5 Practical Steps to Become a Price Action Trader

By Galen Woods ‐ 6 min read

Learning price action trading is not a random process. You need concrete and targeted practice. Follow these five steps to become a price action trader.

Are you a new trader looking to learn a simple trading method? Or a seasoned trader trying to simplify your trading? In both cases, a suitable goal is to become a price action trader.

At its core, price action trading is another device in a trader’s toolbox. But the way you learn price action trading can make or break your eventual trading career. It can equate to either well-spent targeted practice or a waste of your time and money.

Price action trading comes naturally to some. But for most, it’s a strange landscape that’s hard to navigate.

Becoming a price action trader doesn’t need to be a random process. You can become a price action trader with these 5 practical steps.

#1: Appreciate price action trading for what it is

Many traders jump head-first into learning price action. What happens is that they start with misconceptions, and end with disappointment.

To have a sustainable learning journey, appreciate price action trading for what it is.

The key strength of price action trading is simplicity. A definite focus on price gives you what you need to make sensible trading decisions.

Do you enjoy a simple approach to life? If so, you will find price action trading appealing.

Do you like tinkering with formulas and performing statistical tests to avoid multicollinearity? If so, price action trading might not be for you.

Another important note before you start. Price action does not guarantee your trading success. This is because trading is much more than just analysis.

Let’s say you’ve been trading with indicators and a overtrading issue. After mastering price action, you will trade with price action and a overtrading issue. You are overtrading and unprofitable in both cases.

While price action might change your market view, it does not solve your personal issues.

#2: Start learning from scratch

Once you’ve corrected your expectations of price action trading, let the learning begin.

As mentioned, price action trading offers an advantage because it is a simple approach. You don’t want to complicate it from the start.

Hence, the best way to learn price action is to go slowly, from bottom-up.

What this means is that you should not start with:

- Head and shoulders

- Engulfing candlesticks

- Renko bars

- Point & figure

- And all the other concepts with fancy names

You should start with:

- Bar open, close, high, and low

- Bar tail and body (selling and buying pressure and strength)

