4 Tactics to Boost Your Day Trading Profits

By Galen Woods ‐ 5 min read

Lacking that extra boost to bring your day trading profits to the next level? Learn four simple tactics to help you find better and more profitable trades.

Are you struggling with day trading? Just breaking even? Make no mistake. Break-even is a significant trading milestone. But I’m sure you want to boost your day trading profits to the next level. In that case, here are four tactics you may consider for refining your trading approach.

Here are four practical ways to boost your day trading profits. You will find them helpful regardless of your day trading style.

- Limit the number of trades per session

- Trade during volatile periods

- Select volatile markets

- Focus on low-risk entries

#1: Limit the Number of Trades Per Session

Many traders have a daily stop-loss limit or profit target.

- A daily stop-loss limit is a form of risk management. It dictates that you should stop trading after losing a certain amount.

- A daily profit target is simply a personal aim. It states the profit amount you are aiming for each session.

While these rules might work for some traders, they have one undesirable trait. They focus on monetary outcomes.

To boost your trading performance, go beyond thinking about money.

Instead of thinking about how much you can make or lose, focus on the quality of your trading setups.

How do you force yourself to focus on quality?

Limit the number of trades in each trading session.

With limited opportunities to trade, you must select your trading setups carefully.

It discourages sloppy trading and prompts a sniper-like attitude. Unlike the machine gunner, a sniper might have just one chance to hit his target. This explains why a trained sniper is far more accurate.

Simply put, a sniper knows he has only one shot. So he trains for accuracy.

Furthermore, willpower is a muscle that tires. And willpower is vital for sticking to our trading rules and evaluating market opportunities sensibly.

Taking fewer trades allows you to focus your best effort on high-quality trades instead of diluting them over many trades.

Ultimately, limiting the number of trades is a simple approach to improving the quality of your setups and your trading focus. Over time, this will lead to a boost in your day trading performance.

#2: Trade During Volatile Periods

During its volatile hours, price swings last longer and push further.

Ceteris paribus, such conditions imply a more significant profit potential. Hence, a day trader often makes most of his profits during the most volatile time of the day.

During the dead periods, a day trader that overtrades loses more as price movement is muted. In practice, these losses take the form of relentless whipsaws.

A destructive idea traps many traders: a day trader has to trade the entire session. This is not true.

Focus your energy on picking setups during volatile hours. And avoid the period when the market tends to congest. This simple hack can boost your day trading performance and save your time.

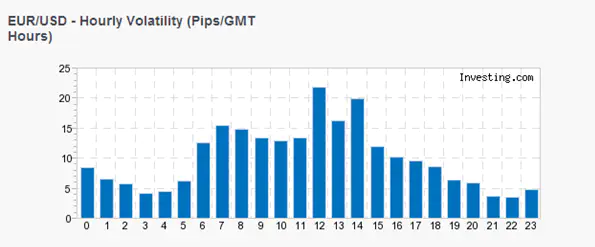

For a simple method to find out which hours are more volatile, look at the bar range on the hourly chart. Then, stick to the hours with a wider trading range. For forex traders, you have a nifty tool for evaluating hourly volatility, as shown in the chart above.

#3: Trade Volatile Markets

Every market has its personality. Some markets move in bouts of fast action; others meander through the day.

Understanding the tendencies of a market is beneficial for day trading. However, this is something hard to define. You can only learn it by spending some time observing price action directly.

Nonetheless, there is one market characteristic you can compute easily. It is the market volatility.

Examine the average trading range of each market over many sessions. Typically, greater volatility affords more trading opportunities and increased profit potential.

To illustrate the point, let’s look at the two sessions below. Which one would you prefer to trade?

Of course, you also need to consider your trading approach. For example, some trading strategies might work better when the volatility is low. However, that’s not usually the case for technical traders.

If your strategy allows, focus on volatile markets to maximize your trading resources. These markets tend to produce greater moves in a shorter time. Hence, they offer a reliable way to efficiently use our day trading capital.

This tactic comes with the caveat of limiting your risk wisely. If the increased volatility requires you to risk disproportionately more, then the volatility is no longer an advantage.

(Similarly, my price action course discusses a concept called the Optimal Trading Environment Index. It evaluates the potential reward-to-risk ratio of a given market and time frame to choose the best price action trading environment.)

Finding low-risk entries is what we will discuss below.

#4: Find Low-Risk Entries

A crucial aspect of earning more is losing less.

Don’t fixate on how much you can earn. Instead, pay more attention to how much you stand to lose.

Keeping risk low in a volatile market is the basis of a sound strategy.

Consider a volatile market. It produces powerful price swings. Accordingly, the usual context of a volatile market is high risk with high return.

But if you are patient and wait for a low-risk setup in that context, you may secure setups with a high reward-to-risk ratio.

A technical tactic is to look for narrow setup bars like the NR7 pattern or the ID/NR4 setup.

The chart below shows an example of this idea - an NR7 setup in the 3-minute crude oil futures market (CL on NYMEX).

Conclusion - Limit Your Trading to Boost Your Profit

Many traders seek to trade more and do more to boost their day trading results.

Perhaps the more straightforward approach is to do the opposite and limit yourself:

- Limit the number of trades you take.

- Limit the markets you trade.

- Restrict the hours you trade.

- Limit the risk you take on.

The idea here is that placing limits increases focus and hence enhances performance.

Want more ideas for improving your day trading performance? Take a look at these tips for intraday price action traders.

The article was first published on 16 March 2015 and updated on 30 August 2022.