How To Limit Risk and Take Profit for Pullback Trading Strategies

By Galen Woods ‐ 6 min read

Pullback trading is great if you can to limit your risk and grab your profits with sound position management tactics. Learn how to with detailed examples.

Pullback trading is a common trading strategy. New traders like it for its simplicity. And seasoned traders appreciate the value of staying with the trend.

But entering the market on a pullback is just the first step. You will also need to carefully consider how to limit your risk and secure your profits.

To do this, you need stop-losses and profit-taking tactics to manage your trading position.

In this tutorial, you will learn an array of position management tactics. You will learn how to:

- Place an initial stop-loss

- Place profit targets

- Trail a stop-loss

The examples below use the Floor Trader System - a well-designed pullback trading strategy. It is easier to follow the charts below if you’re familiar with this strategy. Click here to learn more.

Nonetheless, you can apply the techniques here to any pullback trading strategy.

#1: Place An Initial Stop-Loss

An initial stop-loss is mandatory for most traders.

First, it limits your risk. Second, it gives you a foundation to compute your reward-to-risk ratio.

Pattern Stop

A pattern stop is the primary stop-placement method for pullback setups.

It uses the entry bar/pattern to set the stop-loss. The idea here is that the price pattern that got you into the market should also get you out of it.

You expect a pullback setup to launch you along with the trend. Hence, a pattern stop is a logical approach.

In the example above, we placed the stop-loss one tick above the setup bar. This approach is usually adequate for day trading. But for higher time frames, you can consider putting it further away from the setup bar.

If you experience too many whipsaws, consider a volatility stop-loss instead.

#2: Set Profit Targets With Limit Orders

Setting a profit target helps with a disciplined exit. It is the best way to combat greed and second-guessing.

Tactically, you’re looking for support or resistance areas. You can identify these zones by looking out for past congestion regions, significant pivots, and targets measured using chart patterns.

For a long pullback trade, set your profit target at potential resistance areas. These are zones where the market might reverse downwards against you.

For a short pullback trade, set your profit target at potential support areas. These are zones where the market might reverse upwards against you.

A price target, together with your stop-loss, gives you a sense of the setup’s reward-to-risk ratio.

You take a pullback trade only when you expect the trend to resume. Hence, the most conservative profit objective is the last trend extreme.

(The blue boxes in the chart below are Congestion Zones as taught in my course.)

Check out more profit-taking techniques here.

In some situations, you might find it optimal to let your profits run. In that case, you need one more tool under your belt - trailing stop-losses.

#3: Trail Your Stop-Loss

A trailing stop-loss is a stop-loss order that trails price as it moves in your favor. It is a favorite position management tactic for many traders.

It’s not surprising because a trailing stop-loss achieves several purposes:

- Reduce your risk exposure over time

- Secure your profits

- Allows profits to run in ideal scenarios

To employ a trailing stop-loss in a pullback trade, you need to answer one crucial question.

How closely should your stop-losses follow price action?

If your stop-loss is too close to the market, you risk getting stopped out before the trade reaches its potential.

If your trailing distance is too large, you risk giving a huge chunk of your profits back to the market.

Let’s look at two common ways to trail stop-losses for pullback setups.

