How Profitable Is Losing Money?

By Galen Woods ‐ 3 min read

Losing money is very profitable. Resolve this paradox and learn about this core trading concept that keeps you sound both psychologically and financially.

Very profitable. That’s right. For traders, losing money is very profitable. In fact, if you cannot lose money, you cannot earn any.

If that sounds like a paradox to you, you need to stop trading until you resolve that.

The More You Lose, The More You Earn

In our example, we will assume a trading system with 50% win rate. For simplicity, you earn $200 if you win and lose $100 otherwise.

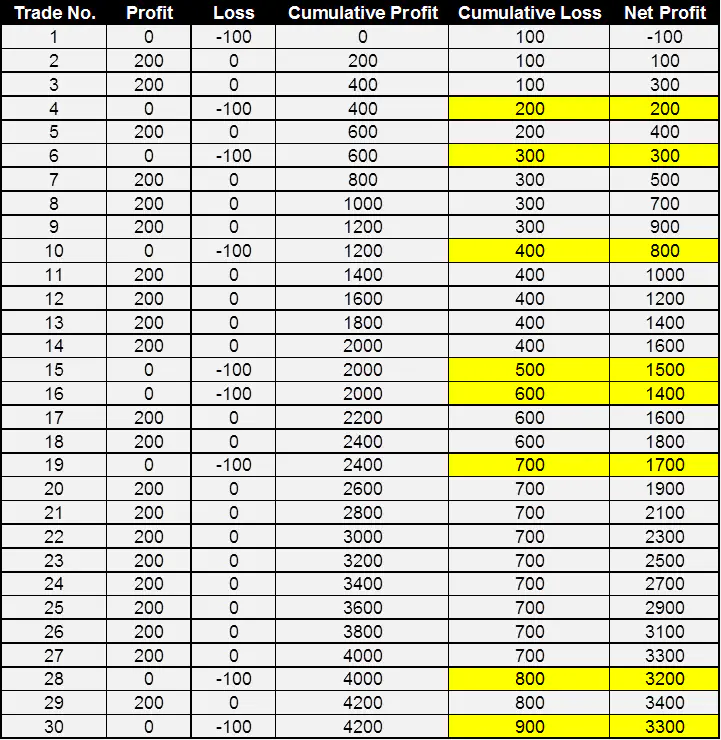

This table shows 30 simulated trades.

Other than the profit and loss per trade, the table also shows the cumulative profit and loss amount. The difference between them is the net profit.

We highlighted the cells in yellow when cumulative loss increases. What do you notice?

Do you earn more as you lose more?

