Trading Psychology Crash Course

By Galen Woods ‐ 12 min read

Trading psychology is the missing piece of the consistency puzzle. After working out a trading strategy, you need to look inwards to sustain your profits.

The market is crashing. It is volatile and uncertain. Many traders are focusing on how to take advantage of the market in such exceptional circumstances. But I recommend taking this opportunity to take a hard look at trading psychology.

Swinging prices lead to highly-charged emotions in the market. There is no better time to remind yourself of the core role of psychology in trading financial markets.

Be careful not to follow the herd or to respond blindly to the volatility. Instead, take time to reflect on the psychology of the market and your personal trading mindset.

I’m not an expert on trading psychology. But I have benefitted from many discussions about the mindset that propels trading performance.

So in this crash course, I’ll not reinvent the wheel.

Instead, I’ll help you navigate the vast expert resources out there from the perspective of a retail trader. (There will be liberal references to resources beyond this website.)

Let’s go.

Trader’s Psychology Versus Market Psychology

In this crash course, we’ll look at two dimensions of psychology relevant to traders.

- Trader’s psychology

- Market psychology

The first is your trading psychology. This aspect involves a personal undertaking to know and improve yourself. It concerns:

- Handling your emotions

- Being disciplined

- Recognizing your biases

- Designing a trading plan that is conducive for psychological resilience

These aspects will help you become a better trader and lay the foundation for understanding market psychology. We will spend most of our time here.

The second is market psychology, which we will explore in the last section. This aspect will aid you in analyzing the market.

This is the realm of behavioral finance. Think of market psychology as an extension of a trader’s psychology. Appreciating the common pitfalls of an individual market participant will better equip you to understand market psychology.

Overview

We will cover the following topics in this crash course.

- Section #1: Introduction to Trading Psychology

- Section #2: Discipline - How To Control Your Emotions While Trading

- Section #3: Dealing With Extreme Outcomes

- Section #4: Common Stumbling Blocks

- Section #5: Practical Steps

- Section #6: Recommended Resources

- Section #7: Market Psychology

Section #1: The Need For Trading Psychology

Isn’t trading about entry strategies? Okay, risk management is essential as well.

But psychology?

Veteran traders will not doubt the link between psychology and trading performance. But new traders might not think that studying psychology is something worth their time.

So here are a few resources to change your mind.

- Read this short introduction from Investopedia to learn the importance of trading psychology.

- Work through this course by the CME Group for a rounded understanding of trading psychology.

- If you want to reinforce the ideas above, skim through this article as well. It presents a comprehensive view of trading psychology fundamentals.

Section #2: Discipline - How To Control Your Emotions While Trading

Without the discipline to follow your trading plan, everything goes out of the window.

- For an overview of why traders lose discipline, read this FX Trader Magazine article discussing the ideal trading state. Be sure to work through the questions towards the end. They help work out your trading issues.

But before we go any further, are you sure you are experiencing a psychological/discipline issue?

- To trade profitably, first, you need a trading edge. But it is not sufficient.

- You also need to handle your emotions well enough to execute your trading plan.

But do not conflate the lack of discipline (control over emotions) with the lack of a trading edge.

- This article from Optimus Futures’ blog takes an unusual but frank angle to trading discipline. It does not hail psychology as the panacea. Instead, it points out the lack of control as a symptom of a lack of market understanding.

- In a similar vein, Dr. Brett Steenbarger also points out a hidden cause of trading psychology issues.

…they short-circuit the learning process and never truly internalize a new edge in the markets they’re trading. - Dr. Brett Steenbarger

The key here is that you must first have a firm hold on your trading edge. That is the objective pre-requisite. No amount of psychological advice can help if you’re not confident of your trading edge.

But how can you build confidence?

Gain Confidence In Your Technical Skills

- The best way to gain confidence in your trading plan is to trade it.

- But without informed confidence, you should not start to trade.

How do we get out of this conundrum?

The answer is paper trading.

Some traders look down on paper trading, thinking that they are a poor copy of the real experience. Yes, there are definitely gaps between paper and actual trading.

- But you can minimize these gaps by following the rules in this article.

- After grasping the ground rules of realistic paper trading, select a simulator platform here, and start honing your technical trading skills.

