Your First Guide to Volume Spread Analysis (VSA)

By Galen Woods ‐ 6 min read

Do you have volume on your charts? Do you know how to use it? Volume Spread Analysis (VSA) offers a basic framework to trading better with volume analysis.

You have heard of Volume Spread Analysis and the value it might add to your analysis. But it sounds like a convoluted trading method with uncommon terms like “No Demand Bar” and “Stopping Volume”. Is VSA really that inaccessible?

Together, let’s take the first step to understanding VSA. With this guide, you will find that VSA is an intuitive method after all.

What is Volume Spread Analysis (VSA)?

VSA is the study of the relationship between volume and price to predict market direction.

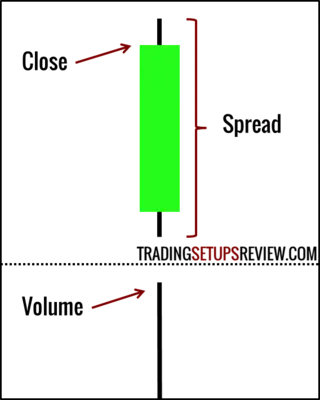

In particular, it pays attention to:

- Volume

- Range/Spread (Difference between high and close)

- Closing Price Relative to Range (Is the closing price near the top or the bottom of the price bar?)

Who invented VSA?

There are three big names in VSA’s development.

- Jesse Livermore

- Richard Wyckoff

- Tom Williams

Jesse Livermore spoke of a theory based on market manipulation. He also worked his theory in his legendary trading career. However, he did not pass down concrete trading methods. His legacy is that of a trader and not an educator.

Neither Jesse Livermore nor Richard Wyckoff used the term “Volume Spread Analysis”. It was Tom Williams who used the term to describe the methods he built based on the Richard Wyckoff’s ideas. Tom Williams’ books and software has helped to propel the concepts of VSA among traders.

Why does VSA work?

The basic idea is that the public can only make money from the markets if we understand what the professional traders are doing. And professional traders are not small players. They play big.

Hence, they leave their footprints in volume data. When the professionals are active, the market shows high trading volume. Conversely, when the market volume is low, the professionals might be holding their horses.

It follows that in order to get a sense of what the big guys are up to, looking at just price action is not enough. We need to look at price together with volume.

Does VSA work in all markets?

VSA focuses on price and volume and seeks to find the actions of professional traders. Hence, as long as a market has a group of professionals and offers reliable price and volume data, the trading premise of VSA holds.

Almost all financial markets (stocks, futures, forex) seem to fit the bill.

However, in the spot forex market, volume is a tricky concept. You will not get actual traded volume. You get tick volume which measures the times the price ticks up or down. If you intend to use VSA methods for trading spot forex, you need to decide if your source of tick volume is a reliable proxy for actual volume. (Need help deciding? The ForexFactory forum has a discussion on trading forex with VSA.)

How do we use VSA to trade?

I will not sugar-coat the fact that VSA is difficult to master. This is because traders have interpreted various VSA concepts differently. To trade well with VSA requires years of practice and market observation. (Consider how much time Jesse Livermore, Richard Wyckoff, and Tom Williams spent studying the markets.)

Nonetheless, we can still improve our trading with basic VSA concepts that are easy to understand. Hence, in this first guide, we will look at two simple VSA concepts.

- No Demand

- No Selling Pressure

VSA Basic Concepts

(The following definitions are based on Tom Williams’ book on VSA - Master the Markets.)

1. No Demand on Up Bar

If the market rises with contracting spread and volume, the market is not showing demand. Without demand, it is not likely to continue rising.

To find “No Demand” bars:

- Price closed higher than the previous bar.

- Volume is lower than past two bars.

- Spreads (Range) are narrow.

2. No Selling Pressure on Down Bar

If the market falls with decreasing spread and volume, the market is not interested in selling. Thus, it is not likely that the market will continue to fall.

To find “No Selling Pressure” bars:

- Price closed lower than the previous bar.

- Volume is lower than past two bars.

- Spreads (Range) are narrow.

