How To Increase Your Trading Profits by 3729% And Cut Commissions by 80%

By Galen Woods ‐ 3 min read

Want a simple step to increase your trading profits and cut your commissions? Put your trading records to use and find out how.

Am I selling a black-box trading system? Or a well-kept break-through technique to turbo-charge your trading profits?

No, you don’t have to pay a single cent for this. And there is nothing secretive about what I am going to share.

Some of you might already know what is coming, especially those who have kept excellent records of their trading activities.

This money-saving (and money-making) idea works with most trading strategies.

Case Study: Trend Bar Failure Strategy

In this example , we will use the Trend Bar Failure setup, which is a pattern discussed in my “Day Trading with Price Action” course.

Strategy Back-test

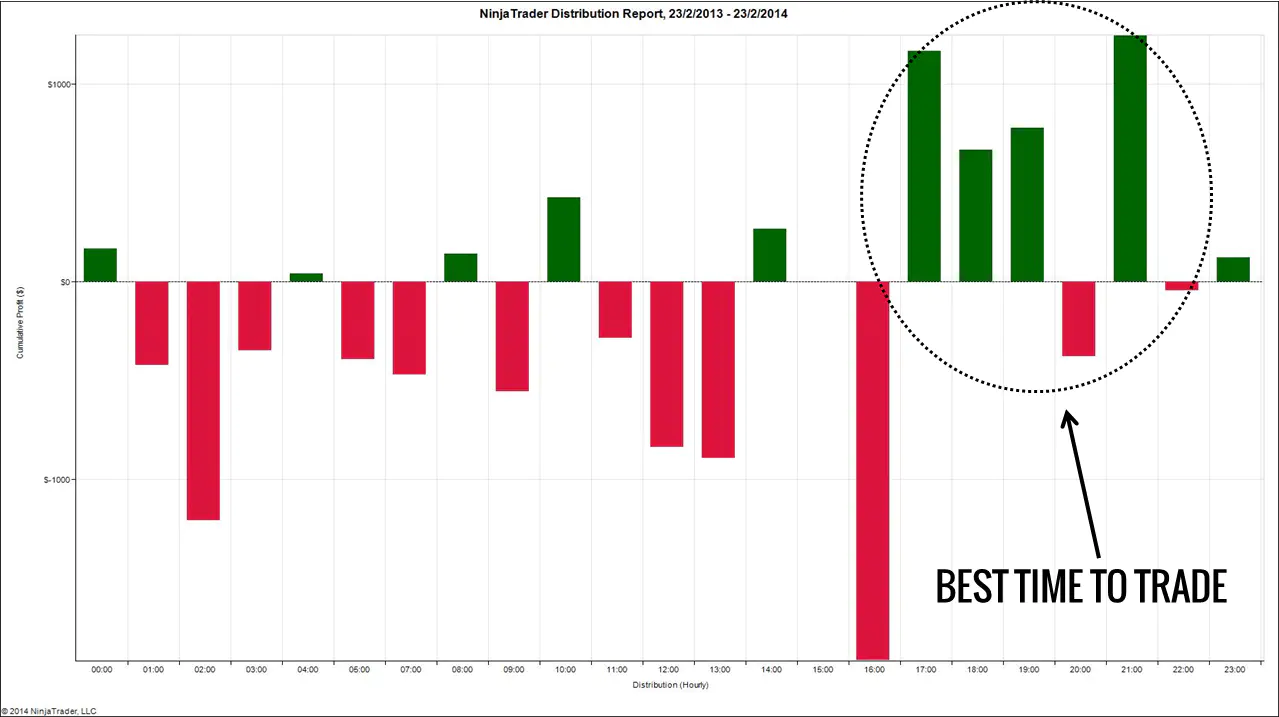

- Instrument: 6E futures (EUR/USD)

- Time-frame: 1-hour

- Period: 23/2/2013 to 23/2/2014

- Stop-loss: Pattern stop

- Target: Average hourly range x 2

With these parameters, we lost $62.40 trading one contract per trade. But that is not the point.

This is:

The three most profitable hours are within a five-hour period.

What do we do with this information?

Let’s re-run the back-test. This time, we will be lazy and trade only during the five-hour period.

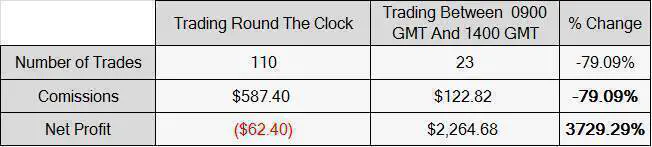

The table below compares the two sets of trading results.

By restricting our trading hours and settling for less action, we have managed to:

- Decrease our commissions by 80%

- Increase our trading profits by 3729%

Do you want to pay $62.40 to take 110 trades? Or do you prefer to take 23 trades and make $2,264.68?

This case study is not about trading Trend Bar Failures using a mechanical approach. If you want to learn more about this simple price action trading strategy, you should refer to this article.

The real takeaway here is the impact your trading hours has on your trading profits.

More Trading Profits For Trading Less

Trading less is more, if you know when to trade.

We can earn more if we know which are the best hours to trade and stick with them.

The best hours to trade depends on many factors including the market you are trading, your trading time-frame, and your trading strategy.

As a rule of thumb, most active trading strategies do better during higher volatility periods.

Back-test your trading strategy like what we did above to gain insights on which are the profitable hours. If you trade with a discretionary strategy and find it hard to back-test mechanically, you can do manual back-testing.

However, manual back-testing is tedious and has greater room for error. So, if you have kept good records of your trades, you can put them to use now. Check your trading records to see if your profitable trades tend to cluster within a certain time period each day. Go through the day trading evaluation cycle and find when to take the best trades.

Examine your trades and you might uncover when you should trade to maximize your trading profits. It is time to forget about taking as many trades as you can. Trade only when it matters.

Take a closer look at your trading records now and uncover this hidden gem in plain sight.

You might realize that trading the first two hours of each trading session makes you more money than trading the entire session. On top of that, you get to free your time from trading and spend them with your loved ones.