Candlestick and Pivot Point Day Trading Strategy

By Galen Woods ‐ 4 min read

Use candlestick and pivot points to construct a potent day trading strategy. Learn how to find areas of price exhaustion for high probability trades.

What is the one trading rule that all candlestick experts agree on? Using candlesticks in isolation is not profitable. Hence, many candlestick trading strategies include other trading tools for confirmation.

John Person’s candlestick trading approach uses pivot points for confirmation. In this review, we are using a simpler version of his trading strategy.

(Explore: Candlestick Trading Strategies)

Trading Tools

Pivot Points

Pivot points are price levels calculated using the high, low, and close of the last trading session. These price levels are potential areas of price exhaustion.

These are the formula for the common pivot points:

- Pivot Point (PP) = (High + Low + Close)/3

- 1st Support Level (S1) = (PP x 2) - High

- 2nd Support Level (S2) = PP - (High - Low)

- 1st Resistance Level (R1) = (PP x 2) - Low

- 2nd Resistance Level (R2) = PP + (High - Low)

Most charting software can plot the pivot levels automatically. If you need to draw them manually, you can use the online Pivot Point Calculator. It calculates up to the 4th support and resistance level.

High Close Doji

John Person devised his own candlestick trade triggers for his trading strategy. The bullish trigger is the high close doji.

Basically, wait for a doji. Then, look out for a candlestick to close above the high of that doji. That is our signal to buy.

Low Close Doji

The low close doji is the bearish version. Similarly, wait for a doji. But in this case, we are looking out for a candlestick that closes below the low of the doji to give us the sell signal.

Trading Rules - Candlestick and Pivot Point

Long Trading Strategy

- Doji at a support level

- Buy on close of high close doji

Short Trading Strategy

- Doji at a resistance level

- Sell on close of low close doji

Candlestick and Pivot Point Trading Examples

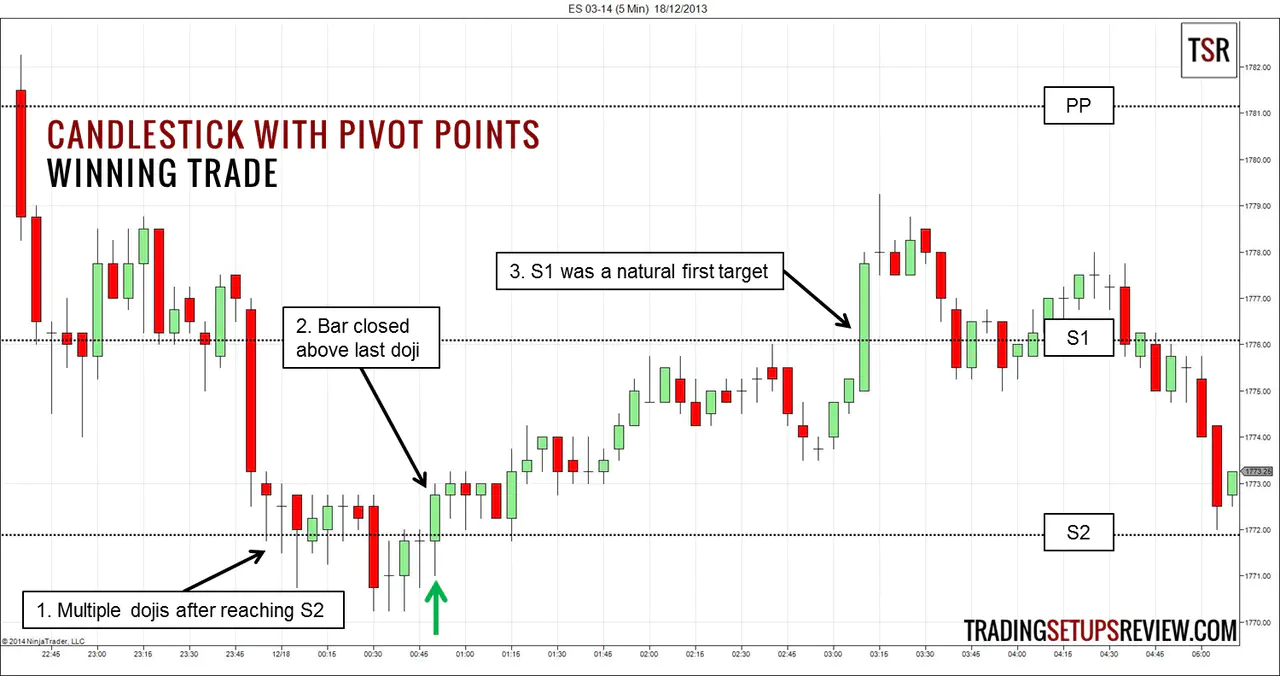

Winning Trade - High Close Doji

This chart shows a complete trading session of ES futures with 5-minute bars. Price started falling right after the market opened.

