10 Tips for Part-Time Day Traders

By Galen Woods ‐ 7 min read

Are you day trading part-time? Are you aspiring to day trade full-time? These 10 tips will help part-time day traders achieve full-time trading success.

Day trading is not always a full-time affair. You might have other commitments during the day or want a taste of intraday trading before venturing into it full-time. In either case, being a part-time day trader is a feasible option.

However, a part-time day trader has unique concerns that are different from a full-time trader. To have a good shot at success, you must be aware of them and handle them properly.

Here, we will cover ten tips for aspiring part-time intraday traders.

Tips for Part-Time Day Traders

Here are the ten tips that you will find helpful as a part-time day trader:

- Pick a suitable trading market.

- Monitor the impact of forex rates on your returns.

- Avoid trading the entire session.

- Select a time-boxed trading setup.

- Do not rely on hot day trading tips.

- Consider automated trading.

- Maintain a full-time trader’s view on risk management.

- Never trade when you’re at work.

- Review your trades on weekends when you’re not trading.

- Consider swing trading instead.

Tip #1: Pick a suitable market for part-time day traders

There are markets all over the world trading around the clock.

You can certainly pick one that is active when you are free to trade.

A few vital practical factors to consider:

- The period of the day when you have time to focus and trade

- Market access offered by your broker

- Liquidity and volatility of the chosen market

For instance, part-time day traders in Asia might day trade (or night trade?) US markets at night after their work. The first two hours of US opening fit nicely into the slot before Asia’s sleeping hours.

For part-time day traders in the US, you can check out Hong Kong’s HSI or Korea’s KOSPI futures.

Are you looking for more options? This list of the largest futures exchanges worldwide offers a starting point for your research.

Tip #2: Watch the foreign exchange rates of markets you day trade

This point relates to the first on choosing a suitable market. Most part-time day traders will end up trading overseas markets due to their commitments during regular work hours.

Trading an overseas market typically requires you to deposit funds in a foreign currency and exposes you to foreign exchange risks.

Watch foreign exchange rates as their fluctuations will affect your returns.

Depending on your circumstance, you can choose to avoid, accept, or hedge the risks posed by forex fluctuations.

Tip #3: Do not trade the entire trading session

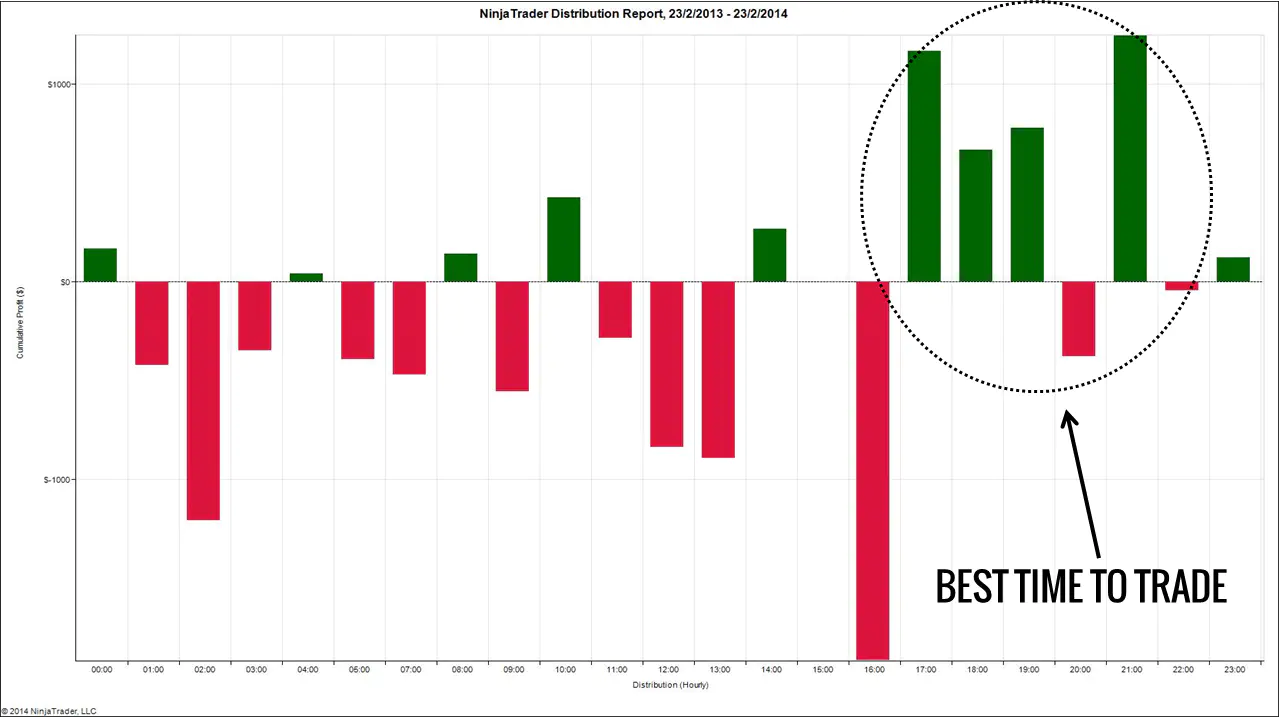

Regardless of which market you choose, consider restricting your trading to the session’s first two and last two hours.

