Forex Tester 5 Backtesting Software Review

By Galen Woods ‐ 15 min read

Read our balanced and comprehensive Forex Tester 5 review to decide if this forex trading simulator suits your backtesting and learning needs as a trader.

Forex Tester 5 is a dedicated forex trading backtesting software. It allows you to backtest mechanical strategies swiftly. It also has the ability to replay price action for backtesting manual strategies.

If you are looking for a realistic forex trading simulator, Forex Tester 5 is a strong contender.

Want to find out if Forex Tester 5 is suitable for you?

Let us help you with this complete and balanced review of Forex Tester 5.

I’ve taken it for a test drive to understand its functions and check its suitability for different trading styles.

Now, before you read on, let’s talk about what you should look for in a trading simulator. This will give you a good sense of our review scope.

There are two main aims of using a trading simulator.

- To learn how to trade without risking money

- To verify a trading edge with historical data

Only a high-caliber simulator can meet these aims well. Minimally, it must be realistic and offers high-quality trade records.

It must also be easy to use so that you do not waste time on the learning curve.

On top of that, your simulator must offer the trading tools you need to put your trading strategy in place.

Finally, you should consider the cost of the simulator versus the value you can get out of it. E.g. time-saving, realistic backtest, opportunity costs.

Hence, I will be answering these five questions in this Forex Tester review.

Overview of Forex Tester 5 Review

#1: Does Forex Tester Offer A Realistic Trading Experience?

#2: Is Forex Tester Easy To Use?

#3: Is Forex Tester A Good Learning Tool?

#4: Is Forex Tester Suitable For You?

#5: Should You Buy Forex Tester?

#1: Does Forex Tester 5 Offer A Realistic Trading Experience?

Simulation Settings

Forex Tester 5 has an array of settings to ensure realistic backtesting and replay.

Most simulators allow you to set your account balance and reset it when necessary. Forex Tester goes a step further. Under the Orders menu, it allows you to record deposits and withdrawals from the account as well.

In its well-organized Data Center, you can define spreads, lot size, and leverage for each pair. By customizing them exactly to your broker’s specifications, you can ensure consistency between your testing and live experience.

With Forex Tester, you can set floating spreads that vary with market conditions. This is an advanced feature that enables much more realistic simulation. However, to use floating spreads, you need to upgrade your data package to include tick data. (More on this below.)

Price Data

The reliability of the price data is critical to practical backtesting.

Forex Tester comes with free basic forex data provided by Forexite. It includes forex data for 7 majors, 9 crosses, and 2 metals, down to 1-minute bars from 2001 (more than 20 years of data!).

For higher time frames (daily and above), this basic forex data package is sufficient.

There are two scenarios in which you might want to consider upgrading your data package.

First, if you need greater granularity in data, you will need to upgrade for tick data. For instance, traders that work with a scalping starting will definitely need to upgrade for realistic backtesting and practice.

Second, if you want data for additional instruments not covered by the basic subscription, you will also need to upgrade. These extra instruments include indices, crypto, and stocks.

With its custom settings and data sources, Forex Tester 5 is able to offer a realistic simulation.

You should not expect anything less from a dedicated trading simulator.

Trading Setups Review has partnered Forex Tester to offer a special discounted price for our readers. Click here to buy.

#2: Is Forex Tester 5 Easy To Use?

You don’t want to waste too much time figuring your way around a new simulator. You want to get started as soon as possible.

The aim is to spend your time on productive work like backtesting and replay practice.

Let’s take a look at Forex Tester’s learning curve.

