MACD Hidden Divergence Trading Strategy

By Galen Woods ‐ 3 min read

Hidden divergence is a very useful trading method when using oscillators like MACD. It defines oversold regions in a dynamic way to improve our trading odds.

Oscillators like RSI, stochastics, and MACD are powerful tools if you know how to use them. Looking out for divergences is a part of using oscillators for trading. Divergence refers to the disagreement between price and the oscillator.

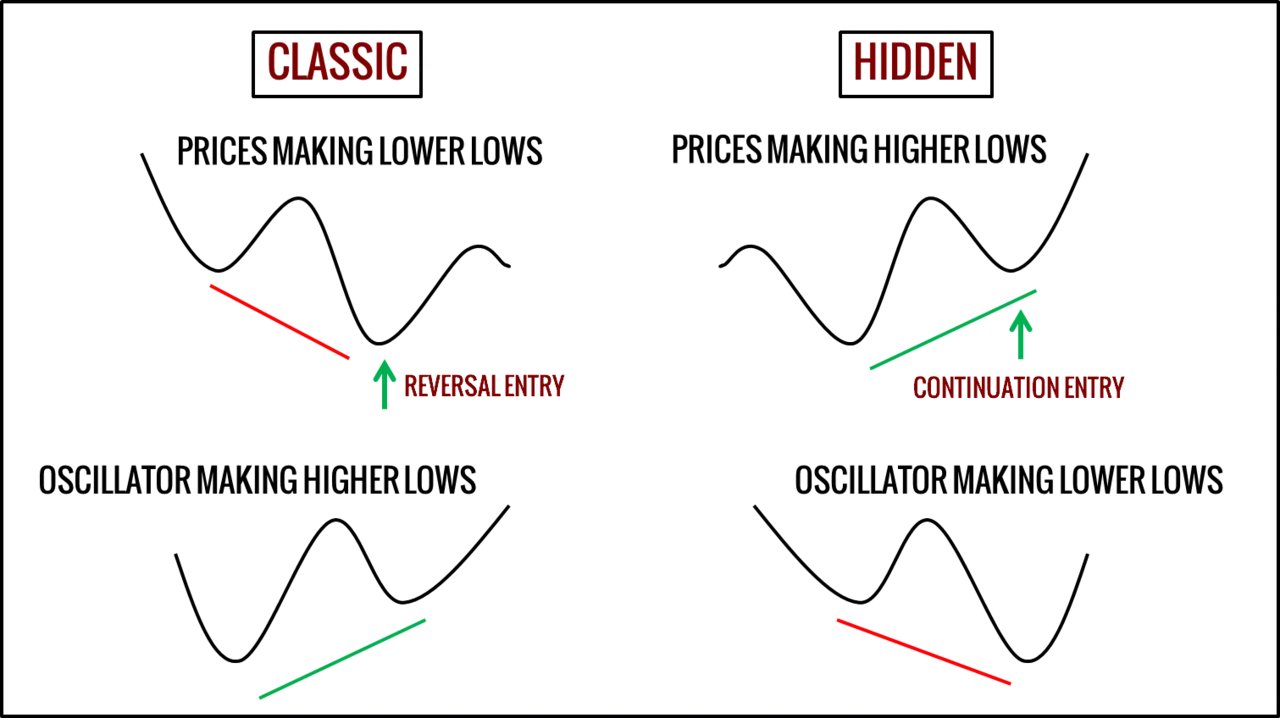

Classic divergences are part of a reversal trading strategy. Hidden divergences point to continuation trades. Take a look at the two types of bullish divergences illustrated below. (Bearish divergences are the reverse.)

For our review, we will be using MACD, but the same trading strategy can work with any trading oscillator.

