Capture High Profits with Low Volume Pullback Trading Strategy

By Galen Woods ‐ 4 min read

Low volume can lead to high profits if you know what to look for. Look at how a simple low volume pullback strategy can find the best trading setups.

Dow Theory relies on volume as a secondary indicator to confirm price action. Nonetheless, interpreting market volume has developed into a whole branch of technical analysis (volume spread analysis) and spurred many traders to create volume indicators. In this review, we will focus on trading low volume pullbacks in trends.

Like everything else in trading, absolute values are useless. Rather than “low”, we actually mean “lower”. We look at changes in volume.

When volume increases, traders are interested. When volume decreases, traders are not keen. The market does not move when traders are not interested. So, the idea is to fade low volume moves.

Trading Rules - Low Volume Pullback

Long Trading Setup

- Price is above the 20-period simple moving average (SMA)

- Price breaks above the last swing high with higher volume

- Price falls with lower volume

- Buy a tick above the next bullish bar

Short Trading Setup

- Price is below the 20-period SMA

- Price breaks below the last swing low with higher volume

- Price rises with lower volume

- Sell a tick below the next bearish bar

Low Volume Pullback Trading Examples

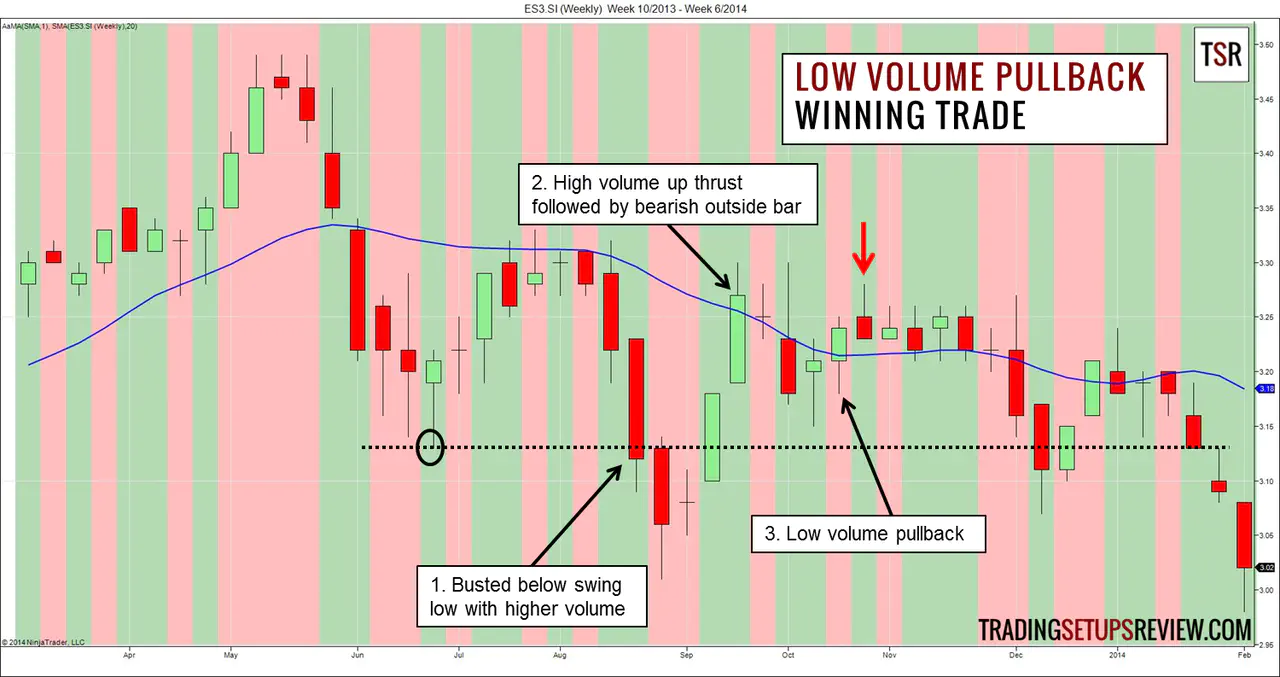

Winning Trade - Short Setup

This is a weekly chart of SPDR Straits Times Index ETF (ES3.SI on SGX). It seeks to replicate the performance of the STI which is the main gauge of Singapore’s equity markets.

Volume overlays are great trading tools. They allow you to keep tabs on volume while you look at price action. They mitigate the risk of ignoring price action and focusing only on volume. In this case, green means higher volume than the previous bar, and red means lower volume.

Click here to find out how to get this overlay.

- After moving up to test the SMA, price plunged down below the earlier swing low with higher volume (as shown by the green background). It confirmed that bearish momentum was still in place.