User Interface

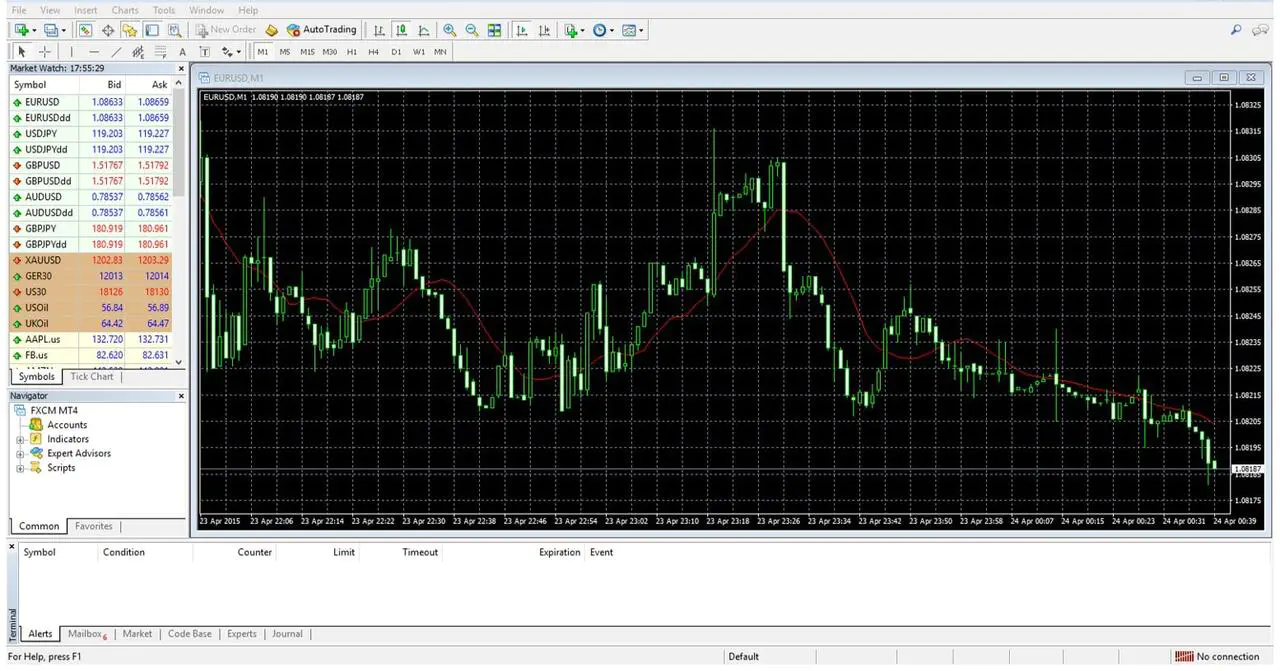

The layout of Forex Tester is similar to that of MetaTrader 4 (MT4).

While it’s not an exact replica, users of MetaTrader 4 will find Forex Tester familiar.

This is a huge plus.

If you’re an experienced MT4 user, this familiar layout shortens your learning curve.

If you are a new forex trader, you will very likely turn to MT4 when you want to transit to live trading. Using Forex Tester will help with a quick transition.

On top of this, there’s good news for non-English speaking users looking for ease of usage. Forex Tester comes in 16 different languages, including English, Japanese, Portuguese, Russian, Vietnamese, Spanish, Polish, Hungarian, German, Czech, Dutch, Indonesian, Slovak, Italian, Thai, and Turkish.

Ease Of Getting Started

When you start up Forex Tester, the first step is to download the market data you need for backtesting.

With a few mouse clicks, I was able to download the forex data using the Data Center.

There are also prominent buttons for essential functions like:

- Creating a new chart

- Adjusting time frame

- Start/stop the testing

- Controlling the speed of replay

There are also 13 video tutorials to help you get started. The one shown below is the first tutorial: Quick Start.

As for chart options like adding indicators, you can do so easily with a right-click on the chart. You can also send trade orders this way.

With these features, it is really simple to get started with manual backtesting using market replay.

How about those looking to use Forex Tester for automated backtesting?

The Forex Tester 5 supports .dll files. As for .mq4 EAs or indicators, you can add them to the Forex Tester 5 program via File -> Install -> Install New Indicator/ Install New Strategy menu so it can try converting them to the Forex Tester format. (It may not work well for complex strategies.)

On top of that, the same guys who built Forex Tester 5 have another great offering, the Easy Forex Builder (EFB).

EFB is a powerful tool that allows anyone to build their forex trading strategy with an intuitive drag-and-drop interface.

It provides you with a graphical interface for you to construct your trading strategy. You can combine indicators, price, time, and volume with various conditions to personalize your trading strategy.

