5 Bollinger Bands Trading Strategies You Should Know

By Galen Woods ‐ 3 min read

Bollinger Bands place price action within the context of market volatility. These are five varied Bollinger Bands trading strategies you should know.

Bollinger Bands are one of the most popular trading indicators. It’s easy to see its appeal.

Bollinger Bands use the basic statistical concept of standard deviation. For this, it is easy to understand.

Bollinger Bands form an envelope around price action. It does not divert your attention with an extra indicator panel and augments price action analysis.

Here, we’ve rounded up five trading strategies to showcase this versatile trading indicator.

But before proceeding, I highly recommend that you go through the two articles below:

- John Bollinger’s Article Introducing Bollinger Bands - For a basic understanding of Bollinger Bands

- Reading Price Action With Bollinger Bands - For an essential guide to interpreting price action with Bollinger Bands

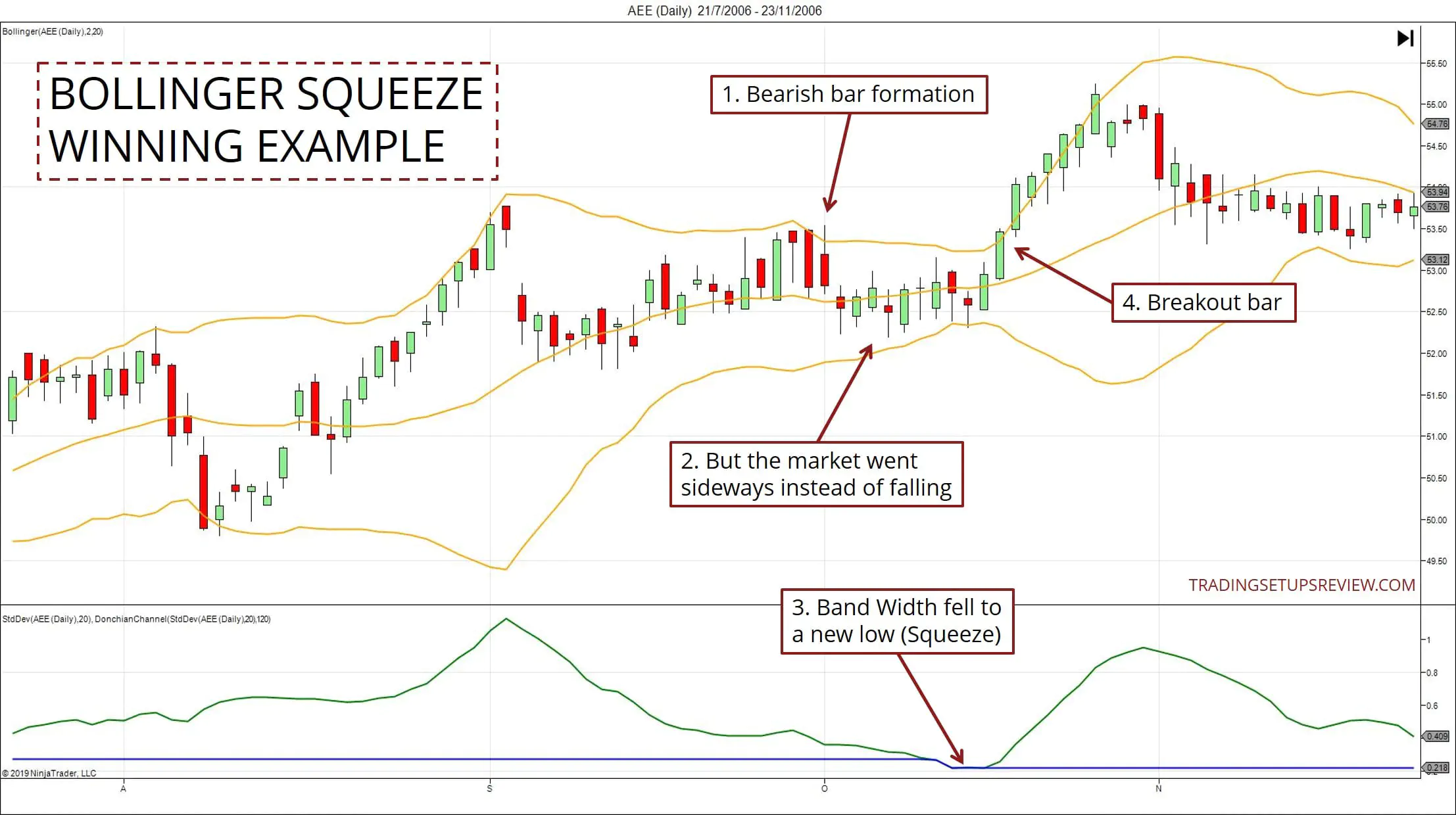

Trading Strategy #1: Bollinger Squeeze

The market exhibits volatility cycles. Low volatility markets shift gears into high volatility before subsiding back into subdued action.

Hence, finding low volatility periods will position you well to trade the subsequent breakout. Bollinger Bands are helpful here because its width reflects market volatility.

If the bandwidth is at a record low, you should stay out of the market and prepare for the eventual breakout.