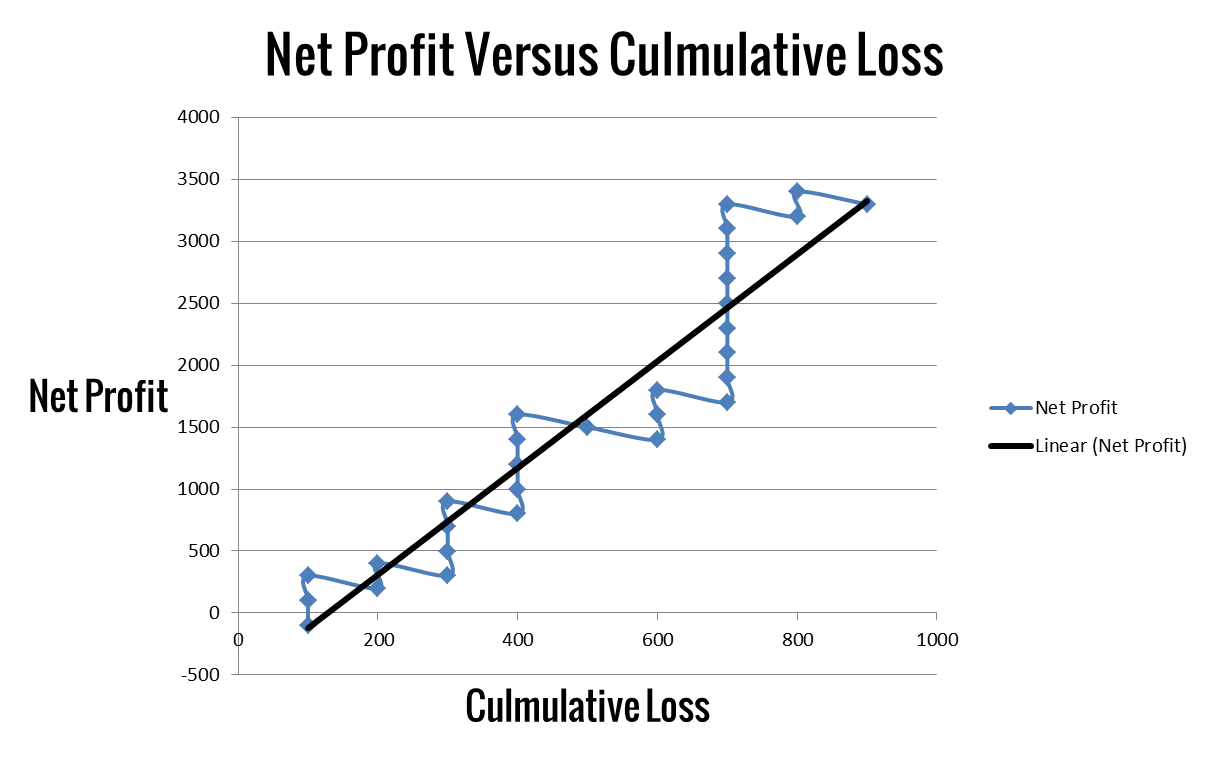

This graph shows clearly that net profit increases with your cumulative loss. In other words, you need to lose to make more.

This positive relationship between net profit and cumulative loss is true for a large sample of trades that follow a trading method with positive expectancy.

Expectancy

Expectancy is the difference between two products with your win rate. The formula is:

(Odds of Winning x Average Win Amount) - (Odds of Losing x Average Loss Amount)

In our example, the trading system’s expectancy is (0.5 x 200) - (0.5 x 100) = 50. It has positive expectancy.

Essentially, to trade profitably is a simple two-step process.

- Learn a trading method with positive expectancy

- Love your losses

Pick Up: Trading Strategies on TSR

A Business Mindset for Trading

Let’s drill in the same idea from a business perspective. Trading is a business and it pays to remember that.

Imagine that you own a brick-and-mortar business of selling computers. How do you make money? You sell computers for a profit.

However, we cannot sell computers without buying them in the first place. We need to buy computers and incur a cost. That is the cost of doing business and making money.

For a trading business, losing trades are the cost of business. You must buy computers to sell them for a profit. You must have losing trades so that you can have winning trades.

The only way to avoid any loss is not to trade at all. No risk, no profit.

Given the probabilistic nature of trading, losses are not only inevitable, they are necessary for trading profitably. Once you appreciate this, you will start to take your losses gracefully and avoid destructive behavior in your trading.

Risk of Ruin

There is one key exception to the principle of “lose more, earn more”. You must not lose so much that you risk ruining your account.

A trading account is ruined when you can no longer trade with it. It means that you can no longer afford to open the smallest possible position in the market that you trade. For instance, your day trading margin for ES futures is $500. If your account falls below $500, it is ruined as you cannot post margin for even a single contract.

As losses are inevitable even in the best trading strategy, your trading account will experience drawdowns. Watch your losses and make sure that they do not ruin your account.

The moral of this exception is: Take losses happily but avoid risk of ruin.

Avoiding risk of ruin is a matter of applying money management models to control your trading size and having the discipline to follow them.

Conclusion: Profitable Traders Love Losing Money

Recognizing the true nature of losses in a profitable trading system is extremely helpful for struggling traders.

Realize that losses make you rich if you:

- Have a trading edge

- Are disciplined

- Apply the right position sizing model

Get these factors in place and you will enjoy losing (and the profits that come with it).