The best part of this tool is that your strategy will be created not just for Forex Tester, but also for MT4. You easily deploy the same strategy in your actual trading. Fantastic feature.

The EFB is free for the moment, and you should take advantage of it if you have always wanted to build your own EA without coding. However, automating backtests of sophisticated strategies might pose a challenge, depending on your programming knowledge.

Software Support

The ideal design of a simulator should be so intuitive that you can figure out everything on your own.

But that’s often not the case, as every trader starts with a different background. You might get stuck and need support from the Forex Tester company.

Luckily, all Forex Tester users get lifetime support provided through:

- Online Chat

- Forum

- Online Guides with Videos

- Comprehensive Online FAQ Bank

You should certainly check out their forum and resource directory to get a sense of the level of support they offer. (You don’t need to log in to view.)

Lifetime support is only valuable if Forex Tester is well-established and stable. According to their website, they’ve been around since 2006. You need to decide if a track record of 15 years is something you can trust.

Overall, it is easy to get started with Forex Tester’s friendly interface. Furthermore, support is also available via multiple channels.

Trading Setups Review has partnered Forex Tester to offer a special discounted price for our readers. Click here to buy.

#3: Is Forex Tester 5 A Good Learning Tool?

Trading Tools

To learn well, you must be able to practice and formulate strategies with a wide variety of tools.

Forex Tester has over 60 built-in indicators, and they are working to add new ones constantly. On top of the standard trading indicators, you’ll also find the more exotic ones like Solar Wind and Polarized Fractal Efficiency.

And for those of you who are using custom indicators in MT4, you can add the .mq4 file to Forex Tester 5 and it will try to convert your indicator into Forex Tester format. However, note this feature is still being heavily developed so it might have problems converting complicated indicators. Be sure to double-check your converted indicators before using them,

As a price action trader, I paid attention to the drawing tools in my review.

They were adequate for my trading style. I was able to draw trend lines and channels quickly. For instance, the Poly line tool was perfect for marking price swings.

Forex Tester also has tools for more specific trading styles including Andrew’s Pitchfork, Elliot Wave, and Fibonacci.

You can assign hotkeys to each drawing tool for more efficient analysis. This is a function I make use of a lot. By mapping it to the hotkeys I’m used to in other platforms, I can draw on the chart efficiently.

Non-time-based charts like Range and Renko charts are also available. (You can find this under the File menu).

For many forex traders, fundamental news plays a critical part in their trading plan. Forex Tester includes historical news records that you can overlay your charts with using a simple toggle. This ability enables you to learn how news impacts prices.

To sum up, Forex Tester has trading tools comparable to most forex trading/charting platforms.

Backtest & Replay

You can backtest multiple currencies in multiple time frames. The layered results might offer you extra insights.

You can practice trading using historical price action with manual testing. It is basically a replay function that is valuable for a new trader who wants to accumulate screen time.

Screen time refers to the time spent analyzing the market as price action develops. Being able to replay the market at a higher speed will help you speed up your progress.

In Forex Tester, you use projects to manage your backtests. Each project is independent.

You can try an automated approach in one project. At the same time, you can start a new project for discretionary trading in a different currency pair.

You can start as many projects as you like, each with a different focus. Projects offer a convenient way to manage your backtests and practice sessions.

