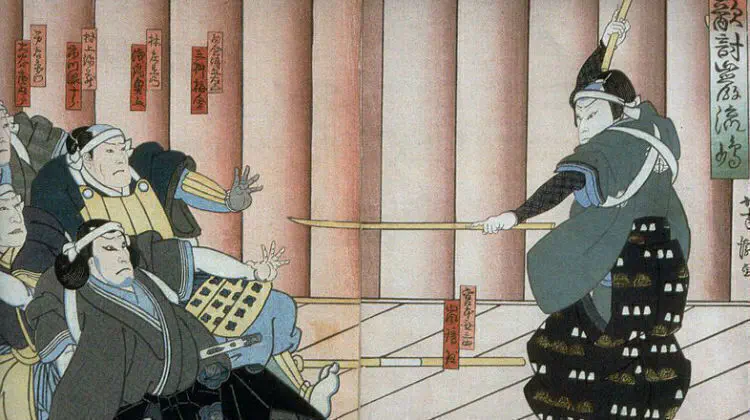

Trading the Markets like a Samurai

By Galen Woods ‐ 5 min read

Learn to trade the markets better with timeless samurai wisdom that applies for all styles of trading. Be a market samurai today!

The modern world may no longer have room for samurais pledging their loyalty to feudal daimyos. But the discipline and focus of samurais may still have a place in helping us trade better.

This article is inspired by this list of samurai quotes I stumbled upon. It has 12 quotes from the legendary Japanese swordsman, Miyamoto Musashi. It is amazing how these gems from an ancient warrior code are so relevant for trading the markets.

Control Your Trading Emotions

When your opponent is hurrying recklessly, you must act contrarily and keep calm. You must not be influenced by the opponent.

As traders, who is our opponent?

Other traders. Or more accurately, their collective actions and the resultant market action.

The market rose quickly. The unprepared trader, afraid of missing out on the next big move, chased the market. After the dust has settled, he found himself holding a long position at the high of a market poised to fall.

To avoid such uncomfortable and unprofitable positions, do not be influenced by the market. When the market is euphoric, stay calm. Do not be pushed into taking positions. You are certainly not in control of the market, but never let the market control you.

Hone Your Trading Instinct

Perceive that which cannot be seen with the eye.

When we lay our eyes on a chart, we see all sorts of visual depiction of the market like candlesticks, chart patterns, and bar patterns. However, unless you trade with rigid rules, your trading edge stems from something beyond the visuals.

This is the crux of discretionary trading. All discretionary traders agree that our minds perceive something that we cannot quantify exactly. And that something is the source of our trading edge. (If you think otherwise, then you should learn how to program mechanical trading systems.)

Thus, in a matter of time, you must start to feel the market and develop your trading gut. But do not use your trading gut as an excuse to trade with your emotions. While you need not have rigid trading rules, you should have valid reasons for taking each trade.

Focus on Your Trading Objective

The only reason a warrior is alive is to fight, and the only reason a warrior fights is to win.

The only reason we analyse the market is to trade, and the only reason we trade is to win. The latter clause is the key to trading consistently.

The reason we trade is to win. Traders often forget this seemingly obvious aim.

At times, we want something else more than we want to win. At times, we want to trade because we want to make up for earlier losses more than we want to win. At times, we want to trade because we want to prove to our peers that we can make money more than we want to win. Each time we forget that what we want is to win, we ignore our trading rules and take rogue trades.

We know that we have a winning trading plan. Yet, we do not follow it. Why?

The only explanation is because we do not want to win, or rather we forget that we want to win. Hence, to trade well, we must remember that we want to win. (The art of reminding ourselves that we want to win is called trading psychology.)

Deal with Losing Trades

Do not regret what is done.

How many times have you regretted taking a trade? How many times have those feelings of remorse helped you trade better?

In the mind of a consistent trader, there is no place for regret.

If we took a trade that was consistent with our trading plan, regardless of its outcome, we should not regret taking it. We expect a large sample of good trades to be profitable. But we should not expect every good trade to be profitable. Thus, if you regret each losing trade, then you have not understood the probabilistic nature of trading.

If we took a trade that was inconsistent with our trading plan, there is no need for regret as well. Recognise the mistake and look ahead. Seize the next trading opportunity as a chance to right the wrong. Regret and dwelling on your losses lead to revenge trading which will ruin your trading account.

Respect the Market

Like a sword, a word can wound or kill, but as long as one does not touch the blade, the sword is no more than a smooth piece of metal. Someone who knows the qualities of a sword does not play with it, and someone who knows the nature of words does not play with them.

And someone who knows the nature of the market does not play with it. If you understand the nature of the market, you will learn to respect it including the risks and uncertainty it brings.

Trading is not a trivial endeavour. It is not game. It is a challenging job and a serious business. Hence, if you are playing with the market, then you have not understood it. You should treat trading as a business or not trade at all.

Print these quotes out and paste them on your trading desk.

Start your journey as a market samurai today!

Want to learn more from Miyamoto Musashi? Take a look at his book on the way of samurai - “The Book of Five Rings”.