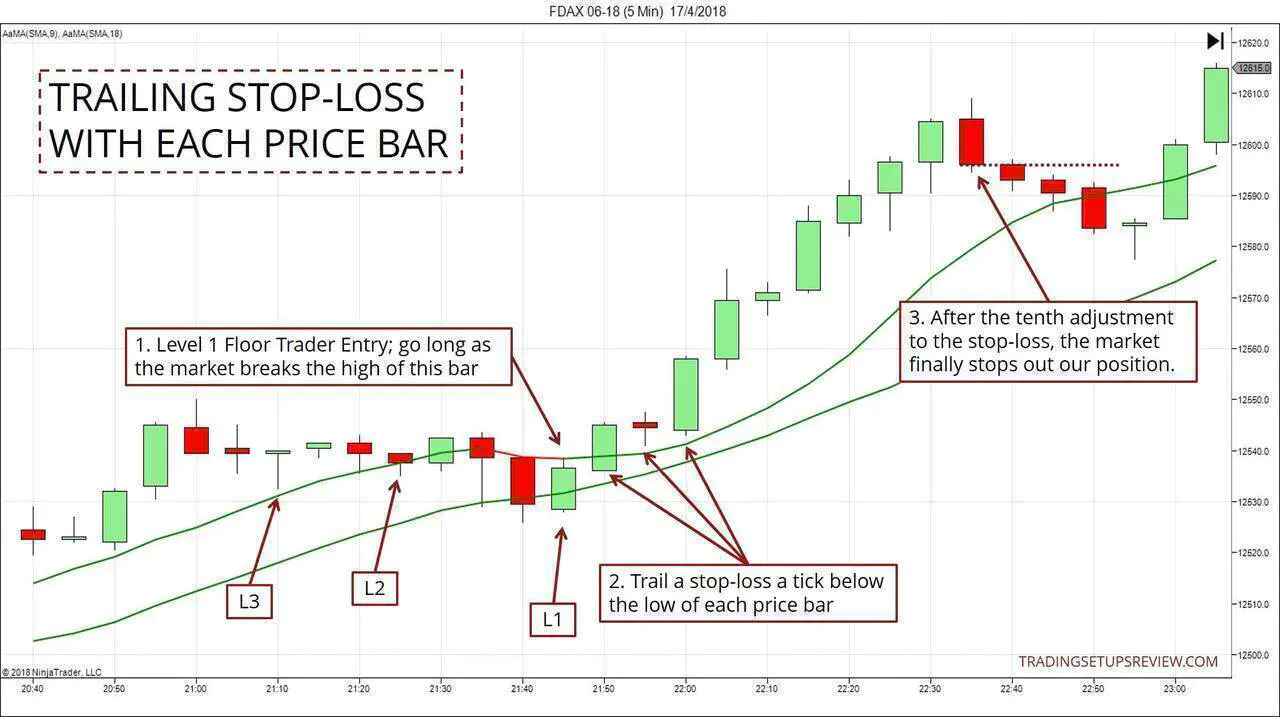

Trailing After Each Price Bar

This tactic is aggressive and works best when you expect a robust price wave. However, strong upthrusts like the one shown below are not common.

The chart below shows all three levels of the Floor Trader Trading System. Let’s assume that you adopt a conservative approach and enter only with the Level 1 entry signal.

This approach limits potential losses aggressively. It also restricts the time you’re exposed to the market. But, in most cases, this technique will not yield substantial profits.

This is because adjusting your stop-loss with every single price bar can suffocate your trade. Hence, you can consider a modified approach that aligns your stop-loss by trailing behind selected (and not every single) price bars.

For course students: An example is the Wide Range Bar Trail explained in Volume 4 Chapter 2.2.3.