Trading Records

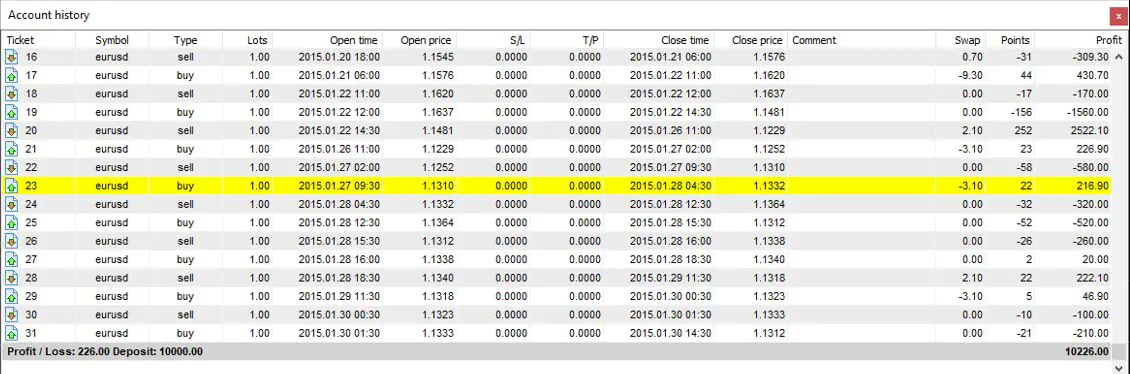

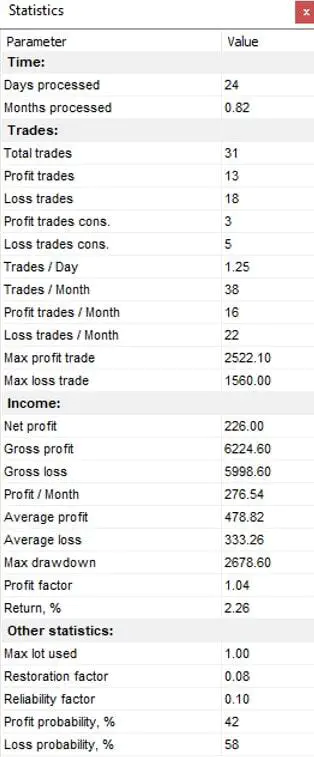

Another key to effective learning is record keeping.

Forex Tester 5 records your trades and calculates useful summary statistics seamlessly.

You can double-click on a particular trade in your account history, and the charts will move to show the trade. This is one of my favorite functions - a quick and intuitive link between trade records and their charts.

The statistics given by Forex Tester are sufficient for most traders.

But if you want to drill for more insights, you can do that easily as the data can be exported to Excel with just two clicks.

I find this export function extremely useful. With the data in Excel, I am able to run simulations and perform advanced analyses on my trades.

A good trade record includes a chart screenshot. It takes just one click to capture a screenshot of the chart.

Forex Tester’s record-keeping ability is convenient and comprehensive. It adds great value to the learning process of any serious trader.

Trading Setups Review has partnered Forex Tester to offer a special discounted price for our readers. Click here to buy.

#4: Is Forex Tester 5 Suitable For You?

In this section, we will consider if Forex Tester 5 meets the needs of different trading styles.

Mechanical Trader

For mechanical trading, depending on the complexity of your trading strategies, you might need to devote more effort to convert them to use them in Forex Tester. But the tools (like EFB) to help you with this area are improving and will continue to improve.

Be sure to consider the time and effort you need to convert your trading strategies for Forex Tester 5.

It’s not tough for someone comfortable with programming. Hence, depending on your coding proficiency, this might not be a concern.

Forex Tester offers the ability to view the charts during an automated backtest. Many platforms do not show you the charts until the backtest is completed. This is a great advantage if you’re looking for real-time insights.

Moreover, you can adjust the strategy parameters on the fly.

If you are fine with the possible need to code separately for Forex Tester, you will find it to be a capable backtesting platform.

Discretionary Trader

Forex Tester is ideal for discretionary price action traders. The learning curve is short, and the drawing tools are robust.

For discretionary traders, the ability to replay price action is critical. And Forex Tester does this well.

Discretionary traders also employ indicators. In fact, many discretionary traders like myself use custom indicators to aid analysis. Hence, being able to get custom MT4 indicators into Forex Tester is a huge plus.

Scalper

Scalping takes place at high speed with uncertain trade execution. Hence, it is one of the hardest trading styles to backtest reliably. This is true regardless of your platform.

If you are a scalper, it is essential that you upgrade to the VIP data subscription for tick data, so that you can enable floating spreads. Hence, you need to factor this into your budget.

Although not perfect, this feature will allow you to use Forex Tester to backtest a scalping strategy with reasonable reliability.

However, this setup will cost more. (Click here for our special discounted pricing.)