VSA Trading Examples

In the two examples below, we will use a 20-period simple moving average as our trend indicator. Our aim is to use the concepts of “No Demand” and “No Selling Pressure” to find trend retracement trades.

In the charts below, I have marked the “No Demand” bars with red arrows and the “No Selling Pressure” bars with green arrows. (Click on the images to zoom.)

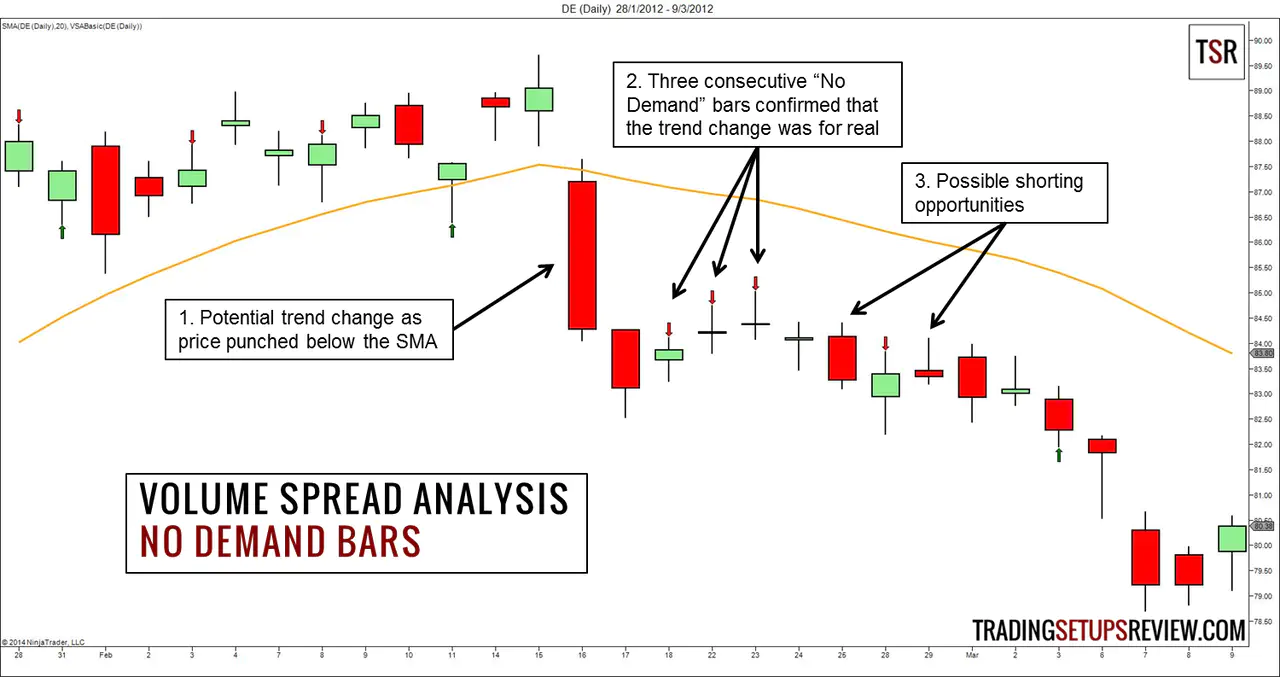

1. No Demand Bar - Potential Short Trade

This chart shows the daily bars of Deere & Company (DE).

- This bar punched below the SMA and hinted at an impending bear trend.

- These three consecutive “No Demand” bars confirmed the lack of market interest to resume the bullish run.

- Hence, we had a great context for considering a short trade.