Learn more about the Bollinger Squeeze:

- Trading the Bollinger Squeeze Breakout

- Bollinger Squeeze with a Head Fake Example

- Identifying the Squeeze with Bollinger and Keltner Bands

Trading Strategy #2: Bollinger + MACD

This a simple trading strategy uses Bollinger Bands as trade triggers. As Bollinger Bands reacts to market volatility, it acts as a dynamic trigger for breakout trades.

In a volatile market, it requires price action to move more to trigger a trade. In a quiet market, a smaller price move is needed to trigger a setup.

Click here for more examples on this Bollinger + MACD trading setup.

Trading Strategy #3: Double Top/Bottom With Bollinger Bands

This strategy is one of my favorites as it uses Bollinger Bands to clarify chart patterns. In this case, we are focusing on double bottoms and double tops (or W-bottoms and M-tops respectively).

Look at the example below to see how it works.

To learn more, refer to this tutorial by Stockcharts.com which has a few helpful examples of this strategy.

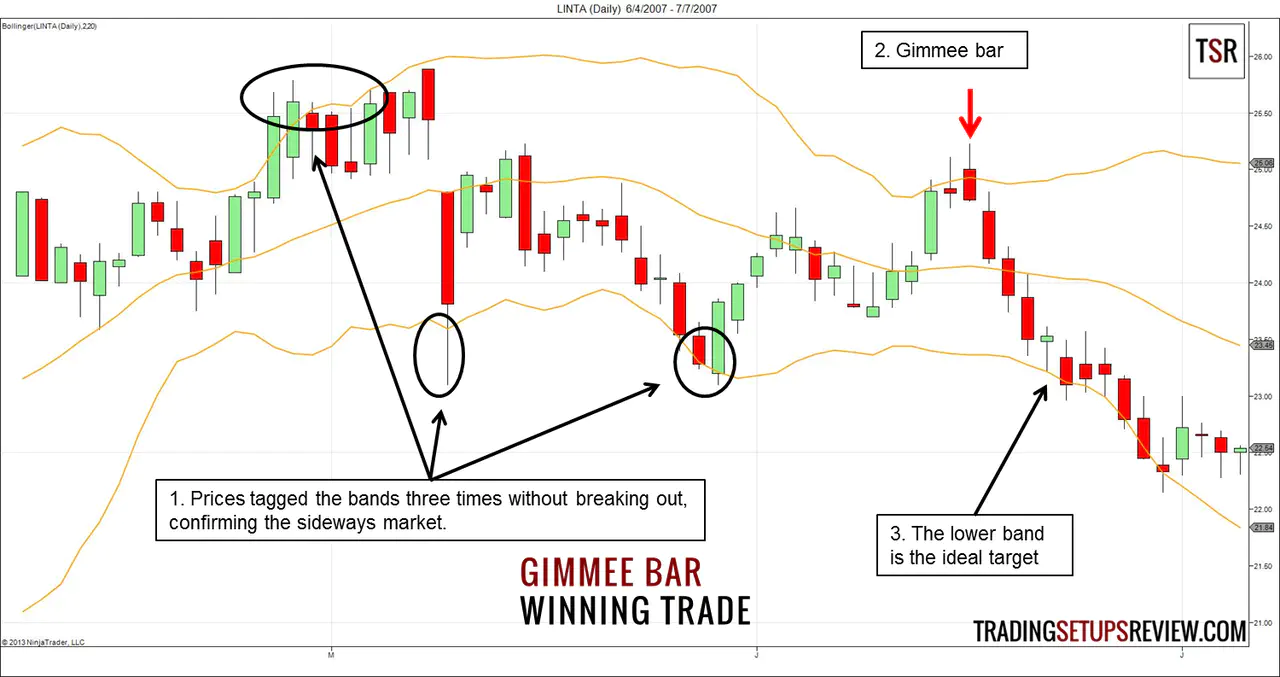

Trading Strategy #4: Gimmee Bar

Gimmee Bar is a concept by Joe Ross - one of the earlier traders to focus on short-term price patterns.

It takes advantage of the fact that a sideways market tends to stay within the Bollinger Bands. This strategy looks merely for the right price patterns to buy low and sell high within a trading range.

Click here for the trading rules and more examples of the Gimmee Bar setup.

Trading Strategy #5: Bollinger Bands Breakout With Increased Volume

This basic Bollinger Bands strategy is a breakout setup that takes on a:

- Long position when a price bar closes above the Upper Band

- Short position when a price bar closes below the Lower Band

And there’s a volume filter - the breakout bar must take place with at least 1.2 times of the average volume.

You can find the specific rules on Quandl’s blog where they conducted a backtest of this strategy on a basket of currency pairs.

Conclusion - Appreciating Bollinger Bands

These five strategies showcase what you can do with this ingenious indicator.

- Bollinger Squeeze - assess market conditions

- Bollinger + MACD - trigger trades

- Gimmee Bar - trade range-bound markets

- Double Top/Bottom With Bollinger Bands - clarify and filter chart patterns

- Bollinger Bands Breakout With Increased Volume - make use of volume signals

Yes, there are many more Bollinger Bands trading strategies out there. But it’s not about getting to know all the trading strategies.

It is about appreciating the different ways to employ Bollinger Bands effectively.

Finally, remember to check out the original book on Bollinger Bands if you haven’t already.