Finally, Forex Tester is also able to calculate the correct number of lots based on a percentage risk model. This is a handy feature for scalpers who want to focus on the action and not waste time calculating their risk exposure for every trade.

Non-Forex Trader

On Forex Tester’s website, they mentioned that Forex Tester 5 is not limited to forex. It also includes metals, CFDs on indices, and stocks.

However, note that the free Basic data subscription includes only forex data, and even the selection is limited to the major pairs. Hence, it’s insufficient if you’re looking to go beyond the common spot forex markets.

The table below details the exact differences between the tiers.

As you can see, if you intend to trade indices or stocks, you must upgrade to the higher tier of data subscription.

Even then, you should check if the exact symbol is included using the filter list on this page. Unless you find the exact symbol you want to trade on this list, do not assume that they are available in Forex Tester.

Forex Tester offers that function to create custom instruments and import your own data. This is a possible but inconvenient workaround.

Hence, if your trading instrument is included in paid data subscription and you are willing to pay extra for the upgrade, Forex Tester is a great candidate. If not, there is no compelling reason to insist on using Forex Tester.

#5: Should You Buy Forex Tester 5?

If you have a demo trading platform that you’re happy with, stick to it.

This is especially true if the platform is the one you will be trading with when you switch to a live account.

But if you are not happy with the functions or the cost of your current simulator, consider Forex Tester.

Based on the above information, you should have a pretty good sense of whether Forex Tester suits your trading needs.

Hence, at this stage, there are only two more things to consider.

Cost of Forex Tester 5

Forex Tester 5 has a regular price tag of $299, and it comes with free Basic Data.

As shown in the table above, there are three levels of data for Forex Tester. Standard and VIP are paid subscriptions.

To decide which data subscription you need, consider your:

- Trading time frame

- Trading symbols

- Need for tick data and floating spread

Clearly, Forex Tester 5 offers the best value for swing traders who look at daily and above time frames. The free basic data plan suffices, and you will just need to make a one-time payment for this great tool.

If you need to upgrade your data package to Standard or VIP, you can choose between monthly or yearly recurring payments. (Cheaper if you pay yearly.) There is also a lifetime one-off payment that makes sense if you are committed to using Forex Tester for the long term.

Trading Setups Review has partnered Forex Tester to offer a special discount for our readers. Click here to learn more.

Consider your alternatives.

Typical demo accounts expire. Those that don’t usually require you to maintain a minimum account balance. Inactivity fees are also a concern.

On top of that, most demo accounts run on a deactivated mode of a trading platform. Such instances do not provide the full features of a dedicated simulator/backtester like Forex Tester.

With Forex Tester 5, you will no longer encounter these issues.

Paying a modest price for an excellent tool to improve your trading skills makes great sense. Especially when you consider the fact that many traders lose far more than the cost of Forex Tester in reckless live trading.

First-Hand Experience

Before you take the plunge and buy Forex Tester 5, I strongly encourage you to download the trial version by clicking the banner below.

Nothing beats trying out Forex Tester for yourself.

The trial version is limited in the ways stated below. But it offers enough for you to evaluate the software meaningfully.

Pros and Cons of Forex Tester 5

To conclude this review, here is a summary of the pros and cons of Forex Tester

Pros

- Works for both mechanical and discretionary traders

- Realistic backtesting environment

- User-friendly

- A comprehensive set of trading indicators and drawing tools

- Seamless export of trading records

- Easy import of price data

- Lifetime and multi-channel support

Cons

- Might need a data subscription (in the form of recurring charges or a one-off lifetime payment)

- Might not be suitable for non-forex traders

- Windows OS only

- Might have issues using complex custom indicators and strategies

Trading Setups Review has partnered Forex Tester to offer a special discounted price for our readers. Click here to buy.

Disclosure

Trading Setups Review received a free copy of Forex Tester to write this review. This review contains affiliate links. This means that we will receive a part of the sales made if you buy through this landing page.

Don’t worry; it won’t cost you anything extra. In fact, you save more by purchasing through this page.

This small percentage helps to support Trading Setups Review and shows us you care about what we do. We appreciate your support!