These periods are usually more volatile and offer more trading opportunities.

You can maximize your part-time trading efforts by focusing on the most volatile periods. Essentially, you spend less time watching the markets while minimizing missed trading opportunities.

Tip #4: Choose a time-sensitive day trading setup

A time-sensitive trading setup is a trading strategy that capitalizes on the behavior of the market at a particular time of the day.

As these trading strategies occur only during certain times of the day, part-time traders can simply focus on those periods to fully use their time.

Kevin Ho’s 15-minute opening range scalp trade is an example of a time-sensitive trading setup and is well-suited for a part-time day trader.

Tip #5: Do not rely on hot day trading tips

This advice applies to all traders and investors, not just part-time day traders. However, hot tips are incredibly tempting for part-time day traders due to time pressure.

Part-time day traders might lack time for performing their own analysis. Hence, some might want to make up for that by relying on other people’s analyses, which are basically tips from fellow traders or their favorite finance blogs.

That is a terrible idea.

Day trading part-time is still day trading. Of course, part-time day traders should adapt and make the most of their limited time. But this is different from cutting corners.

Do not turn your trading platform into an online casino.

You either do it right or not do it at all.

Tip #6: Consider automated day trading

If you are well-versed in programming, you might want to consider automated trading.

Automated trading is ideal for part-time day traders. You work in your day job while your trading platform trades for you automatically.

You can devote your free time to researching trading ideas and developing trading systems.

However, this is not for everyone, as automated trading has a peculiar set of risks. Therefore, you should take time to understand them before embarking on it.

If you are keen to code and trade your own trading systems, check out these resources:

- Trading Systems and Method by Perry Kaufman

- Building Reliable Trading Systems by Keith Fitschen

- Best Day Trading Simulators

- Ten courses on Automated Trading

Tip #7: Maintain a full-time day trader’s view on risk management

Even if day trading is a part-time endeavor for you, you must not neglect day trading risks.

Risk management has many aspects, including:

- Position sizing

- Cash management

- Operational risk

You should learn about the different position sizing models and control your trading size to avoid the risk of ruin. (Bennett McDowell’s book is a good starting point.)

Cash management is crucial for part-time day traders aspiring to move into full-time day trading.

It involves how much of your profits you withdraw regularly and how much you use to grow your day trading capital. Consider your personal finances from the point of view of a full-time trader to answer these questions.

Also, to mitigate the operational risk of day trading, you should:

- Back up your trading terminal regularly.

- Use a spare power source (use an Uninterruptible Power Source if necessary).

- Get a backup internet connection.

- Have your broker’s number on speed dial.

Despite being a part-time job, it is still a job that puts your capital at risk. So it’s best to be professional about it.

Tip #8: Never day trade at work

Day trading requires complete focus. So no matter how tempted you are, never trade at work.

You might enjoy fantastic broadband internet speed at work and have a top-notch mobile trading platform from your broker. So you might be tempted to trade at work, but don’t.

Imagine that your boss calls you away from your desk before you can place your stop, and you return to find your trading account wiped out. Or a sudden loss of connectivity on your iPad with the latest version of your broker’s trading app.

Too many things can go wrong when you trade in the office beyond the reliable environment of your trading terminal. (Not to mention that your company won’t be too happy about it.)

Tip #9: Review your trades on weekends when you are not day trading

Part-time day traders have limited time on weekdays, so you will need to use time efficiently.

Apply the principle of batch processing, which is the grouping of similar tasks and completing them together.

On weekdays, your time is limited, so focus on following your rules and trading with discipline. On weekends, gather your trade data and review them together.

By grouping your tasks in this way, you can take the time pressure off your weekday trading sessions and enable yourself to evaluate your trades in detail on weekends.

Tip #10: Consider swing trading instead of day trading

I know. This is an anti-climax.

But swing trading is a sensible option for traders who are short of time.

Ultimately, for most people, day trading part-time is like holding on to two jobs. It takes a toll on your health, and there’s a high risk of burning out.

If swing trading is acceptable to you, regarding the capital required and overnight risk exposure, you should consider it a serious option.

It is much easier for part-time traders to analyze after the market ends each day and place their orders before the market opens. And this is a standard workflow of swing traders holding positions over days.

Conclusion

Part-time day trading is challenging and time-consuming. So the first step is to decide if you want to commit to this endeavor.

If so, review these tips and create a trading plan that caters to your situation.

Finally, remember to define clear rules to manage your risks.

It’s pervasive for part-time traders to adopt a hobbyist attitude. It’s not wrong, but hobbies tend to cost money.

The article was first published on 28 November 2013 and updated on 28 June 2022.