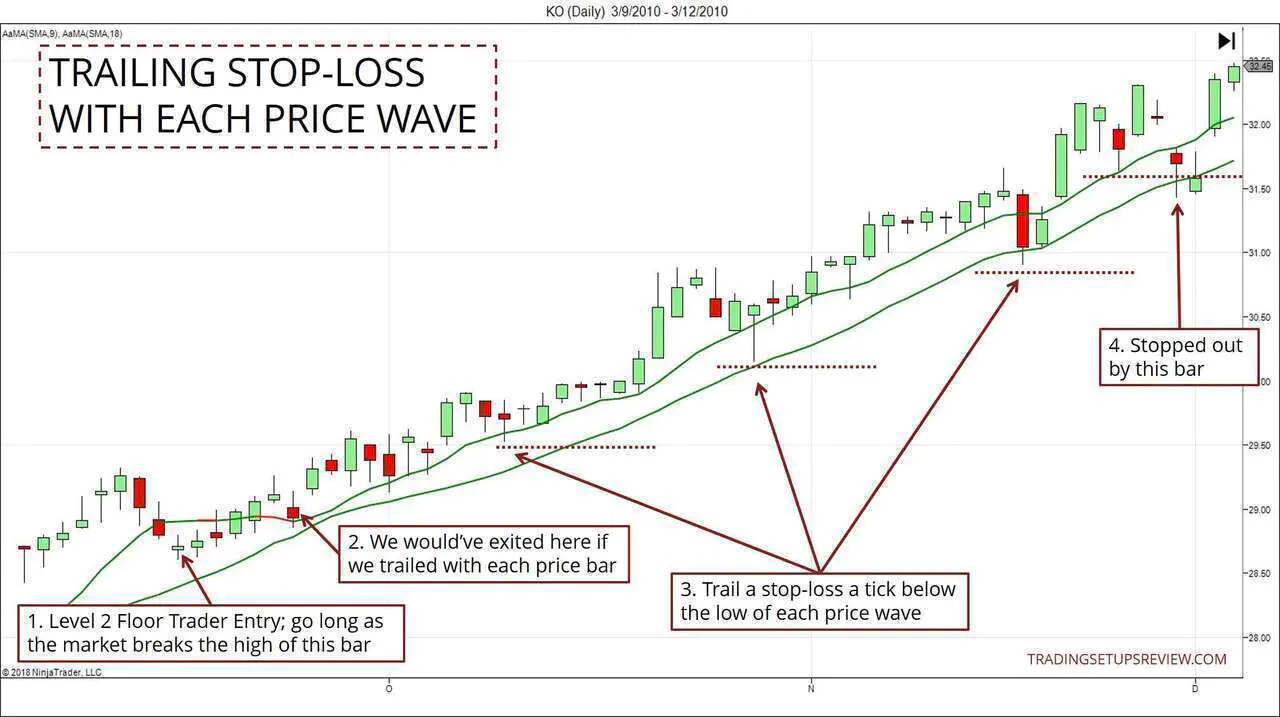

Trailing After Each Price Wave

Trailing after each price wave provides more room for the trade to wriggle. It respects price action while offering a chance at windfall profits.

This method is useful for letting profits run on the daily time frame.

Trailing with price waves is not as simple as it seems.

First, you need to decide what is a price wave. Then, you need to decide on when to adjust the stop-loss.

- Do you count shallow pullbacks against the trend as a new wave?

- Do you adjust your stop-loss the moment a wave is formed?

- Do you adjust it only when the last trend extreme is exceeded?

No matter how you adjust your stop-losses, do not leave it to your emotional mind. Adhere to a consistent approach.

The two charts above show how to adjust a stop-loss according to the market price action. If you prefer a mathematical approach, check out Parabolic SAR - an indicator designed for implementing trailing stop-losses.

Advice for New Traders

It’s easy to let your emotions dictate your trading decisions. Especially after you’ve placed your money on the line.

Hence, stick to a straightforward method for position management. (E.g. fixed stop-loss and target orders with an all-in, all-out approach.)

Also, you’re likely to be fine-tuning your entry strategy. If you’re changing too many variables at once, you’ll not find out what is working.

Options To Explore For Experienced Traders

- Use a combination of trailing stop-loss and target for optimal results.

- Adjust targets according to price momentum after your trade entry.

- Exit at the market after prolonged congestion or a climactic move with heavy volume. (Signs of reversal)

- How do you choose between a trailing stop-loss and a target order? Consider the profit potential of the pullback trade. For instance, if you’re day trading with limited time left in the session, there is little point in trying to let your profits run. Take profit with a reasonable target order instead.

Conclusion

Remember, you don’t need to squeeze every single cent out of a pullback trade. So don’t get frustrated if you give some profits back to the market or suffer a few whipsaws.

What you need is positive expectancy across your trades. Adjust your position management approach to attain this.

Then, you simply need to scale up your position size gradually to increase your profits.