Trading Rules - MACD Hidden Divergence

Long Trading Strategy

- Bullish MACD hidden divergence

- Buy one tick above any bullish reversal bar

Short Trading Strategy

- Bearish MACD hidden divergence

- Sell one tick below any bearish reversal bar

MACD Hidden Divergence Trade Examples

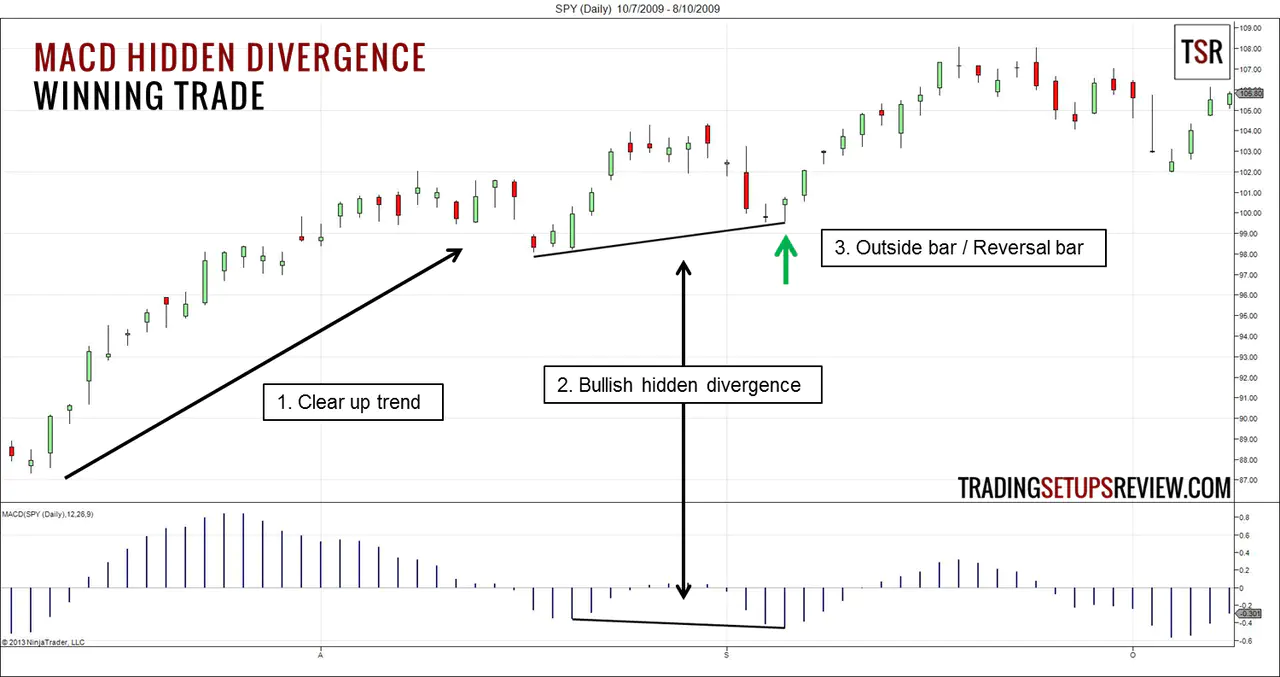

Winning Example - Bullish Hidden Divergence

This is a daily chart of the S&P exchange-traded fund, SPY, with the MACD histogram on the lower panel.

- There was a clear up trend leading up to our trading setup, which is crucial for continuation trades.

- To find hidden divergence, pay attention to the last low of MACD. Once MACD descends past it, you turn your attention to price. If price is above the last swing low, you have a hidden divergence. However, if price continues down below the last swing low, the hidden divergence becomes invalid.

- After the hidden divergence, we had a reversal bar that showed its strength as it turned into an outside bar. We entered a tick above its high for a nice swing upwards.

Losing Example

This is a daily chart of Ross Stores. It shows a bullish MACD hidden divergence that failed.

- Like the previous example, we had a clear up trend, without any significant pullback.

- We got a bullish hidden divergence that set us looking for reversal patterns.

- After entering a tick above the bullish inside bar, prices stalled with a couple of dojis. As prices attempted to move up again, the bears made their stand with the large bearish outside bar.

Review - MACD Hidden Divergence

Divergence trading strategy requires you to pay attention not just to the indicator, but also to price itself. This is why it is a better way to use oscillators. We should never use trading indicators without consulting price.

Another advantage of hidden divergences is the higher odds of success, given that it finds trades along the trend and not against it.

Bullish hidden divergences highlight oversold regions in an up trend. However, instead of using a fixed oscillator value to decide if prices are oversold, we use the previous low of the oscillator. (The reverse is true for bearish divergence.) This is definitely an improvement over the using fixed thresholds.

Despite having the help of the MACD histogram, we must emphasize that finding divergences is an art. The subjectivity lies with picking out significant lows and highs on both the oscillator and price. For better results, traders usually ignore minor swing lows and highs. However, in powerful trends, those minor swings could lead to explosive moves.

For those interested in MACD and divergences in general, here are some resources for further study.

- MACD Basic Trading Strategy from the inventor of MACD

- Trading strategy using Classic Divergence with RSI

- Hidden Divergence article in Stocks & Commodities V. 14:7 (285-289) by Barbara Star

Too busy looking for divergences? Don’t forget to look at price. Learn the value of price with our trading guide.