7 Price Action Trading Myths Debunked

By Galen Woods ‐ 5 min read

Are you looking for false comfort or real profits? If you want the truth on price action trading, you need to dispel these seven price action trading myths

The barriers to financial trading have been falling. With discount brokers and improved market access through the Internet. There are more independent traders now than ever before. And together with it, a market approach rapidly rising in popularity is price action trading.

Studying price action is illuminating.

However, many myths and misconceptions have emerged about it over the years. To make matters worse, these claims often obscure the essential idea of price action trading and its actual value.

Here are the seven common—and stubborn—myths you might have heard.

Price action trading is:

- The only path to trading success.

- A cover for trading education scams.

- Easy to learn.

- All you need to trade.

- The only leading indicator.

- A high probability approach.

- About candlestick patterns.

Let’s shatter them one by one.

Myth #1: Price action trading is the only path to trading success.

You can easily find cults of traders proclaiming price action trading as the only path to success. Their favorite pastime is deriding anyone who uses indicators to trade.

The truth is that there are many well-documented and widely discussed trading methods that work.

They include algorithms, fundamental analysis, indicators, price analysis, news, any combination of these factors, and other secret sauces.

To claim that what has worked for you is the only viable method is an arrogant display of ignorance.

Ignore this sweeping claim; focus on finding a trading method that makes sense to you - price action or otherwise.

This is the sound and consistent path to trading effectively.

Myth #2: It is a cover for trading education scams.

This is a half-myth.

“Price action trading” is indeed overused. Due to its growing popularity, it makes good marketing sense to label trading products with it. Thus, at times, you will find this term abused.

However, it does not always trigger a scam alert. Bear in mind that “price action trading” is a descriptive term.

It describes trading focusing on price and assigns great analytical weight to price movement. That is all.

If that is what’s offered, then it is the correct label to use.

Don’t treat all related products as scams. Instead, watch out for outlandish promises of guaranteed profits.

Beware of words like:

- “Sure-win”

- “Just click and earn.”

- “Guaranteed return”

Here’s a cliche.

If it’s too good to be true, it probably is.

If you want to spot and avoid scams, Ken Fisher has a great book on identifying fraud.

Myth #3: It is easy to learn.

Basic price action trading concepts are easy.

You can pick them up with these guides:

But it is not easy to trade profitably with price action.

It is a simple tool. But the simplest tool requires the highest level of skill to operate.

You need an expert chef to slice your favorite sashimi with a simple knife. But anyone can press the “on” button on a sashimi slicer machine.

Price action trading is a discretionary approach. So you need to hone your skills.

It’s simple, but not easy.

Myth #4: It is all you need to trade.

Price action is just a way of understanding the market. However, you need to understand more than the market to make money from it.

You need to understand yourself. This means that you need to learn about trading psychology.

You need to understand risk. And this means that you need to size your position prudently to avoid the risk of ruin.

Ultimately, you need to combine analysis with risk management to form a trading plan that accounts for your psychology.

In a nutshell, you need much more to build a viable trading business.

Myth #5: Price action is the only leading indicator.

Price action is, by definition, a current and past indicator.

Yes, it is responsive, but to say that it leads the market is plain wrong.

The market is made up of prices. Price is the market. How can the market lead itself?

Price does not lead the market.

But it does keep us close to what’s happening in the market and help us form probabilistic market expectations.

And that’s already incredibly useful for a trader.

Myth #6: It is a high probability approach.

Regardless of how you trade, your winning probability depends on the type of trades you look for.

Whether you use price action or not, generally:

- Scalping for small profits within a ranging market is a high probability approach.

- Trading retracements within a trend have a lower probability.

- Trading reversals have the lowest winning probability.

And crucially, high probability always comes at the expense of your reward-to-risk ratio.

Anyone who says that it offers a high winning probability needs to qualify their claim.

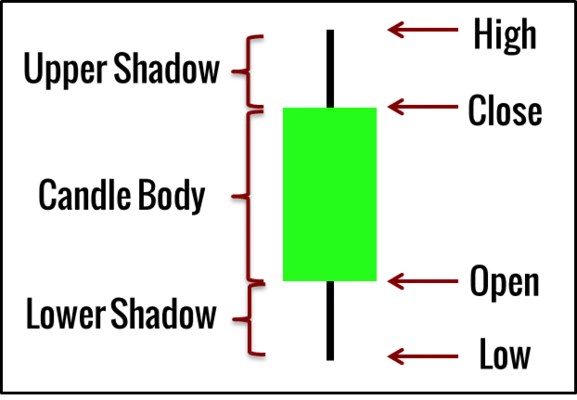

Myth #7: It is all about candlestick patterns.

Candlestick patterns are helpful. This is why candlestick charts have become the chart type of choice for active traders.

However, they are over-hyped as mystical patterns. Accordingly, you will find websites and books introducing them as money-making tools with miraculous power simply because they have fanciful names of Oriental origins.

Most importantly, price action trading is not about candlestick patterns.

It is not about rigid price patterns with unique names. It’s about learning when and why they (don’t) work.

This is an essential skill that takes practice and experience.

Conclusion - Price Action Myths Debunked

Even without this article, as you gain experience as a trader, you will see through these myths yourself.

But hopefully, our discussion gives you a better chance at avoiding overly optimistic or simplistic claims about price action trading. In doing so, you can start exploring this fascinating approach with a realistic mindset that can bring you further in the long run.

Except for Myth #2, many of these misconceptions are perpetuated by “trading gurus,” and generally, anyone wants you to trade more. They are more interested in selling you stuff than telling you the truth.

I am selling too, and offer a price action trading course. But I want you to consider it from a realistic perspective with the right expectations, away from these comfortable but misleading myths. And I hope this article has helped you in doing so.

The article was first published on 26 February 2016 and updated on 29 March 2022.