- If you cannot achieve consistency in paper trading after repeated attempts, your personality might be incompatible with your trading plan. Work through this short exercise to learn more about your trading personality. Then, consider if other trading approaches are more suitable for you.

Once you are confident that you have a winning strategy, and all that’s holding you back are psychological issues, move on to the following.

Control Your Risk

When you genuinely accept the risks, you will be at peace with any outcome. – Mark Douglas

Over-leveraging and risking too much is the easiest way to mess with your emotions.

There is no reason to neglect risk. By controlling your risk, you are protecting both your financial and emotional capital.

- Always use a sensible position-sizing model. If you already have one in place, stick to it without exceptions. If not, read this article to learn three basic models you can apply right now.

- This article tackles both financial and psychological risks. They are intertwined.

- To get a broad foundation in risk management, start with this module from Zerodha Varsity.

Exercise Patience

A patient trader is a disciplined trader.

If you want to improve your trading mindset, learning to be patient is a practical first step.

- Go through this article to appreciate how patience affects trading discipline.

- Skim through this interview with Jack Schwager, who highlighted that doing nothing requires the patience of a saint.

- This guide brings you through the steps you can take to become a more patient trader.

Section #3: Dealing With Extreme Outcomes

Your trading psychology is critical during extreme events.

Here, we’ll look at the two extreme circumstances for traders: losing and winning.

Losing Streak

Losing streaks happen to every trader at some point. Some traders fall into a downward spiral, but others recover with a fresh perspective.

If you are prepared for them, you stand a higher chance of being in the latter group.

- This is an article I wrote after reflecting on how I dealt with and recovered from consecutive losses.

- Look at the diagram in this short article on Seeking Alpha. It shows how your thoughts, emotions, and actions are interrelated.

- In this short and sweet video, Mike Bellafiore (co-funder of SMB capital), talks about overcoming a painful trading loss using the 1-hour rule. It is a simple but effective rule.

Winning Streak

Winning streaks are easier to handle. But it’s common for traders to neglect to prepare their minds for success.

Hence, winning streaks can prove to be more dangerous than consecutive losses.

- Winning a lottery is not exactly like trading profitably. (Assuming you have a solid trading plan) But these tales of bankrupt lottery winners demonstrate the need to plan for success, both financially and emotionally.

- Hubris is the downfall of many trading legends. They grew big and arrogant, and they crashed. Learn to tell the difference between confidence and hubris.

- If you’re aware that success can get to your head, you are already ahead of the pack. This article on Medium offers a few more reminders on what to do after achieving success.

Section #4: Common Stumbling Blocks

Here are a few standard psychological stumbling blocks you’ll encounter.

The earlier you can identify them, the sooner you can move beyond them. So go through the list below and acquaint yourself with these obstacles.

Failure To Adjust Perspectives

Many successful professionals from other fields find trading to be a challenge. This is because successful trading requires significant adjustments to your mindset.

Trading is different, primarily because it involves putting your ego aside and thinking in terms of probabilities. These are no mean feats when your hard-earned cash is at stake.

- Watch this interview with Mark Douglas on Mind over Market. He does a great job of drilling in the probabilistic nature of the markets.

- With Fooled by Randomness, Nassim Taleb brought the discussion of randomness from the academic world onto a bestseller list. James Clear has an excellent summary here. You won’t find it hard to relate the points to your trading experience.

- Shift away from your need to preserve your self-image. Read this article by trading psychologist Rande Howell.

Chasing the Holy Grail

Perfection is the enemy of good - Voltaire

Every trader goes on this chase at some point. Some never stop.

- You have to be willing to take the good with the bad. This short piece by Charlie Bilello explains this with a simple moving average strategy.

- How about changing the definition of the Holy Grail? On FXSTREET, Simon Cotterill argues that consistency is the real Holy Grail of trading.

- My take on the perfect trading setup.

Failure to Recognize Cognitive Biases

We are biased. We just don’t realize it most of the time.

- Go through this list of cognitive biases, and spot them in your trading behavior.

The Challenge of Small Accounts

Small accounts cannot make big money. Too many retail traders ignore this and end up ruining their accounts.

- Read this article for some tips on handling small accounts.

Section #5: Practical Steps To Buttress Your Mind

In the previous sections, our focus was on understanding the correct trading mindset.

In this section, you’ll learn concrete steps you can take to improve your trading psychology.

