A 5-Point Plan for Price Action Traders Who Want Consistent Results

By Galen Woods ‐ 6 min read

To a trader, what is more elusive than profits? Consistency in your trading performance. Follow this 5-point plan to become a consistent price action trader.

Price action trading is a beautiful thing, a simple way to read the market and make your trades.

That’s if you have a sound price action trading plan, and you stick to it.

You would love to be more profitable, suffer less drawdowns, and have fewer losses. You buy every single trading book you can find and learn the most from your fellow traders. And they can be helpful.

But one of the best things you can do to improve your trading is to make it simpler, and hence, easier to follow. Even better, as long as you stick to a simple price action method, you don’t need any costly and fancy indicators.

Here’s a straightforward plan to achieve consistent results as a price action trader.

#1: Make it simple

If you’re acquainted with price action trading, you knew this one was coming.

Complexity leads to confusion. A confused trader is who we prey on, not who we want to become.

Simplicity is effective and practical. You understand what you are doing, and you can follow your plan. Yet, a simple approach does not mean an empty arsenal.

Everything should be made as simple as possible, but not simpler.

Albert Einstein

This means that you need to figure out the simplest trading method that works. Not one that is simplistic. In other words, you need to understand the market, and you need to do it with as few tools as possible.

This is the way to do it. Remove all your indicators. Yes, all.

Then, try to read price, analyse price, and practise anticipating price action. Don’t even think of about taking any trades at this stage.

Now, add the one indicator that you miss the most. You will know which one after spending enough time with a naked chart.

Repeat your price reading exercise. Now, you can see not only price, but also its interaction with the indicator you just added. Like the example below, which shows price interacting with a moving average.

Add your indicators one by one and practise reading the market. Then, you will truly appreciate the value (confusion) that each indicator brings. You either start to use each indicator better, or start to realise how useless they are. In any case, the outcome is helpful.

There are trading methods out there that promise guaranteed returns with complex black-box indicators. They want to convince you that trading is complicated and you need their help to do it. You need to pay them a lot for it.

Don’t do that. Hone your skills to get a good understanding of the market and how it moves. Learn basic and simple price reading skills that you can apply to all markets. Anything less is a waste of your time.

#2: Work on your trading instinct

This one takes time, but it will repay you many times over.

Hone your trading skill.

Here’s a weird thing about price action trading: Lots of people swear by it, saying that it is the Holy Grail.

But is it?

Price action is just another tool. It is just an approach to understanding how prices move and react. Traders like to think that they’ve found the Holy Grail. They will be profitable now because they know some market secrets that nobody else does.

They don’t realise that what matters more is the one holding the tool - the trader. To become a better price action trader, you need to build up your trading instinct as a discretionary trader.

To do that, you need time. You need to stay gritty. More than that, you need to practise correctly.

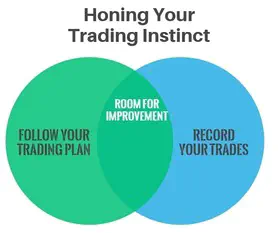

The correct practice is both focused and consistent. If you stick to your plan and keep good trading records, you can find out your strengths and weaknesses. Then, you have a basis for improving your trading gut.

Learn how to keep trading records that help you improve as a discretionary trader.

#3: Use sensible risk management

Along with your trading strategy, your risk management is a critical part of your trading plan. The way you handle risk can make you bankrupt overnight. It can also protect you from the market’s ruthless waves.

Look at the trading strategies out there, in books and online. They focus heavily on when to enter the market, because that’s what attracts a large audience. People want to know when to buy and sell.

But as a consistent trader, it’s your job to know how much you can risk on each trade. Keep your eye on potential exit points, and don’t be afraid to cut your losses. Decisions to cut risk are not sexy, and are not interesting to talk about. Yet, they are critical to your survival as a price action trader.

Make sure you do not risk more than what you can afford. Find out how to manage your positions to cut risk through extensive simulation trading.

You can use the NinjaTrader Platform for free simulation, even replaying past market data for practice.

If you trade forex, consider the Forex Tester.

(We are an affiliate of Forex Tester.)

Here are some resources to help you with risk management:

- Position Sizing Guide

- The Case for an Initial Stop-Loss

- Setting a Logical Stop-Loss

- Dealing with Drawdowns

#4: Make it fluid

The market evolves — and if your trading plan stays static, your results will suffer.

So make sure you have a process for updating your trading plan based on the feedback you get from the market.

This is a tough step. You need to keep a delicate balance here.

On one hand, you need to remember that your trading plan is a work-in-progress. It must evolve with the market to stay relevant.

At the same time, don’t be too anxious to change your trading plan. A well-designed price action trading method does not require huge and frequent changes. It is more likely that you will make incremental changes.

If you remove a profitable aspect due to a temporary drawdown, you will not even know what you will miss. Gather enough observations before changing any major aspect of your trading plan.

If you change your trading plan too often, you will not know what works.

#5: Expand your knowledge (and mind)

Many traders specialise. For instance, I focus on trading with price action.

In a matter of time, you will find yourself gravitating towards one trading style or concept. You will specialise and gain success with your in-depth knowledge of a trading method. It could be fast scalping with tape reading, day trading with price action, or investing with indicators. It could be anything.

Becoming a specialist is great. You get to know an aspect really well and are able to communicate them to others in a concise way.

But do not become closed to other ideas. Do not dismiss anything different as useless just because you’ve found some success in your area.

Stay open-minded. Even after I’ve developed my own trading style, I still find many useful ideas from other traders.

The attitude of condemning trading methods other than your own is pointless. Such arrogance reflects insecurity with your own method. If you need to look down on other trading methods to feel good about your own, you are not that confident after all.

Stay open-minded, but be realistic and sceptical.

In today’s world, both trading experts and convincing fraudsters share information rapidly online. New knowledge is not lacking — but it’s up to you to extract the most out of what you learn.

Use these five points to plan your trading journey, if you want it to be a long and consistent one.