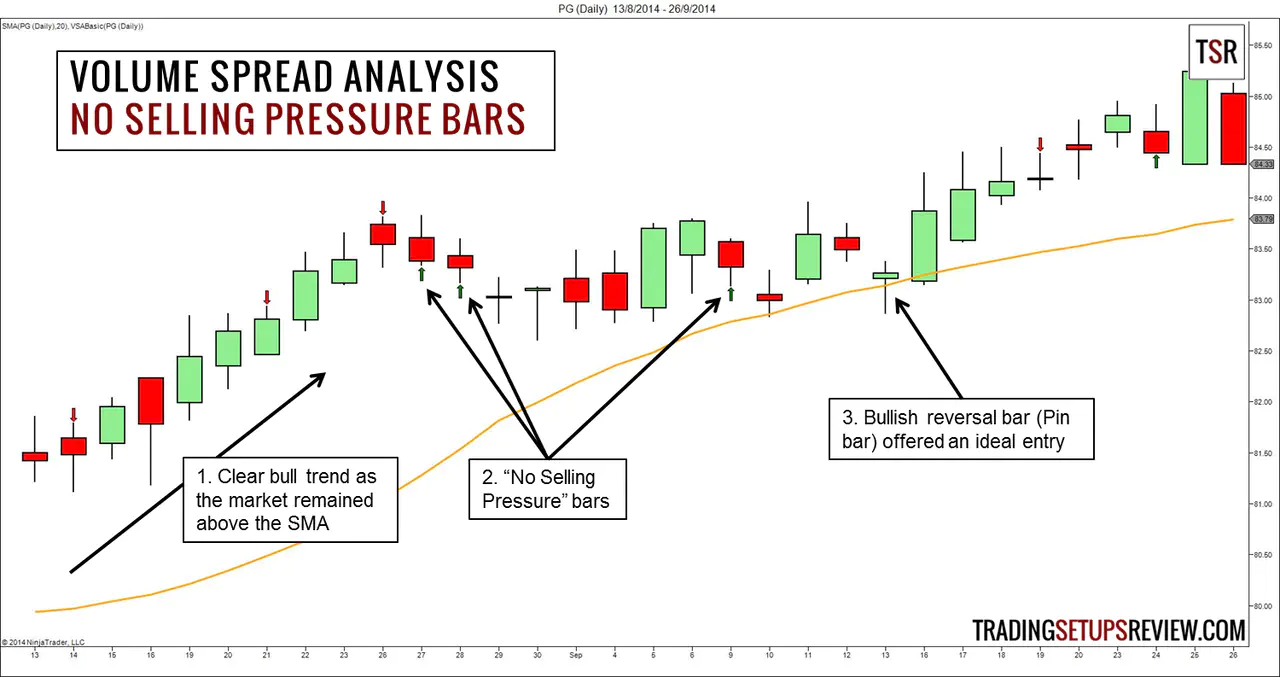

2. No Selling Pressure - Potential Long Trade

This chart shows the daily bars of The Proctor & Gamble Company (PG).

- The market was in a strong bull trend and remained above the SMA.

- In this sideways pullback, we observed three “No Selling Pressure” bars. They hinted that the bears are not forthcoming, and the stage for a bullish retracement trade was set.

- This bullish Pin Bar offered the ideal setup bar.

Where can we learn more about VSA?

VSA is gaining in popularity, and there is no lack of resources to advance your understanding.

Books on VSA

- Master the Markets

- Trading In the Shadow of the Smart Money

- Trades About to Happen: A Modern Adaptation of the Wyckoff Method

Forum Discussions on VSA

There are great discussions on VSA on Traders Laboratory and Forex Factory. To find information on VSA in popular trading forums with a click, try our Trading Forums Search Engine.

VSA Trading Software

There are many software that claim to use VSA techniques to help you trade better. I would not comment on their efficacy as I have not used them.

But I am sure that no software will bring you trading success unless you truly understand the VSA principles. Hence, you should definitely learn as much as you can about VSA, before relying on a software for your analysis. This approach will make sure that you do not use the software blindly, if you do buy one.

Related Volume Strategies

These are not classic VSA methods, but they will help you understand the interaction between price and volume.

Conclusion - VSA

Volume is valuable because it offers another market dimension for analysis. Volume is also dangerous because it confuses those who do not understand it.

Take one step at a time. Pick up VSA concepts steadily and use them in your trading prudently. Once volume starts to make sense to you, you will see progress but improvements will not come overnight.

Price and volume giving conflicting signals? Master price before volume. Learn more about my price action trading course.