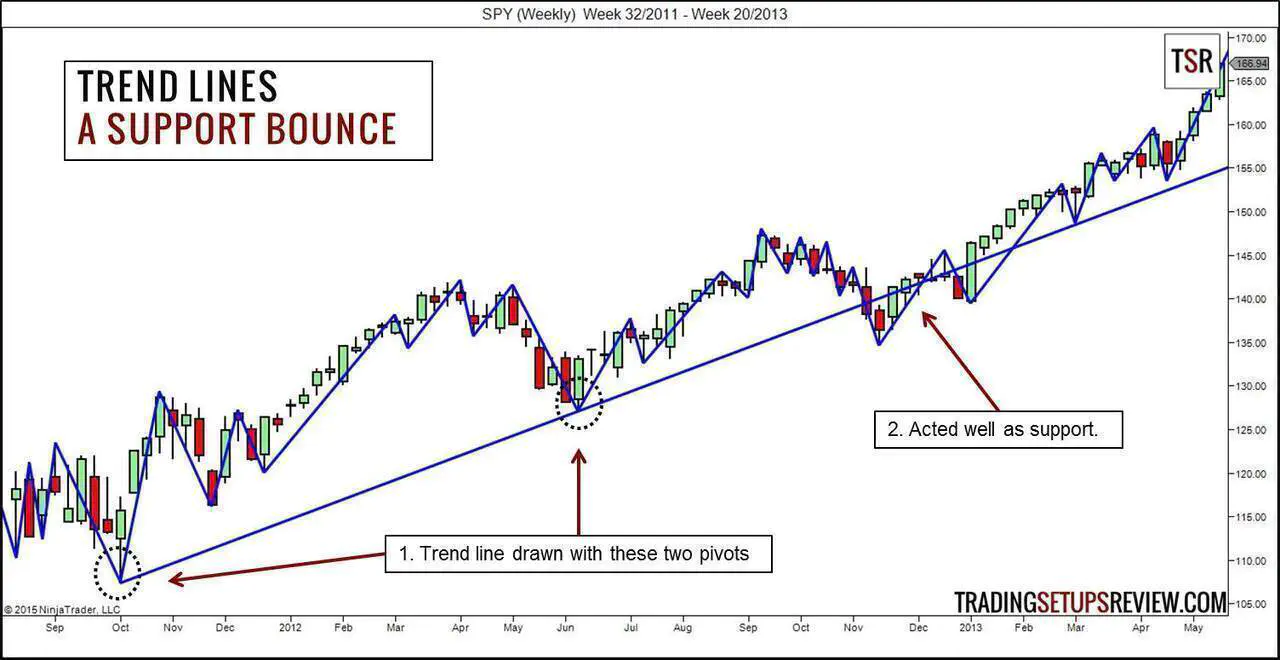

- Swing pivots (turning points)

- Concepts of support and resistance (market structure)

With a strong foundation of price action, you can pick up sophisticated concepts easily. You can break down price patterns. You can also appreciate the underlying logic of each pattern and not be bogged down by their labels.

#3: Replace your trading indicators

After grasping the basic price action tools, your shift to price action trading can begin.

If you have been using indicators, it will be a challenge to strip your favourite tools off the price chart. The key is to approach this task with a clear system.

Follow this system.

- List down the indicators you are using.

- For each indicator, write down its purpose.

- Can you achieve the same purpose with price action?

- If you can, remove the indicator.

Do not think that you are removing your trading indicators. Think of it as replacing your indicators with price action methods.

For instance, you have a 50-period simple moving average on your chart. You use it to gauge the market trend.

Now, think of the price action methods you’ve learnt to determine the trend. E.g. trend lines and market swing structure.

Can you identify the market trend using these methods?

If your answer is “yes”, then you can safely remove the moving average.

You might not be comfortable with pure price action analysis. It’s fine to keep the indicator on, but increase your focus on price movements.

Over time, as you hone your price action skills, you will find the moving average redundant.

However, you need to stay focused. Force yourself to use price action as your primary tool. Refer to the indicators only when you’re unsure.

If not, you will be confused, as you cannot decide which tool to trust - price action or indicator.

#4: Form a price action trading strategy

With what you’ve learnt about price action, construct your price action trading strategy.

Follow these guidelines:

Keep it simple. Use only the price action methods that make sense to you. Do not try to overload your brain with new concepts.

Stick to the type of trades you’re used to. If you have been trading retracements with indicators, then stick to trading retracements. The only difference is that you use price action techniques now.

Keep one indicator, if you wish. Most traders have a favourite indicator. If you feel insecure trading naked, keep one indicator. However, remember that your aim is to wean yourself off the indicator and not to use it as a crutch.

This price action trading strategy is a work-in-progress. But it is a solid launchpad for your price action trading education.

#5: Simulate and forward test with price action trading

We start learning price action by looking out for price patterns and market swings. In other words, we begin with the science of price action trading.

However, price action trading is also an art. You can only develop true skill through observing the market in real-time. Understanding price action trading as an art is the endgame.

You need to develop your intuition as a trader. Watching price action and waiting for your perfect setup patiently is the best way to do that. You’ll learn when your trading strategy works and when it does not.

For this final step, I recommend keeping a written journal. I’m not referring to a record of your trades after you’ve taken them. I’m talking about a journal of your ongoing price action analysis.

Observe price action and write down your analysis. Do this in real-time, regardless of whether you’ve taken a trade. This will help you reinforce your learning and build your confidence as a price action trader. Click here for analysis examples.

To recap, the five steps to becoming a price action trader are:

- Appreciate price action trading for what it is

- Start learning from scratch

- Replace the indicators on your chart

- Form your price action trading strategy

- Simulate and learn in real-time

These five steps aren’t magic — and you might have to repeat some steps, but they do work. And if you can stay gritty, you’ll stand to profit from a simpler approach to trading.