandelier Stops in action as a trailing stop.

Approach #5: Conditions have changed, exit at market

We enter each trade with a set of reasons or premises.

If our reason for taking the trade is no longer valid, we should exit immediately.

For instance, you entered a trade based on the Holy Grail setup, which finds opportunities in strong trends.

Then, you observed that prices were moving sideways for a prolonged period. It became clear that the strong trend you wanted to capitalize on was not present. Upon that realization, an exit was in order.

For pure fundamental traders (or investors), this might be the only valid approach.

They usually have fundamental reasons to invest in a stock. While they might not peg their exit plan to any specific price, they ought to be aware of the type of fundamental developments that might negate their trading premise.

This approach is the most logical way, but it is also the most subjective.

A trader must understand his or her trading edge extremely well to apply this exit strategy effectively.

Most traders are too excited when they are in a trade, with their eyes glued to the P/L movements, to reassess their edge continually. Hence, they might be better off staying with passive exit strategies.

Exits: Consistency over Perfection

It’s easy to obsess over the perfect exit, wanting to avoid any losses and to squeeze out every cent of profit from each trade.

But doing that will set you up for failure.

First, recognize that there is no perfect exit. There is almost always a better exit. The best exit plan you can aim for is one that is consistent with other parts of your trading plan. Not the one that nets you the most profit each time.

Next, remember you don’t need perfect exits to make more from your trades. You just need a positive expectancy over a set of trades. Once you achieve that, you can aim to scale up your position size prudently.

Finally, regardless of the method that appeals to you, you must have an exit strategy in place before entering any trade.

Every trading template should have a section on an exit strategy.

The article was first published on 9 May 2013 and updated on 6 August 2020.