Day Trading Setup Evaluation Cycle

By Galen Woods ‐ 5 min read

The key to improving day trading performance lies in rigorous post-trade evaluation. This how you should conduct your day trading setup evaluation.

Evaluating trading setups in real-time is a fast and almost subconscious process for day traders. Hence, day traders must focus on post-trade evaluation to boost their day trading performance. This is the only way to identify broader patterns and trends in our trade data to improve our trading plan.

However, day traders often neglect to evaluate their trades ex-post. Many traders mistakenly think their job is over once the trading session ends. As a result, they overlook the critical day trading setup evaluation cycle.

The Trade Evaluation Cycle

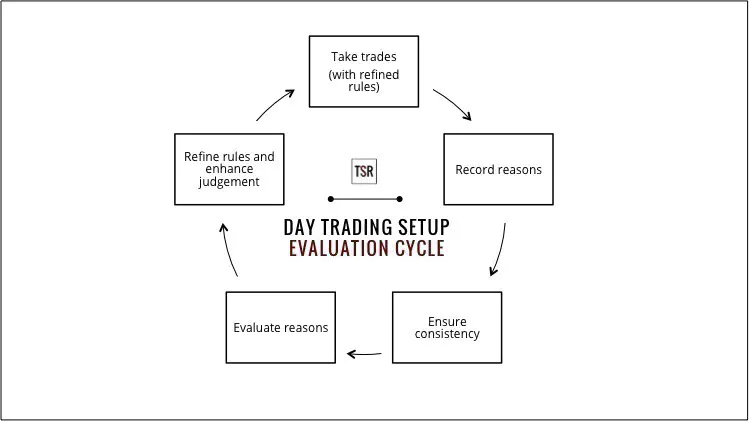

The diagram below shows the evaluation cycle for day traders.

- Look at the top box. That’s the starting point you will keep returning to. You take trades.

- Then, record the reasons for taking the trade.

- Next, ensure that the trade is consistent with our trading plan.

- Once you confirm consistency, evaluate the trade and your reasons in detail.

- And if you uncover reliable insights from the evaluation, refine your trading plan.

Finally, you return to taking trades, but now with an upgraded trading plan.

Ideally, you will build a reliable and adaptable trading approach over iterations of such cycles.

#1: Trade According To Your Trading Plan

To kickstart the cycle, you must have a written trading plan. It serves as a benchmark and rulebook for your trades.

This rulebook will improve as you run through the evaluation cycle again and again.

In this stage, the most critical part is to trade according to your trading plan. Otherwise, the evaluation cycle will not make sense.

#2: Record The Reasons For Your Trades

Clearly, you must have your reasons for taking each trade. But having reasons is not enough.

Write them down.

For instance, you took a 9/30 trading setup as the market found support at the daily pivot level. On top of that, you also noticed that it was a two-legged pullback from the day’s high in what seemed like a strongly trending session.

Pen down these reasons.

However, do not let this record-keeping affect your trade execution. Instead, quickly scribble your reasons for taking the trade and focus on the ongoing trade.

Remember that you should write down your reasons right after you decide to take the setup. You must record them before the trade is over.

Do not allow the result of the trade to taint your original reasons for taking the trade. Essentially, we are trying to avoid hindsight bias here.

You may have good reasons for making a losing trade or ridiculous reasons for entering a winning trade.

In any case, for your day trading setup evaluation to be effective, you need to know your real impetus for taking each trade. Hence, you must record your reasons as soon as you decide to take a trade.

#3: Ensure Consistency in Your Trades

Before analyzing a trade setup, make sure that it is consistent with your day trading plan. A trade that is inconsistent with your trading plan is a rogue trade.

Do not evaluate rogue trades.

Admit that it was a mistake, and work on your discipline to follow your trading plan.

Need help with discipline? Check out The Disciplined Trader by Mark Douglas or our guide for building trading discipline.

Reflect on why you took the rogue trade but DO NOT analyze it for price action nuances. Because you did not adhere to a trading plan for that trade, it offers no value for improving the plan.

For a constructive day trading setup evaluation, you must compare apples to apples.

If you planned to take 9/30 trades but took a trade based on a moving average channel, you have lost the basis for comparison.

Start comparing after you have picked out the apples.

#4: Evaluate and Analyze Trades

Examine the reasons you wrote down earlier.

Good reasons generally lead to profitable trades. And we want to identify these reasons.

For example:

- Do trades that bounce off pivot levels do better?

- Are two-legged pullbacks superior to one-legged pullbacks given your trend determination method?

Keep probing your reasons for taking each trade.

This step is crucial to building your confidence as a discretionary day trader. Your work here also offers a chance to confirm your understanding of price action.

However, avoid hasty conclusions based on a few recent trades. Also, you need a decent sample size before coming to any conclusion.

Remember:

- We are not looking for the perfect setup.

- We are looking for factors to help us avoid bad trades, not to eliminate losing trades.

Bad trades are not losing trades. (Why?)

However, taking bad trades over time does make you a loser.

#5: Refine Your Trading Plan

To complete the evaluation cycle, factor in your analysis going forward in your search for trading setups.

For instance, your study concludes that two-legged pullbacks do better within the parameters of your trading plan. In that case, consider giving more weight to setups with two-legged pullbacks.

Ideally, over time, you’ll find reliable observations that you can use to improve your trading plan. The outcome is a battle-tested trading approach.

Complete The Day Trading Setup Evaluation Cycle

Finally, you will return to taking trades with your improved trading plan. By doing so, you complete the cycle.

It’s important to know that you will not make improvements to your trading plan after each session. It may take many trades and cycles before you arrive at any progress. Nonetheless, sticking to the evaluation process is the best way to remain adaptable to the markets.

This evaluation cycle is not only for live trading. Start employing it when you’re trading in simulation mode. It will help you build excellent habits right from the start. Moreover, it can also empower you to learn and gain confidence without risking your capital.

For independent traders, the ability to self-learn is essential. And this day trading setup evaluation cycle offers a robust framework to do so.

The article was first published on 23 July 2013 and updated on 25 May 2022.