Keep Solid Trading Records

Rationalizing is a considerable drawback for traders who want to improve.

And its insidious nature makes it all the more dangerous.

- To counter rationalizing, keeping accurate trading records is essential. The right trading journal solution will guide you through the record-keeping process. It will also facilitate post-trade analysis to ground your trading expectations. Click here for a list of top trading journal software.

- For a discretionary trader, keeping reliable records can be challenging. Go through this guide for an overview of best practices.

Meditation

The first step of improving your trading psychology is to be aware of the things that can go wrong with your thoughts.

- Mindfulness is an effective way to improve your awareness. Read this article by Dr. Gary Dayton (Author of Trade Mindfully).

- To get started, try Headspace, an app for guided meditation. (You don’t need to sign up for the paid subscription. Even the free Basic series offers a lot of practice for beginners.)

Breaking Bad Habits And Honing Consistency

Becoming aware of your emotions and biases is the first step to enhancing your trading prowess.

This means that you can now recognize your bad habits.

The next obstacle features your frustration over your inability to break bad habits.

- In this article, Dr. Brett Steeenbarger addresses bad trading habits by considering:

The key idea is that problem patterns often represent ways of meeting needs that unfortunately bring their own consequences.

- Choose one destructive trading habit you would like to break. Then, refer to this guide and work through it.

- To work on your long-term consistency, work your way down this list.

Section #6: Recommended Trading Psychology Resources

To dive deep into the trading mindset, consider picking up some books on trading psychology.

There are two types of books that are relevant:

- Books that deal explicitly on aspects of trading psychology (for practical advice)

- Books that focus top traders (for learning from their experience)

Trading Psychology

Click here for a comprehensive list of books on trading psychology.

But if you want a few quick recommendations, consider these:

- Trading In The Zone by Mark Douglas

- The Daily Trading Coach by Dr. Brett Steenbarger

- High Performance Trading: 35 Practical Strategies and Techniques to Enhance Your Trading Psychology and Performance by Steve Ward

Interviews With Traders

If you find the books above too dry to get through, you might enjoy the following books more.

They feature lively interviews with or biographies of both retail and institutional traders with varying trading styles.

- Jack Schwager’s Market Wizards Series (highly recommended)

- Reminiscences of a Stock Operator

- Trading Mentors

These books expound the same core ideas from different angles. Once you internalize the lessons, you will find them repetitive.

But every individual responds to a different communication style. So finding the perspective that you can relate to (that aha moment) is invaluable.

Beyond Books

- No time for books? This video runs through 20 habits of successful traders.

- And before you move on, you should definitely add Dr. Brett Steenbarger’s blog to your RSS feed. It gives you an invaluable stream of ideas from a top trading psychologist.

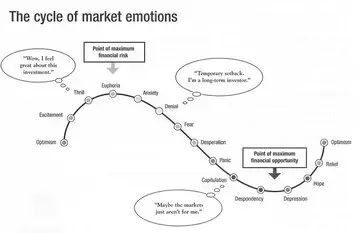

Section #7: Market Psychology

Let’s shift gear in this final section to explore the collective psychology of the market.

After confronting your own emotions and biases, you realize that you are not an objective and emotionless market player. And of course, you are not alone.

- The market is made up of other investors and traders, each subject to their own biases. This fact is at odds with the Efficient Market Hypothesis, which you can learn more about in this Investopedia article.

- The attempt to reconcile the market with its irrational participants brought about the field of behavioral finance. This academic paper gives an overview of this exciting field of study.

Moving beyond an introduction in the market psychology is beyond the scope of this crash course. But it’s easy to find in-depth resources if you are interested.

I recommend these books:

- Extraordinary Popular Delusions and the Madness of Crowds

- Investment Psychology Explained

- Adaptive Markets

If you’re keen to explore this field of study, consider this course on Behavioral Finance offered by Duke University on Coursera.

Beyond This Crash Course

A holistic approach to master trading psychology requires:

- Being aware of your mindset, emotions, and biases

- Trading experience

- Observing and reflecting on your feelings and actions while taking on financial risks

This crash course is designed to help you with the first item on the list.

Now that you’ve completed this crash course, you are ready to move on to gain practical experience.

- As you trade, bear in mind the ideas you picked up here.

- Revisit the resources above whenever you need a reminder or to ground your perspective.