- As prices pulled back up, it seemed as though we would not have a low volume trading setup. The pullback bars rose up sharply with higher volume. However, the bearish outside bar halted the upthrust and signaled the return of the bears.

- Two bars later, we got an up bar with lower volume. It verified the lack of market interest in pushing prices higher. The next bar was a solid bearish reversal bar. We sold a tick below its low.

It took 15 weeks, but this trade proved profitable as the ETF fell to its earlier extreme low.

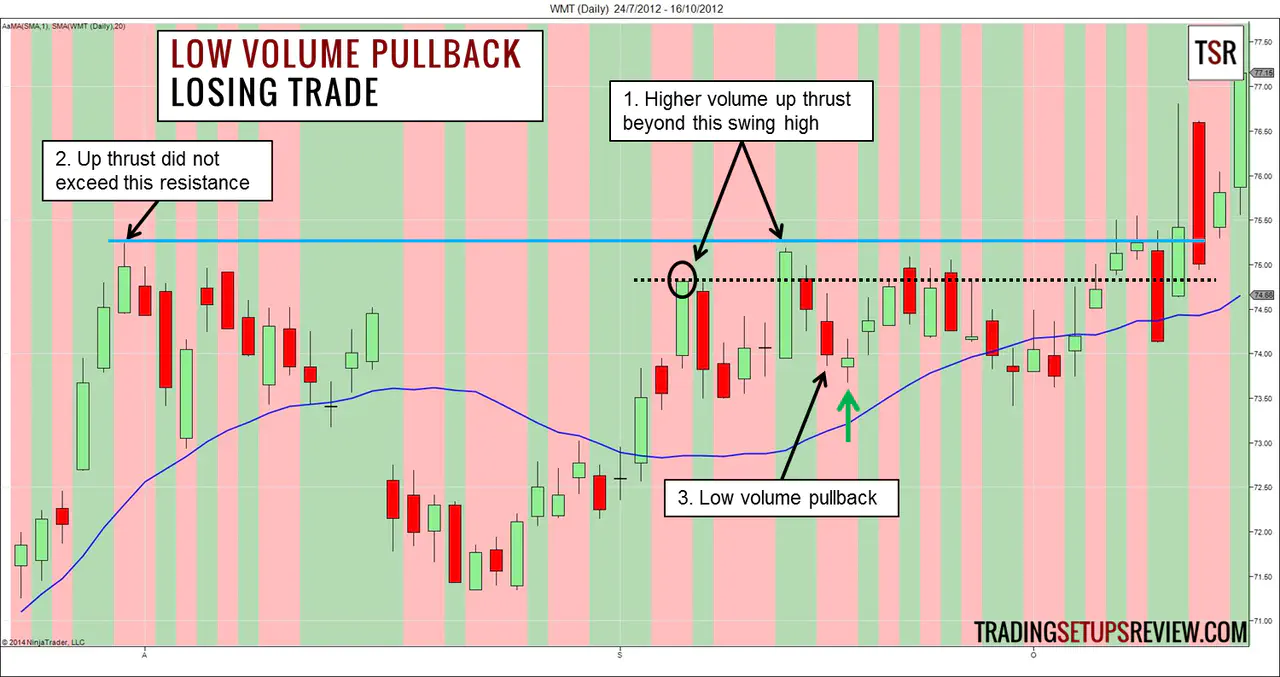

Losing Trade - Long Setup

This is a daily chart of Walmart.

- Shortly after price moved above the SMA, it made a new high with higher volume.

- However, if we extended our perspective, we would have noticed that price failed to rise above a key resistance that sent prices down below the SMA earlier. This failure made the picture less rosy.

- We had a low volume pullback followed by a bullish reversal bar. We entered a tick above the reversal bar.

The trade’s maximum profit potential is larger than the amount we risked. However, the trend did not resume until it moved below our signal bar to test our stop-loss level.

Review - Low Volume Pullback Trading Strategy

We used basic volume trading principles directly to create this simple low volume pullback trading strategy.

We looked for increasing volume during break-outs to confirm the market momentum. Then, we took advantage of low volume pullbacks to time when we enter the momentum.

(Like the idea of using volume to confirm trend break-outs? Check out the Yum Yum continuation pattern.)

This trading strategy is extremely useful for clarifying price action. When you can’t tell what price is trying to do, the volume might shed some light.

Paying attention to low volume pullbacks also improves other retracement trading strategies. Combine this low volume approach with the following setups.

Want to learn more about this strategy? Look at my second article on the low volume pullback strategy.

If you want to pick up more ideas about using volume in trading, have fun with these.