- Prices found support at S2. The four dojis and three bullish bars tangling around S2 confirmed the support.

- The bullish close above the last doji fired off a high close doji signal.

- S1 was the natural first target.

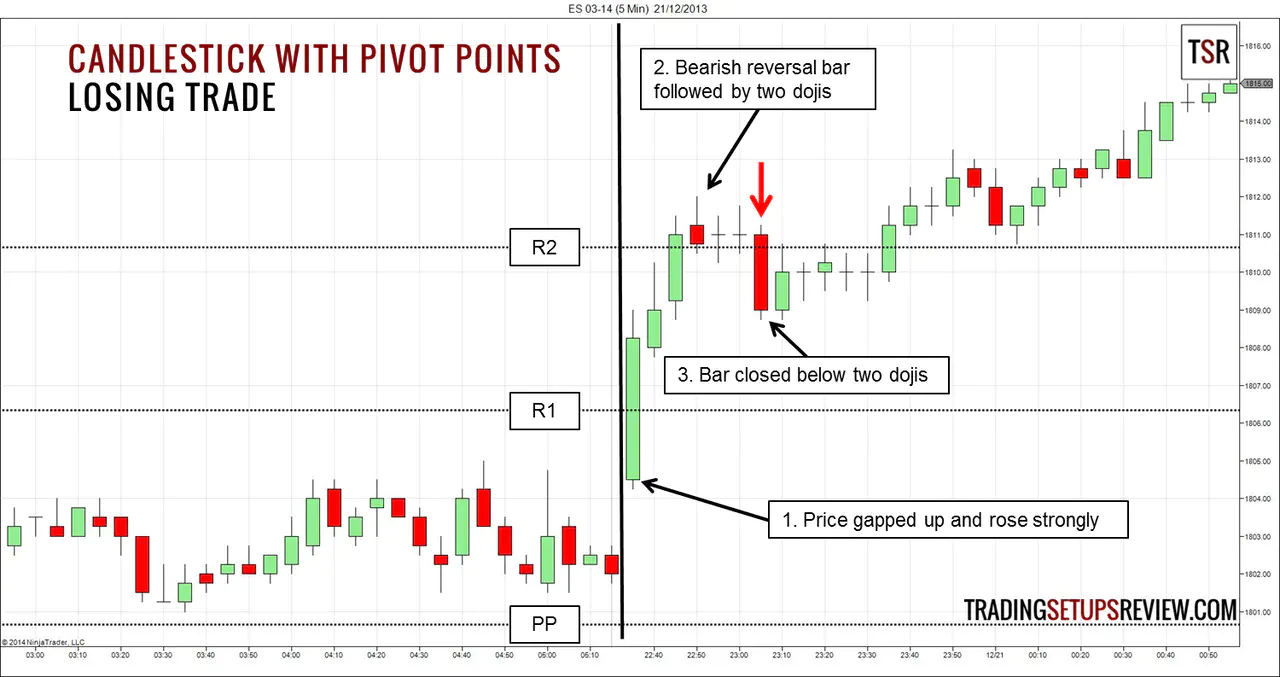

Losing Trade - Low Close Doji

This is another 5-minute chart of ES futures. It shows part of the previous trading session. The solid vertical line separates the trading sessions.

- Price gapped up and rose strongly through R1.

- The ascent paused at R2 with a bearish reversal bar. However, it had little follow-through as shown by the two dojis.

- This bar closed below the lows of the two dojis, setting up a low close doji. We sold into a losing trade as the upwards trend continued.

Review - Candlestick and Pivot Point

Trading candlestick patterns found around support and resistance levels is an effective trading strategy. In this particular variant, we used John Person’s high close doji and low close doji with pivot point levels.

Dojis represent uncertainty. High close dojis and low close dojis are break-outs from uncertainty. Most break-outs fail.

To find high close dojis that perform better, look out for the following:

- Multiple dojis around pivot levels to confirm price exhaustion

- No strong bearish bars

- Failed low close doji

Apply the same logic for low close dojis.

When in doubt, it is always better to wait for more price action to unfold. This is because the best trades usually come after some congestion around the pivot levels.

Pivot points are popular day trading tools. However, they are not superior to other forms of support and resistance. Do not trade reversals with them indiscriminately.

The complete trading approach of John Person includes moving averages and the use of divergence for confluence. He also uses another trade trigger called jackhammer. To learn more, refer to his books: